Springfield Mo Sales Tax Calculator

Sales taxes are another important source of revenue for state and local governments in missouri. You can print a 8.1% sales tax table here.

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

The springfield city code chapter 70, article v, requires hotels, motels, and tourist courts to pay a tax equal to 5% of the gross rental receipts paid by transient guests for sleeping accommodations.

Springfield mo sales tax calculator. Create your own online store and start selling today. The combined rate used in this calculator (5.975%) is the result of the missouri state rate (4.225%), the 65810's county rate (1.75%). Find 258 listings related to sales tax calculator in springfield on yp.com.

Find sales and use tax rates enter your street address and city or zip code to view the sales and use tax rate information for your address. This is the total of state, county and city sales tax rates. If you need access to a database of all missouri local sales tax rates, visit the sales tax data page.

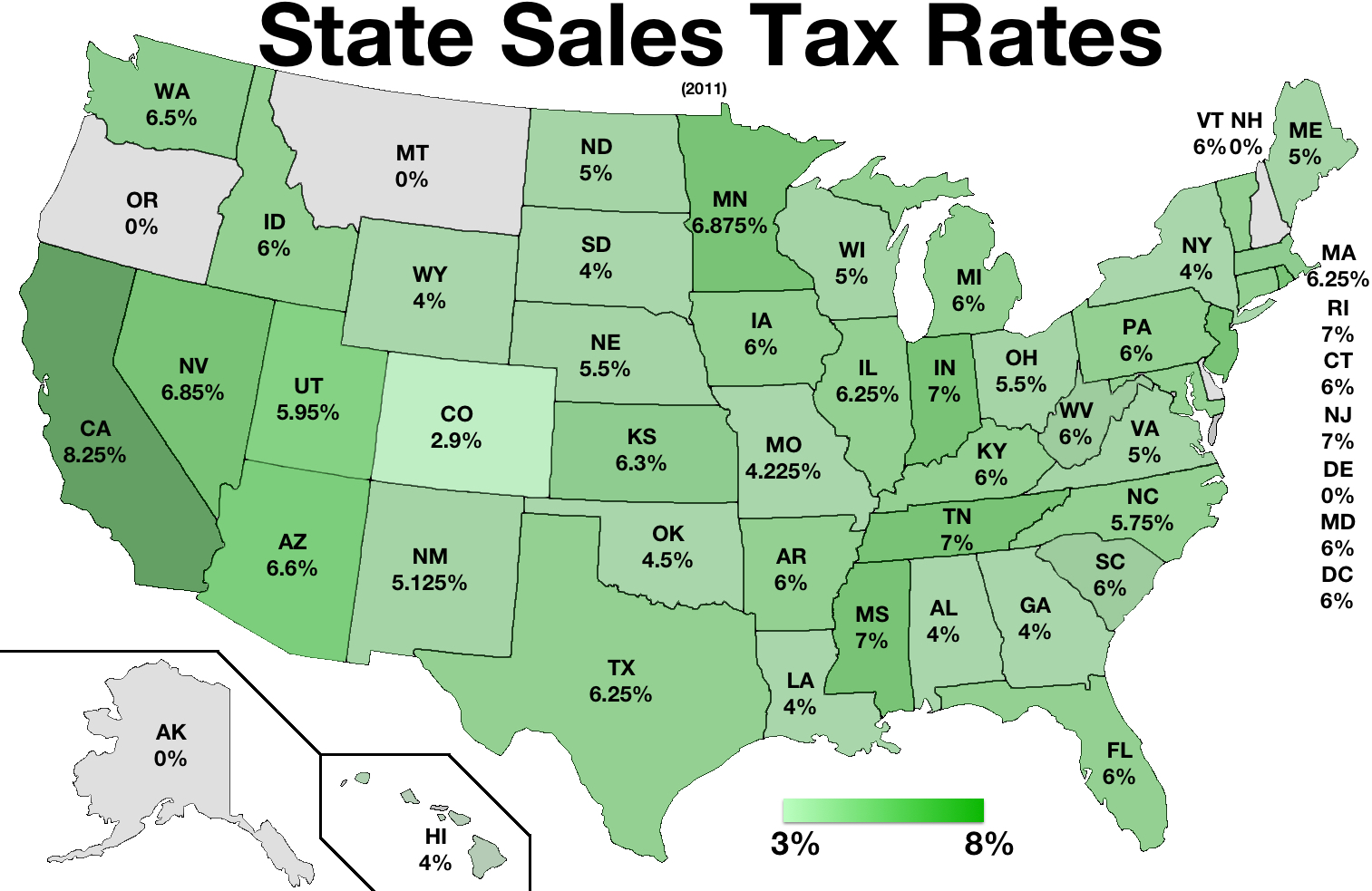

The missouri statewide rate is 4.225%, which by itself would be among the lowest in the country. Home » motor vehicle » sales tax calculator. Each business owner makes the decision as to.

Mount vernon, missouri and springfield, missouri. For tax rates in other cities, see missouri sales taxes by city and county. The republic, missouri, general sales tax rate is 4.225%.the sales tax rate is always 8.35% every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (1.75%), the missouri cities rate (2.375%).

How 2021 sales taxes are calculated in republic. Subtract these values, if any, from the sale. See reviews, photos, directions, phone numbers and more for sales tax calculator locations in springfield, mo.

Since the tax is on the hotel or motel and not the customer, there are no exemptions from the tax. What is the sales tax rate in springfield, missouri? The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

The minimum combined 2021 sales tax rate for springfield, missouri is. Total price is the final amount paid including sales tax. For additional information click on the links below:

Try it now & grow your business! 101 rows how 2021 sales taxes are calculated for zip code 65810. Missouri has a 4.225% statewide sales tax rate , but also has 456 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.809% on.

The 65810, springfield, missouri, general sales tax rate is 5.975%. There is no applicable special tax. However, since counties and cities also levy sales taxes, actual rates are often much higher, in some areas reaching 10.350%.

Motor vehicle titling and registration. The december 2020 total local sales tax rate was also 8.100%. 2021 cost of living calculator for taxes:

The 8.1% sales tax rate in springfield consists of 4.225% missouri state sales tax, 1.75% greene county sales tax and 2.125% springfield tax. The missouri sales tax rate is currently %. Calculate a simple single sales tax and a total based on the entered tax percentage.

Net price is the tag price or list price before any sales taxes are applied. To use this calculator, simply. For state, use and local taxes use state and local sales tax calculator.

The county sales tax rate is %. The current total local sales tax rate in springfield, mo is 8.100%. Try it now & grow your business!

The springfield sales tax rate is %. There is no special rate for republic. Missouri has 1,090 cities, counties, and special districts that collect a local sales tax in addition to the missouri state sales tax.click any locality for a full breakdown of local property taxes, or visit our missouri sales tax calculator to lookup local rates by zip code.

Our premium cost of living calculator includes, state and local income taxes, state and local sales taxes, real estate transfer fees, federal, state, and local consumer taxes (gasoline, liquor, beer, cigarettes), corporate taxes, plus auto sales. Create your own online store and start selling today.

Salesuse Tax Credit Inquiry Instructions

Missouri Income Tax Calculator - Smartasset

Missouri Income Tax Rate And Brackets Hr Block

Sales Taxes In The United States - Wikiwand

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Missouri Sales Tax Rates By City County 2021

Sales Taxes In The United States - Wikiwand

Individual Income Tax

Missouri Car Sales Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States - Wikiwand

Louisiana Sales Tax Rates By City County 2021

Sales Taxes In The United States - Wikiwand

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States - Wikiwand

Missouri Property Tax Calculator - Smartasset

Missouri Sales Tax - Small Business Guide Truic