Extended Child Tax Credit Portal

Not everyone is required to file taxes. This year, americans were only required to file taxes if they.

Gst News Chapter Goods And Service Tax Goods And Services

See below for more information.

Extended child tax credit portal. Eastern time on november 29, 2021. The current expanded ctc is a refundable credit, being partially paid in advance in 2021. Advance payments are sent automatically to eligible people.

Plus, you had to have at least $2,500 of earned income to even get that. If you're making a new claim; Prior to 2021, the child tax credit was only partially refundable (up to $1,400 per qualifying child).

The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. Expanded monthly child tax credit extended into 2022. Here's what to know about the fifth ctc check.

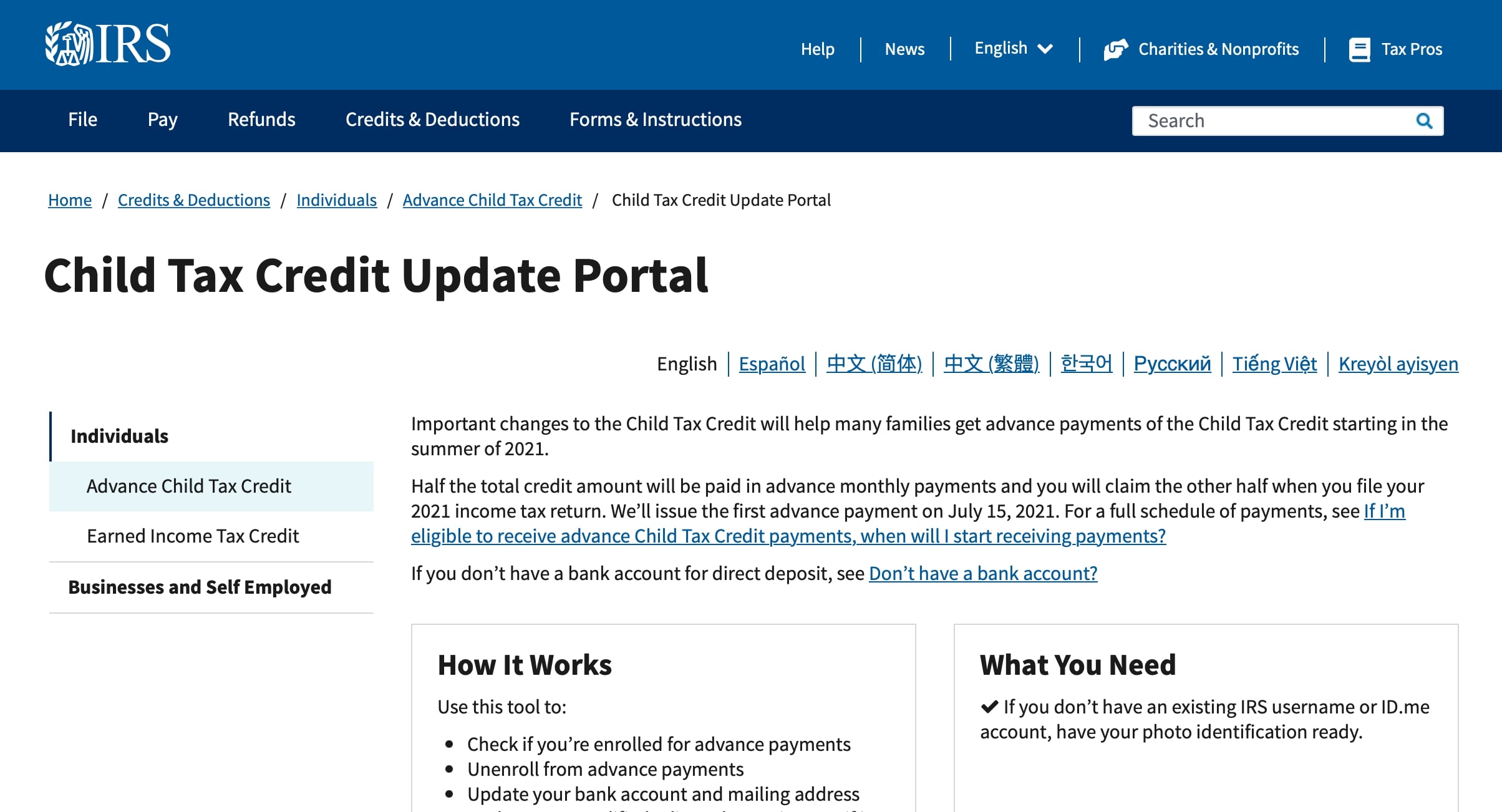

Child tax credit will not affect your child benefit. You can only claim child tax credit for children you’re responsible for. The irs said it will open a child tax credit portal by july 1 that will let you manage parts of your payment, such as whether you want to receive monthly payments through the end of 2021 or one.

The advance child tax credit or ctc payments began in july 2021 and end. During a speech in illinois wednesday, the president said he is looking to extend the expansion in the child tax credit. Sanders calls for the child tax credit to be extended.

Receives $1,800 in 6 monthly installments of $300 between july and. The child tax credit payment should roll out on december 15. The child tax credit update portal, which is an irs tool that lets you check on the status of your child tax credit payments and make minor tweaks to your information, will soon get an update that.

See the payment date schedule. The child tax credit update portal currently lets families see their eligibility, manage their payments, update their income details and unenroll from the advance monthly payments. Important changes to the child tax credit are helping many families get advance payments of the credit:

Agency is working to resolve the issue but warn that some people may be unable to check their status on the irs' online portal. The latest on the enhanced child tax credit getting extended past 2022. You may be eligible for child tax credit payments even if you have not filed taxes recently.

The credit was expanded when the american rescue plan was signed into law in march and increased from $2,000 per child to $3,000 for each child aged 6. Under biden’s build back better spending plan working its way through congress, the currently expanded child tax credit has provisions for a further one year extension, bringing the total amount paid over 2 years to a maximum of $7,200. Given the popularity of the program with millions of families, there's a chance the credit could be extended.

Half the total credit amount is being paid in advance monthly payments. But calls are growing for the child tax credit benefits to be extended through 2022. In a $3.5 trillion economic bill released on sep.

The irs says it will be available later this year. if you don't get all the payments for your new child during the year, you will be able to claim the missing amount as a credit on your 2021 tax return. Most eligible families will be able to receive half of their 2021 child tax credit money in advance due to changes in. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021.

You claim the other half when you file your 2021 income tax return. The update portal for adding a dependent is not available yet. Increased to $3,600 from $1,400 thanks to the american rescue plan ($3,600 for their child under age 6).

The last child tax credit payment of 2021, which could be worth up to $1,800 for some parents, is set to be sent out in just days. That depends on your household income and family size. The expanded tax credit delivers monthly payments of $300 for each eligible child under 6, and $250 for each child between 6 to 17 years old.

The expanded child tax credit, which is for 2021 only, passed in march, as part of the american rescue plan act, although the biden administration has. Eligible families can receive a total of up to $3,600 for each child under age 6 and up to. The enhanced child tax credit payments are only set to last through 2021, but president biden has suggested that this may be extended through as long as 2025 as part of the american families plan.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Breaks Every Small Business Needs To Know About I Know Tax Time Has Passed But You Can Always Amend Or Be Bett Business Tax Irs Taxes Small Business Tax

2

Credit Models Using Gst Data In 2021 Financial Institutions Underwriting Data

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More - Cnet

Itr 3 Form Income Tax Income Filing Taxes

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Return Income Tax Tax Forms

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Form 26as How To Download Form 26as From Tds Traces Form Tax Forms Tracing

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Make Sure Youre Signed Up For The Final Stimulus Payment Of 2021

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 4 D Income Tax Filing Taxes Tax Services

Cbic Has Introduced Sms Facility For Filing Nil Gstr 1 Returns Sms Data Analytics Facility

Gstn Portal Generates Over 17 Lakh E-way Bills Generated In 3 Days Gst India Goods And Services Tax In India Goods And Service Tax Goods And Services Generation

Spanish Version Of Irs Child Tax Portal Now Available Khoucom

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Before You Register On The Income Tax Portal It Is Necessary To Ensure That You Have A Copy Of The Following Documents Income Tax Tax Return Income Tax Return

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Decode Budget - Compare To New Ay Income Tax Budgeting Income