Mississippi State Income Tax Rate 2021

An act to create the mississippi tax freedom act of 2021; 2021 state income tax rates and brackets;

Bfnbn2regx2uzm

State individual income tax rates and brackets, 2021 single filer married filing jointly standard deduction personal exemption;

Mississippi state income tax rate 2021. The mississippi tax calculator is designed to provide a simple illlustration of the state income tax due in mississippi, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions (and more), please use the main 2021/22 tax reform calculator. Keep in mind that some states will not update their tax forms for 2021 until january 2022. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5.000%, spread across three tax brackets.

State rates brackets rates brackets single couple single couple dependent; Income tax tables and other tax information is sourced from the mississippi department of revenue. Be sure to verify that the form you are downloading is for the correct year.

Counties and cities can charge an additional local sales tax of up to 0.25%, for a. Starting in 2022, only the 4 percent and 5 percent rates will remain, with the first $5,000 of income exempt from taxation (up from $3,000). Find your pretax deductions, including 401k, flexible account contributions.

Gunn says his plan will give a big tax break to a vast majority of mississippians while creating a better tax structure. Alabama (a, b, c) 2.00% > $0: Mississippi's 2021 income tax ranges from 3% to 5%.

The mississippi state sales tax rate is 7%, and the average ms sales tax after local surtaxes is 7.07%. Applicable in addition to all state taxes. In tax year 2021, only $1,000 in marginal income will be subject to the 3 percent rate, with the other $1,000 exempt.

The list below details the localities in mississippi with differing sales tax rates, click on the location to access a supporting sales tax calculator. 2021 mississippi state sales tax. Check the 2021 mississippi state tax rate and the rules to calculate state income tax.

Count for 89% of total tax revenue on average in the state of mississippi from 1950 to 2019.1 in 2019, these three tax types account for 93% of total tax revenue. 18 cents per gallon of regular gasoline and diesel The tax rates in this state fall between 1.1% and 2.9%.

Mississippi has 3 state income tax rates: Kansas * 3 factor south dakota no state income tax kentucky * sales tennessee triple wtd sales louisiana sales texas sales maine * sales utah sales maryland (3) 75.0% sales, 12.5% property vermont double wtd sales & payroll virginia double wtd sales/sales massachusetts sales/double wtd sales washington no state income tax Mississippi state tax quick facts.

Exact tax amount may vary for different items. Mississippi personal income tax rates; These rates are the same for all filing statuses, as well as for businesses.

Other than the states that do not levy an individual income tax, north dakota has the lowest income tax rate in the nation. Mississippi tax forms for 2020 and 2021. Tax rates, exemptions, & deductions.

The two days of tax hearings wednesday and thursday are in response to house speaker philip gunn’s proposal to eliminate the state’s individual income tax and raise the state’s sales tax from 7% to 9.5%, along with increases in other user or “consumption” taxes. Mississippi's maximum marginal corporate income tax rate is the 3rd lowest in the united states, ranking directly below north dakota's 5.200%. This page has the latest mississippi brackets and tax rates, plus a mississippi income tax calculator.

States with maximum income tax rates of at least 5% but less than 6% are rhode island, maryland, virginia, kansas, ohio, oklahoma, alabama, and mississippi. Calculate your state income tax step by step. Tax year 2018 first $1,000 @ 0% and the next $4,000 @ 3% tax year 2019 first $2,000 @ 0% and the next $3,000 @ 3% tax year 2020 first $3,000 @ 0% and the next $2,000 @ 3% tax year 2021 first $4,000 @ 0% and the next $1,000 @ 3% tax year 2022 first $5,000 @ 0%

2021 mississippi state sales tax rates.

Taxation Of Social Security Benefits - Mn House Research

Salary Taxes Social Security

List Of States By Income Tax Rate - See All 50 Of Them With Interactive Map

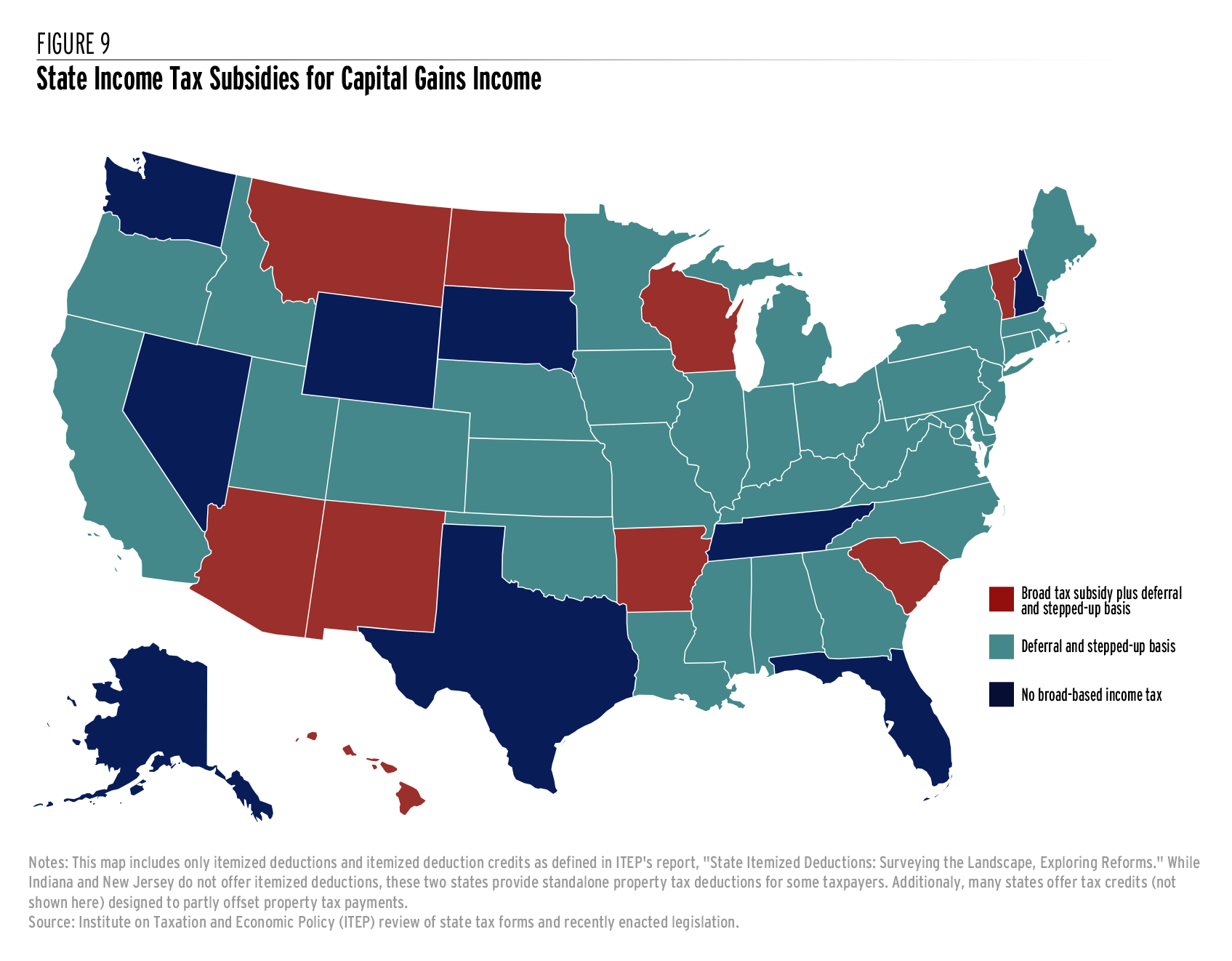

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

State W-4 Form Detailed Withholding Forms By State Chart

Wheres My Tennessee Tn State Tax Refund Taxact Blog

Percentages Of Us Households That Paid No Income Tax By Income Level 2019 Statista

Pennsylvania Income Tax Rate And Brackets 2019

The Dual Tax Burden Of S Corporations Tax Foundation

Mississippi Tax Rate Hr Block

How Progressive Is The Us Tax System Tax Foundation

10 Most Tax-friendly States For Retirees Retirement Locations Retirement Advice Retirement Planning

Mississippi Tax Rate Hr Block

State-by-state Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

These 7 Us States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

25 Percent Corporate Income Tax Rate Details Analysis

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

State Taxes

House Democrats Tax On Corporate Income Third-highest In Oecd