Home Depot Tax Exempt Id Florida

Please include your order number in this request. Hope this helps, good luck!

Tax Exempt The Home Depot

Enter your business information and click “continue.”.

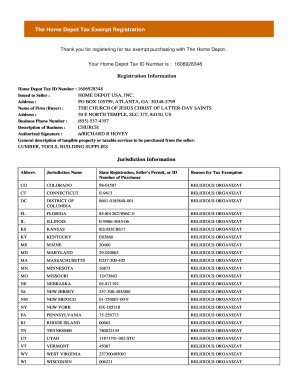

Home depot tax exempt id florida. The employer identification number (ein) for home depot u.s.a., inc. The home depot tax exempt id number is used when making tax exempt purchases in lieu of the state issued tax exempt id number. To obtain more information on obtaining a tax exempt number for a non.

1602018739€€€feb 11, 2016 your home depot tax id card 1602018739 please present this card to the cashier each time you make a tax exempt purchase Your home depot tax id number is : Ein for organizations is sometimes also referred to as taxpayer identification number (tin) or fein or simply irs number.

Furthermore, the department rationalized the seller could not collect the sales tax, since it was not registered, which left only the third party to collect the. A partial exemption from sales and use tax became available under section 6357.1 for the sale, storage, use, or other consumption of diesel fuel used in farming activities or food processing. The id number will be numeric only and is displayed on the printed registration document.

In my store (se usa), we do accept tax exempt forms but there are limitations on what we accept. Use your home depot tax exempt id at checkout. Tax exempt organizations may include churches, public charities, private foundations, social welfare groups, trade associations, social clubs, fraternities, employee benefit funds, veteran and political organizations, etc.

Generally, businesses need an ein. Is incorporated in florida and the latest report filing was done in 2020. To obtain a home depot tax exempt id number, you must register to receive one on home depot’s website.

You are looking to speak with either their ikea business person or one of the front line leaders and/or manager. The partial exemption applies only to the state sales and use tax rate portion. To obtain a refund, please fax or mail a brief refund request to our tax department along with your tax exemption documentation.

The irs does not issue any numbers specifically to tax exempt organizations. The partnership between the two organizations has funded more than 73 veterans' housing projects, providing more than 2,500 units for veterans, including more than 400 units specifically for women. Organizations or individuals wishing to verify sales tax exemption can do so through florida's department of revenue certificate verification system.

Ein for organizations is sometimes also referred to as taxpayer identification number or tin or simply irs number. If you have a federal government purchase card, no additional registration. There is no tax on sale of real property sales so you are required to pay sales tax on building material in the use and construction of real property.

Pull up the link to the florida department of revenue certificate verification system (see the resources section for the link). To get started, we’ll just need your home depot tax exempt id number. Duke university and its affiliates are tax exempt.

Since 2011, the home depot foundation has given more than $11 million to volunteers of america to improve housing solutions for homeless veterans and their families. Once you're approved, shop in our stores or online and simply provide your tax id at checkout to receive tax exemption on your eligible purchases. For our government buyers with federal government purchase card 1.

View or make changes to your tax exemption anytime. The department, in this instance, held tax must be collected by the third party on the sale by the seller and the buyer, since the seller’s customer is located in florida and the goods were in florida at the time of the sale. North carolina direct pay permit number 209.

Consider using the uniform sales & use taxexemption/resale certificate (multijurisdiction). You may apply for an ein in various ways, and now you may apply online. Office depot, llc tax department p.o.box 5029 boca raton, fl.

1606928348€€€jun 17, 2016 your home depot tax id card 1606928348 please present this card to the cashier each time you make a tax exempt purchase I would contact the store directly and get that straightened out with them. 501(c)3 tax exemption is key.

An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity. 1702030899 feb24,2017 thank you for registering for tax exempt purchasing with the home depot. The number is auto assigned by the system during the registration process.

Go to the home depot tax exempt registration page in your web browser (see resources). The employer identification number (ein) for home depot, inc. Following are the specific federal and state tax identification numbers for our different business entities:

Home Depot Employer Id Number Jobs Ecityworks

I Bought My Products At Home Depot And Provided A Receipt Receipt Template Free Receipt Template Bar Graph Template

Home Depot Tax Exemption Application - Youtube

2

2

2

Arlington Man Schemed 11 Million Out Of Home Depot By Reusing Receipts For Refunds

2

Home Depot Tax Exemption Application - Youtube

Home Depot Tax Exempt - Fill Online Printable Fillable Blank Pdffiller

2

2

Tax Exempt Purchases For Professionals At The Home Depot

2

2

Tax Exempt Registration Support Home Depot Contact Information Finder

2

Home Depot Tax Exempt - Fill Online Printable Fillable Blank Pdffiller

Home Depot University - Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts