Inherited Annuity Taxation Irs

The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. However, you may be able to avoid early withdrawal penalties if you take distributions from an inherited annuity before age 59 ½.

3 Mistakes To Avoid When Making A Large Portfolio Withdrawal3 Mistakes To Avoid When Making A Large Portfolio Withdrawal In 2021 Financial Advice Portfolio Finance

Inherited annuity earnings are subject to taxation.

Inherited annuity taxation irs. How do i avoid paying taxes on an inherited annuity? Inheriting a qualified annuity, on the other hand, means owing taxes on any withdrawals from the annuity, including principal and interest. In a recent article from nj.com, “who pays inheritance tax on.

You can take the entire value of the annuity as a lump sum, or set up an inherited ira to receive the money. Treat it as his or her own by rolling it over into a traditional ira, or to the extent it is taxable, into a: Principal that was not taxed and earnings will be subject to taxation as income.

The amount depends upon your relationship to the deceased and the value of the annuity. If the beneficiary is the spouse of the annuitant, the spouse can change the contract into his or her own name. Ird is the income element of inherited property.

Inherited annuities are taxable as income. Inheriting an annuity can be a financial boon. Can i cash out an inherited annuity?

If the inherited annuity was originally established inside an ira, you could exchange it for a qualified annuity inside your own ira. Then, all deferred taxes on the gains must be paid sooner or later. Treat it as his or her own ira by designating himself or herself as the account owner.

If a traditional ira is inherited from a spouse, the surviving spouse generally has the following three choices: Inherited annuity taxation if you inherit an annuity , you need to find out if it’s qualified or nonqualified. Yes, there are taxes due on inherited annuities.

According to irs publication 575, persons who inherit annuities pay taxes in the same way as the original annuity owner did. While it’s not possible to completely avoid taxes on an inherited annuity, there are several ways to minimize current taxes while. One of the biggest advantages of an annuity, tax deferral, can be lost when anyone other than a spouse inherits an annuity.

There would be tax consequences. But there are things you can do to defer payment on what you inherit. You can transfer it to another annuity.

The taxation on the distribution depends on how you choose to have that money dispersed. If you have inherited your spouse’s annuity, you can choose to transfer the annuity contract into your name. If you're not the spouse of the deceased, you basically have two options for taking distributions.

Can i rollover an inherited annuity? The internal revenue service (irs) taxes annuity income to the extent of gains distributed from the contract, and gains are distributed first. Annuity distributions are taxed differently depending on whether they began before or after the required payout start date.

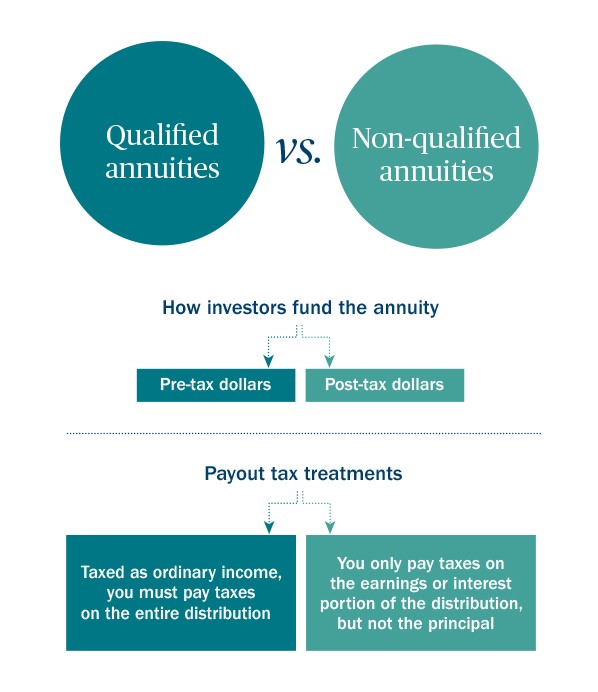

Sticking your beneficiaries with a tax bill. Unfortunately, you can’t completely avoid paying taxes when you inherit an annuity. The difference stems from the way the two types of annuities are funded.

The death of a contract owner does not eliminate taxation on an annuity. But, without thoughtful consideration for tax implications, it could be a bust. You will also be able to receive remaining funds as a stream of payments instead of a lump sum.

You’re on the right track, but the inheritance is not the same as cash. Instead, the annuity is considered income in receipt of a decedent, or ird. Do i have to pay taxes on an inherited annuity?

In turn, taxation of annuity distributions depends on whether. So, the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. Irs publication 575 says that, in general, those inheriting annuities pay taxes the same way that the original annuity owner would.

The taxed amount depends on the payout structure and the beneficiary’s relationship with the annuity owner, as a surviving spouse or otherwise. If it seems like everything is subject to an inheritance tax, well, that is often true. As discussed earlier, qualified annuity payouts are taxed as ordinary income while nonqualified annuity payouts are only taxed on interest and earnings.

Not adjusting your withholding strategy. This also applies to penalties on.

Pin On Little Lovely

2

Annuity Taxation How Various Annuities Are Taxed

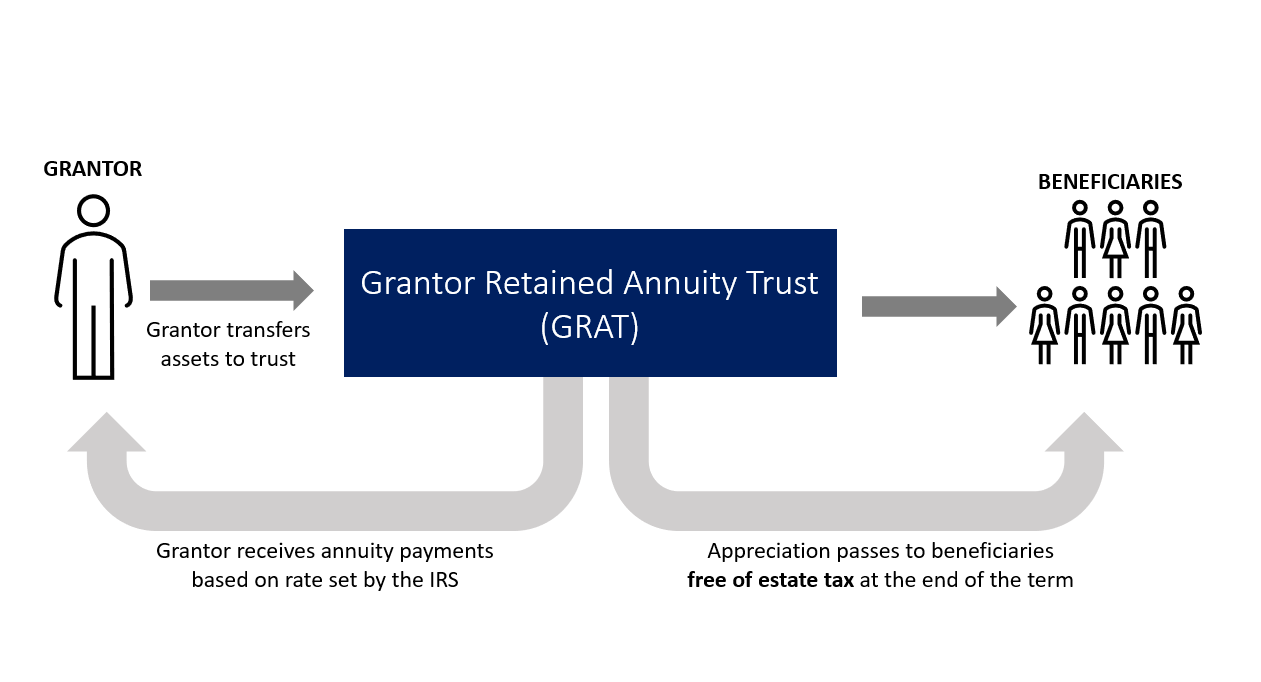

How To Use Grantor Retained Annuity Trusts Grats To Transfer Wealth To Beneficiaries Tax-free Plancorp

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

Internal Audit Video In 2021 Internal Audit Cpa Internal Control

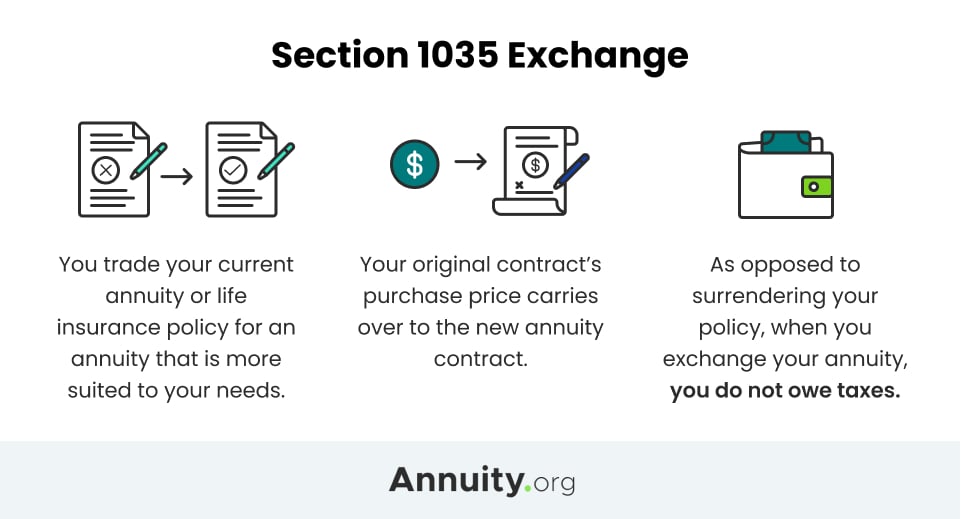

1035 Annuity Exchange Swapping One Annuity For Another

Taxation Of Your Benefit - Mtrs

Form 5329 Instructions Exception Information For Irs Form 5329

3113 Individual Income Tax Returns Internal Revenue Service

3113 Individual Income Tax Returns Internal Revenue Service

A Couple Could Shield Nearly 24 Million From Federal Estate And Gift Tax In 2021 Compared To Just 10 Million In 2011 4 Mill In 2021 Inheritance Tax Irs Estate Tax

Understanding Annuities And Taxes Mistakes People Make - Due

Taxation Of Annuities Ameriprise Financial

Annuity Exclusion Ratio What It Is And How It Works

Form 1099-r Instructions Information Community Tax

3113 Individual Income Tax Returns Internal Revenue Service

Irs Form 1099-r Box 7 Distribution Codes Ascensus

Qualified Annuity - Overview Payout Structures Benefits