Indiana Inheritance Tax Exemptions

The indiana inheritance tax was repealed as of december 31, 2012. Indiana’s inheritance tax has been repealed for taxpayers who died after dec.

Allencountyus

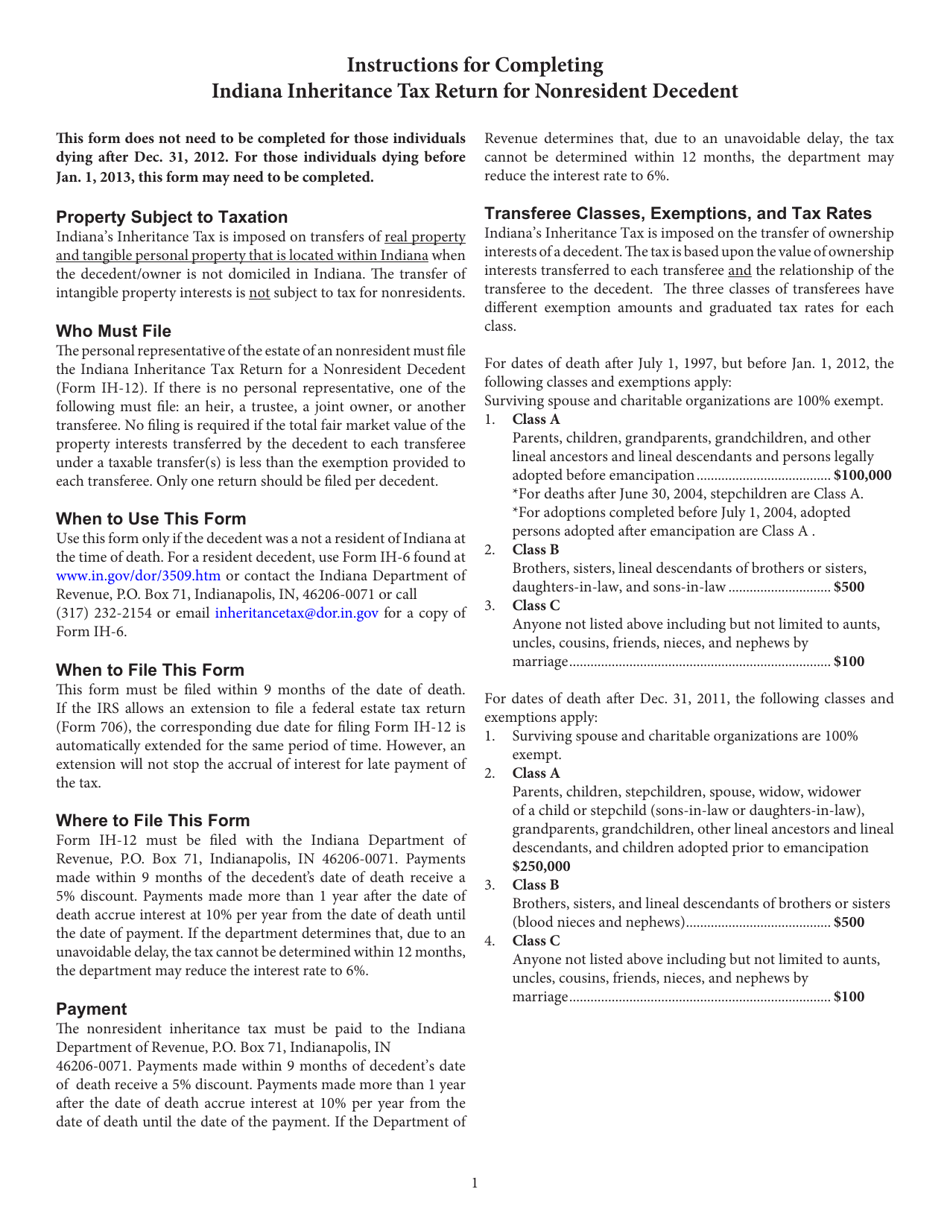

Transferee classes, exemptions, and tax rates indiana’s inheritance tax is imposed on the transfer of ownership interests of a decedent.

Indiana inheritance tax exemptions. For taxpayers who died after dec. However, many states realize that citizens can avoid these taxes by simply moving to another state. As an example, if a parent dies in 2013 with a $1,000,000 estate which is divided equally between two children.

Beginning in 2022 the inheritance tax would cease to exist. On april 27, 2013 the indiana general assembly passed legislation repealing the tax, and governor mike pence signed the bill into law on may 8, 2013. Ad an inheritance tax expert will answer you now!

No tax has to be paid. Surviving spouse, charitable organizations class a. An heir, a trustee, a joint owner, or another transferee.

If a financial institution has a 20% hold placed on an account for an extended period of time, contact the indiana dept. The federal estate tax exemption has fluctuated significantly over the past decade. Indiana inheritance tax was eliminated as of january 1, 2013.

Repeal of the inheritance tax, estate tax, and generation skipping tax. For individuals who die after that date, no inheritance tax is due on payments from their estate. The amount of each beneficiary's exemption is determined by the relationship of that beneficiary to the decedent.

Exemption levels for beneficiaries and heirs prior to 2012 100% exempt. Indiana inheritance tax and gift tax? Indiana does not have an inheritance tax nor does it have a gift tax.

I’ve got more good news for hozier residents. Replaced by departmental notice 44. Child, stepchild, parent, grandparent, grandchild, and other lineal ancestor or.

No filing is required if the total fair. An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Each heir or beneficiary of a decedent’s estate is divided into three classes;

States have typically thought of these taxes as a way to increase their revenues. The decedent’s surviving spouse pays no inheritance tax due to an unlimited marital deduction. Indiana tax exemptions relating to specific events held in indiana and.

2012 legislative changes to inheritance tax. On the other hand, indiana’s changes to the inheritance tax allow for more family members to receive larger exemptions while slowly phasing out inheritance tax entirely. The first inheritance tax law of indiana was passed in 1913.

This replaced indiana’s prior law enacted in 2012 which phased out indiana’s inheritance tax over nine years beginning in 2013 and ending on december 31, 2021 and increased the inheritance tax exemption amounts retroactive to january 1, 2012. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. The first $250,000 for each child would be exempt.

An annuity, or other payment, described in section 2039(a) of the internal revenue code is exempt from the inheritance tax imposed as a result of a decedent's death to the same extent that the annuity or other payment is excluded from the decedent's federal gross estate under. The tax is based upon the value of ownership interests transferred to each transferee and the relationship of the transferee to. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

There is also an unlimited charitable deduction for inheritance tax purposes. Indiana’s inheritance tax still applies. For individuals dying before january 1, 2013

The irs did, however, change the federal estate tax exemption from 2018. As a result, indiana residents will not owe any indiana state tax after this date with respect to transfers of property and assets at death. Indiana collects taxes on cigarettes equal to 99.5 cents per pack of 20 cigarettes.

This act was substantially a. Class a beneficiaries exemptions effective 07/01/97: Indiana inheritance tax exemptions and rates.

If there is no personal representative, one of the following must file: Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. However, be sure you remember to file the following:

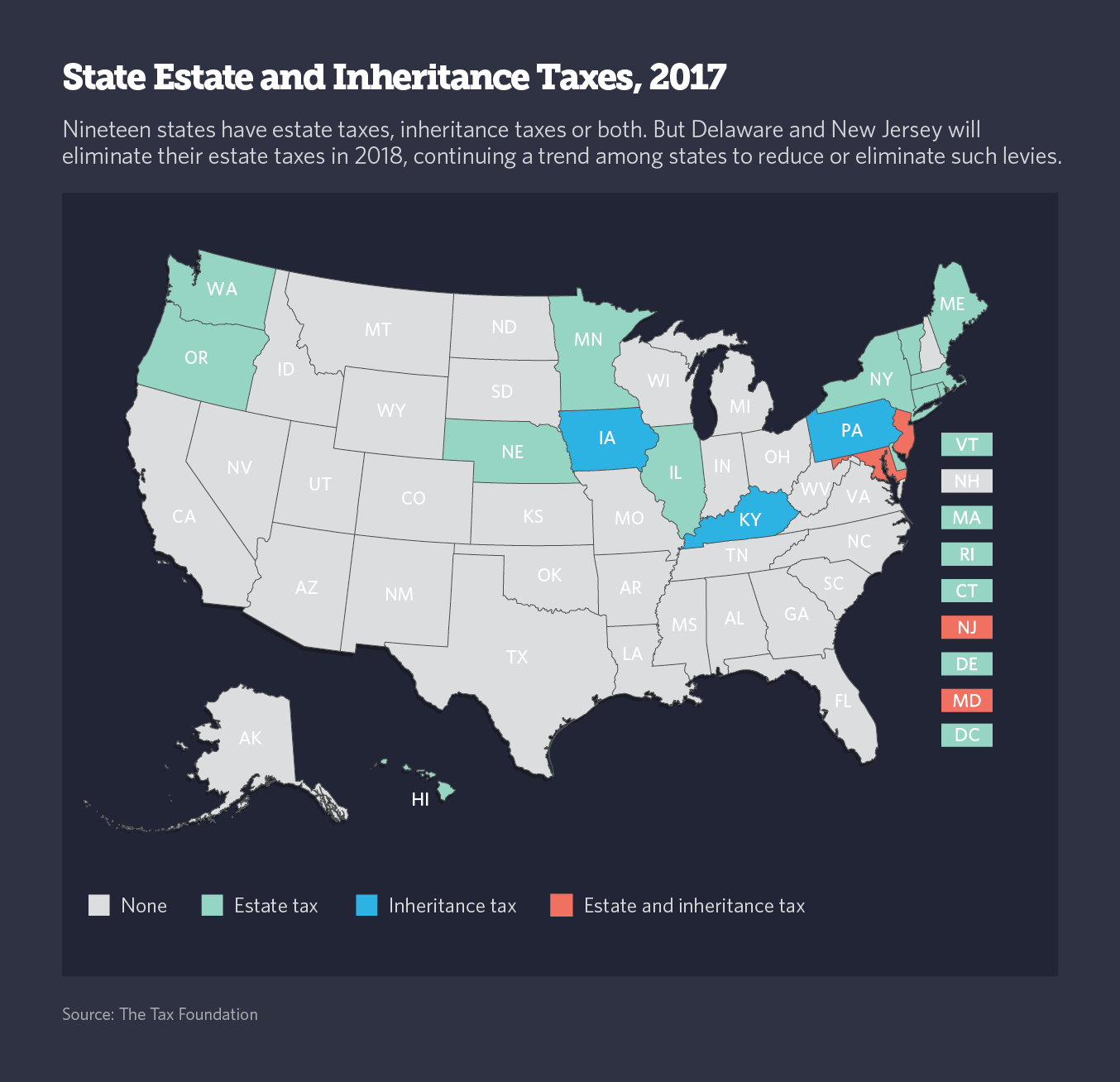

The federal government does not impose an inheritance tax, so the recent tax changes from the trump administration did not affect the inheritance taxes imposed by the states. The other $250,000 inherited by each child would incur a tax of $7,250.

State Estate And Inheritance Taxes In 2014 Tax Foundation

How To Transfer Property In Indiana - Pdf Free Download

Ingov

New Yorks Death Tax The Case For Killing It - Empire Center For Public Policy

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Form 48831 Ih-exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Where Not To Die In 2014 The Changing Wealth Tax Landscape

Ingov

Fillable Online Ih-6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print - Pdffiller

Download Instructions For Form Ih-6 Indiana Inheritance Tax Return Pdf Templateroller

Indiana Inheritance Tax Free Download

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Estate And Inheritance Taxes

Form Ih-6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Does Your State Have An Estate Or Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Download Instructions For Form Ih-12 State Form 51492 Indiana Inheritance Tax Return For Nonresident Decedent Pdf Templateroller