What Is Maryland Earned Income Credit

If you qualify, you can use the credit to reduce the. The relief act also enhances the earned income tax credit for these same 400,000 marylanders by an estimated $478 million over the next three tax years.

Pin On Maryland Estate Planning

The bill’s purpose is to expand the numbers of taxpayers to whom the earned income credit (eic) is available and to provide for a new maryland child tax credit.

What is maryland earned income credit. What is the earned income tax credit? Because julie works and qualifies for the working americans credit, the irs sends her a check in the mail every year. The credit is equal to 50% of the federal tax credit.

You can use this eic calculator to calculate your earned income credit based on the number of qualifying children, total earned income, and filing status. Qualifying marylanders who claim it on their federal return. For singles and couples without children, the most you can get is only about.

If you qualify for the federal earned income tax credit and claim it on your federal return, you may be entitled to a maryland earned income tax credit on the state return equal to 50% of the federal tax credit. These economic impact payments will be issued by the maryland comptroller to all qualified taxpayers. Some taxpayers may even qualify for.

In 2019, 25 million taxpayers received about $63 billion in earned income credits. Refundable earned income credit worksheet (21a) to claim credit you must: The earned income tax credit.

For instance, individuals with credit report below 640 are generally thought about to be subprime borrowers. If you qualify for the federal earned income tax credit also qualify for the maryland earned income tax credit. The state eitc reduces the amount of maryland tax you owe.

It plays a key role in a lending institution’s decision to state “yes” or “no” to your loan or credit card application. The state eitc reduces the amount of maryland tax you owe. Senate bill 218 extends the tax credit to people who pay taxes using individual taxpayer identification numbers (itins) for the 2020, 2021 and 2022 tax years.

The local eitc reduces the amount of county tax you owe. In addition, the legislation increases the refundable earned income tax credit to 45% for families and 100% for individuals. Expansion of the earned income credit (sb218) was enacted under article ii, section 17(b) of the maryland constitution.

A credit score is a considerable element of your financial life. This credit is the amount by which 25% of your federal earned income credit exceeds your maryland tax liability. 2019 maryland earned income tax credit (eitc) maryland's eitc is a credit for certain taxpayers who have income and have worked.

Think of it this way: An expansion of maryland’s earned income tax credit passed quietly into law when gov. What is maryland earned income credit.

The eic reduces the amount of taxes owed and may also give a refund. That group of taxpayers, which includes undocumented immigrants, certain. The credit also increases as the number of children claimed on your tax return increases.

The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes. Relief payments will be made to maryland Complete the refundable earned income credit worksheet (21a) and enter the result on this line.

Does maryland offer a state earned income tax credit? Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. 2019 maryland earned income tax credit (eitc) maryland’s eitc is a credit for certain taxpayers who have income and have worked.

The earned income tax credit (eitc) on their 2019 maryland state tax return. It was intended to be just a temporary legislative provision, but the credit is still available today. The maryland earned income tax credit.

If you earn less than $57,000 per year, you can get free help preparing your maryland income tax return through the cash campaign. It is different from a tax deduction, which reduces the amount of income that your tax is calculated on. Who is eligible for a relief act economic impact payment?

More support for unemployed marylanders The earned income tax credit (eitc) is a benefit for working people with low to moderate income. (r) allowed the bill to take effect without his signature.

Stimulus Checks California And Maryland Approve Plans To Send Direct Payments To Eligible Residents In 2021 Checks University Of Los Angeles How To Plan

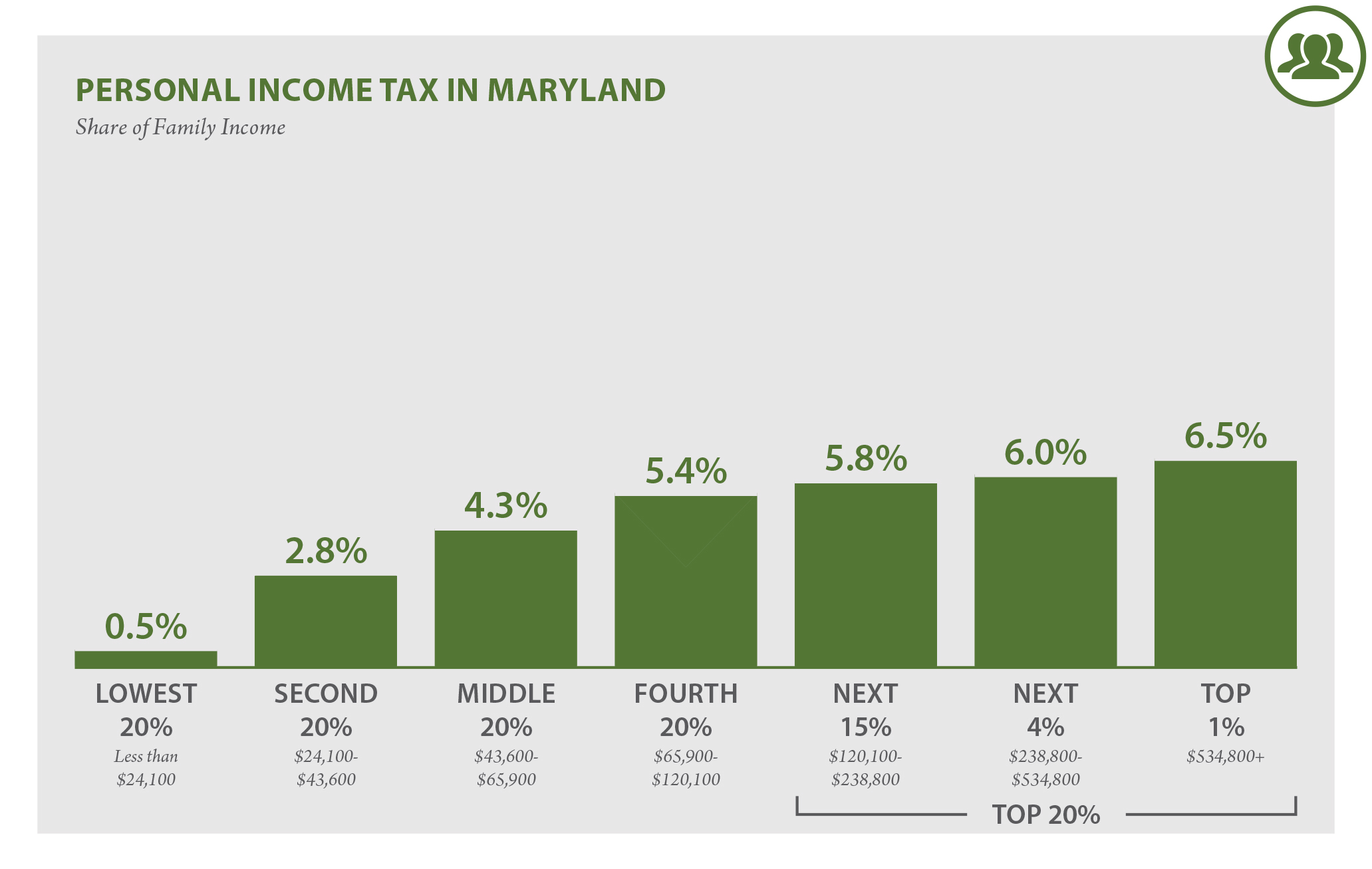

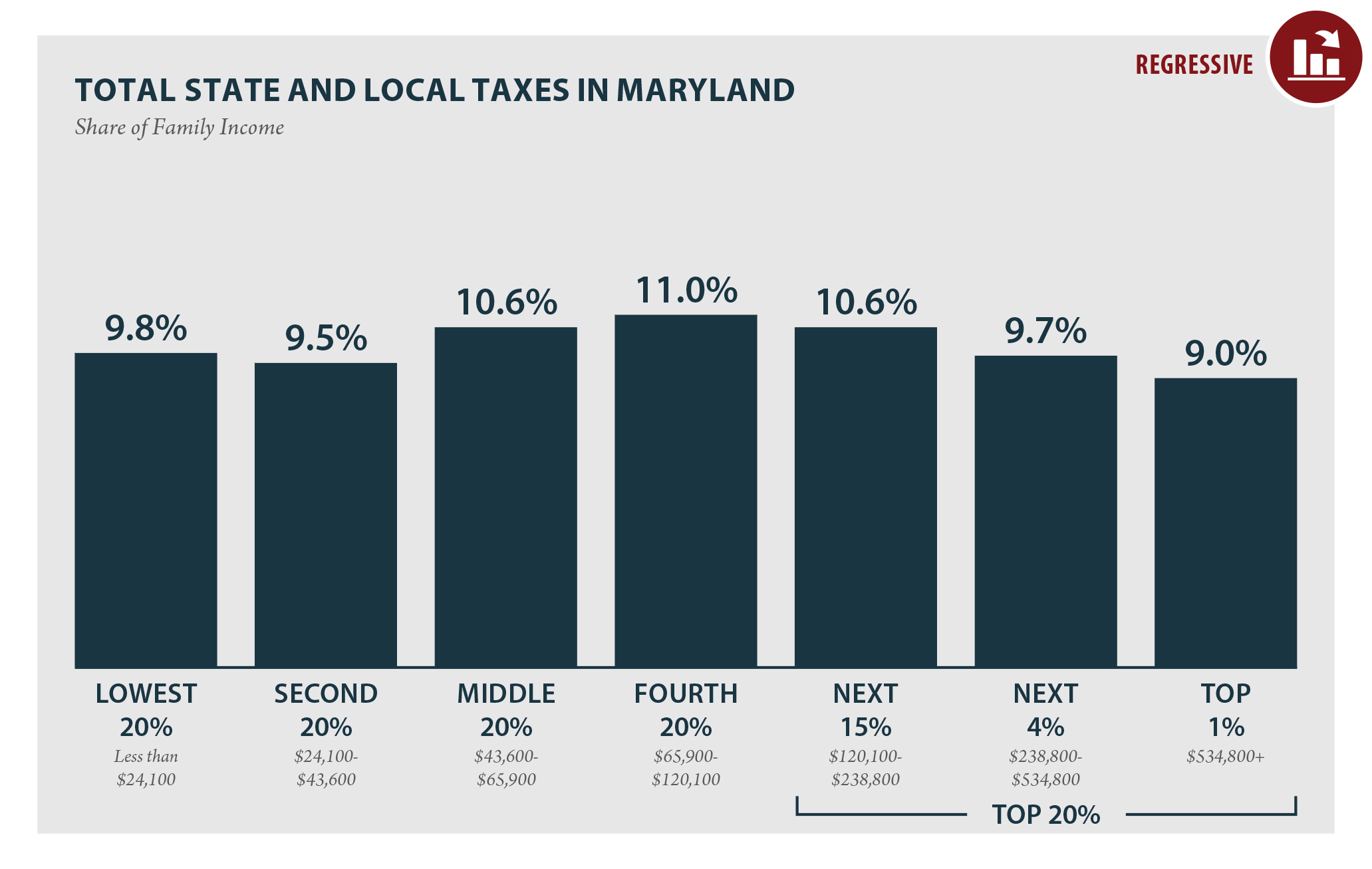

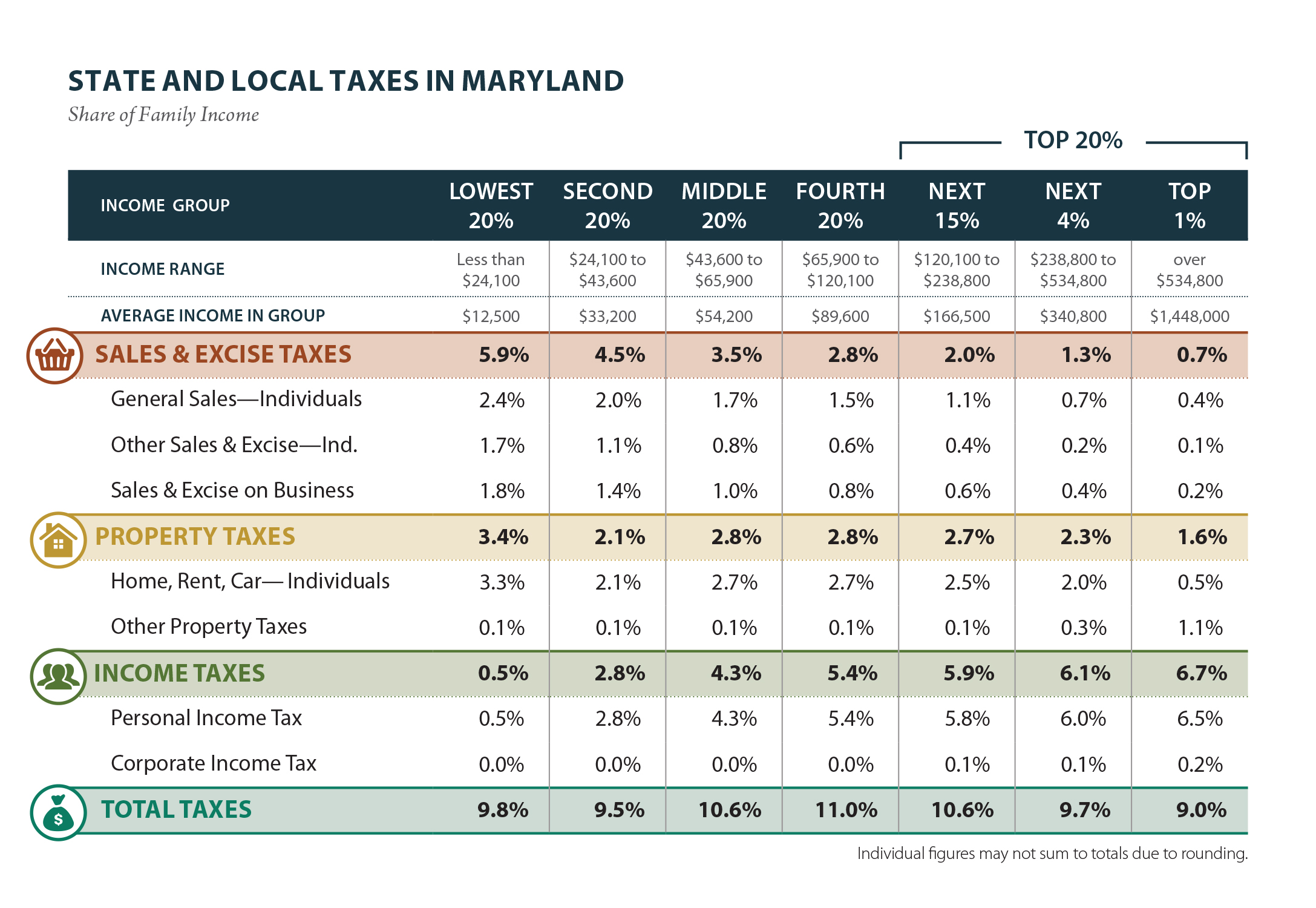

Maryland Who Pays 6th Edition Itep

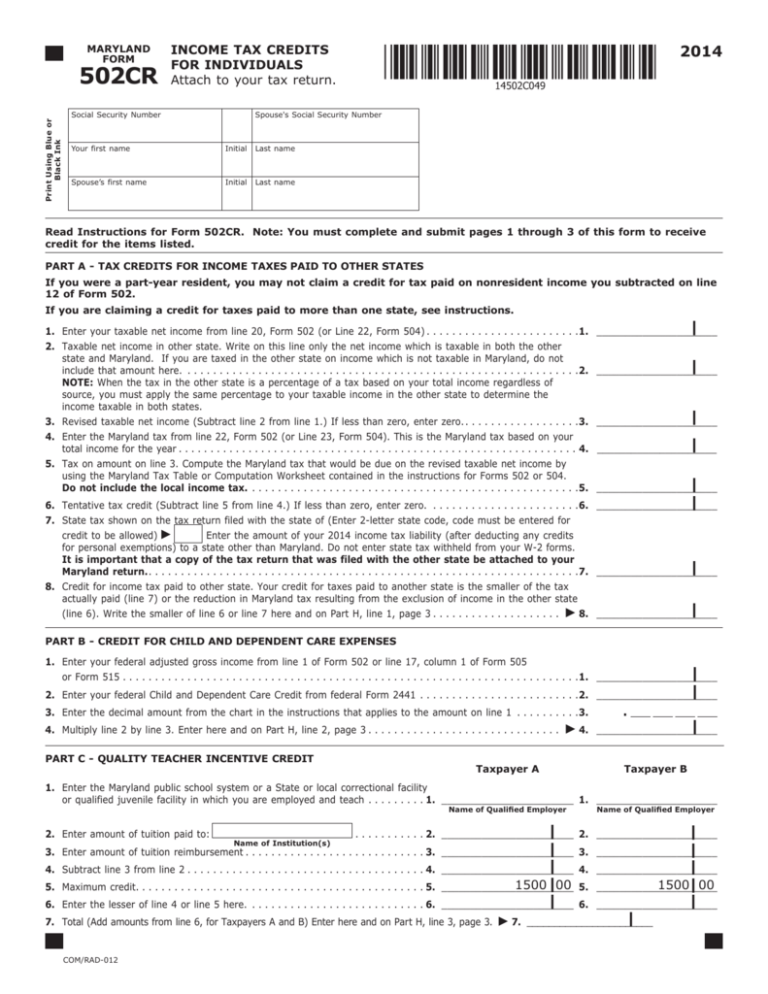

502cr - Maryland Tax Forms And Instructions

Maryland Tax Forms 2020 Printable State Md Form 502 And Md Form 502 Instructions

Governor Larry Hogan - Official Website For The Governor Of Maryland

Maryland State Tax Deadline Is July 15 2021 Wusa9com

Tax Day Our Shared Investments In Maryland Maryland Center On Economic Policy

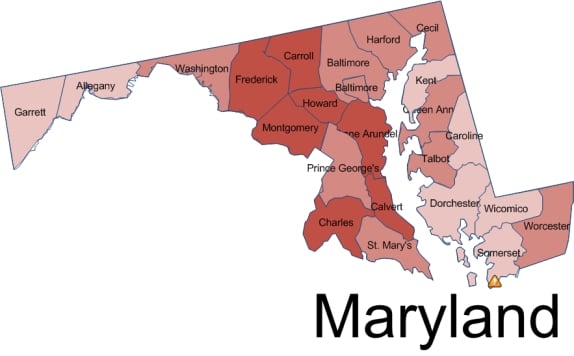

Rich-county Poor-county Gap Widens In Md News Cecildailycom

Rules For The Maryland State Income Tax Subtraction Modification For 2020 - Maryland State Firemens Association

Maryland Who Pays 6th Edition Itep

Maryland Who Pays 6th Edition Itep

Maryland State Veteran Benefits Militarycom

If You Are A Maryland Resident Maryland Resident Income Tax

You Dont Have To Crunch Every Single Number Yourself But Start Off The Right Way Have The Numbers Ready So Th Small Business Growth Accounting Llc Business

2

Low-earners Paying More In Taxes Than The Well-off In Maryland Maryland Center On Economic Policy

Pin By Dannyclaudia Membreno On Taxes Income Tax Income Tax

Revised Maryland Individual Tax Forms Are Ready

Maryland Who Pays 6th Edition Itep