Japan Corporate Tax Rate History

Current japan corporate tax rate is 47.40%. World tax database, office of tax policy research.

Real Estate-related Taxes And Fees In Japan

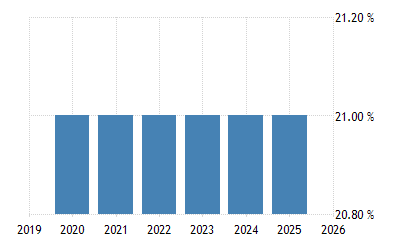

Before 1 october 2019, the national local corporate tax rate is 4.4%.

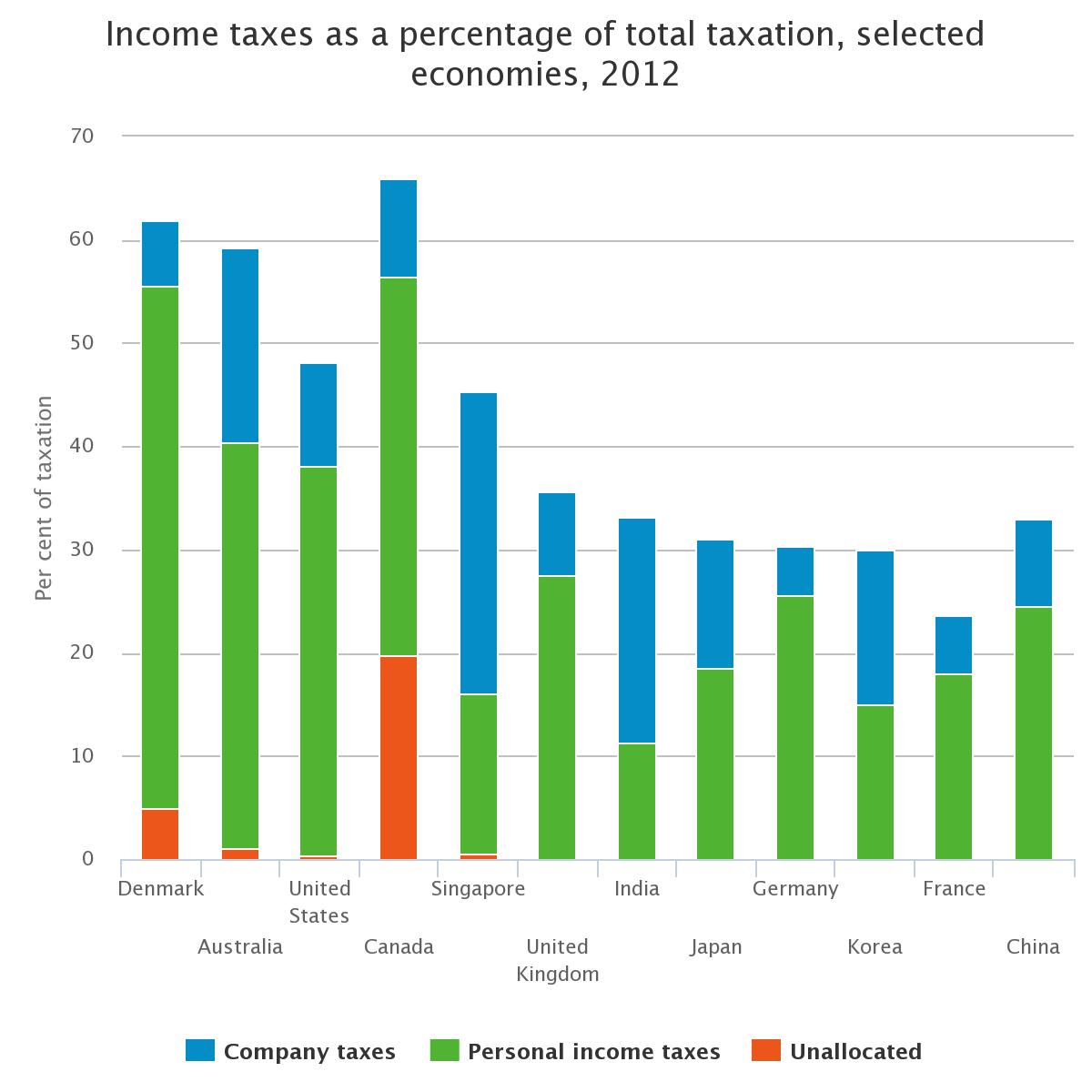

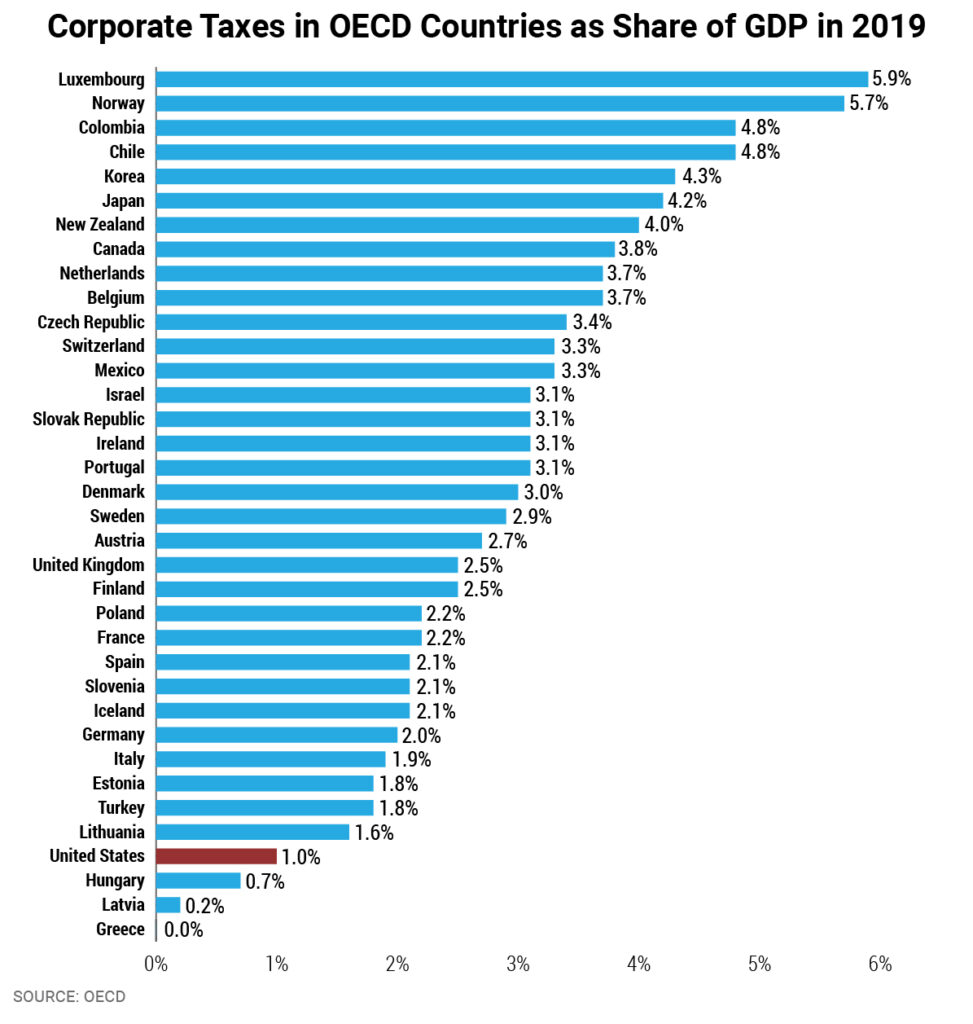

Japan corporate tax rate history. The corporate tax statistics database brings together a range of valuable information to support the analysis of corporate taxation. 4.2 total % of gdp 2019 japan % of gdp: Headline individual capital gains tax rate (%) gains arising from sale of stock are taxed at a total rate of 20.315% (15.315% for national tax purposes and 5% local tax).

Historical uk corporation tax rates this list shows the history of uk corporation tax rates and thresholds from 1971 to 2023. Table 1, below, gives a history of corporate tax rates from 1909 to 2002. Corporate profits were at their highest level in history, and corporate failures were at their lowest level, while investments in plant and equipment for manufacturing products, such as semiconductors, were very active.

Provincial and local governments may levy additional taxes. Standard enterprise tax (and local corporate special tax) ※information on japanese tax system can also be obtained from the following url.

Japan (red) tax on corporate profits indicator: The uk fiscal year runs from april 1st to march 31st. Corporate income tax rate exclusive of surtax.

Corporation tax is payable at 23.2%. Outline of the reduced tax rate system for consumption tax. Most companies' financial years will differ from this though, creating overlaps.

Companies also must pay local inhabitants tax, which varies with the location and size of the firm. Sales tax rate in japan averaged 6.88 percent from 2006 until 2021, reaching an all time high of 10 percent in 2019 and a record low of 5 percent in 2007. The inhabitants tax, charged by both prefectures and municipalities, comprises the corporation tax levy (levied

Japan corporate tax rate table by year, historic, and current data. Learning more about taxes (june,2021) The oecd's work on tax and the environment investigates to what extent countries harness the power of taxes and tradable permit systems for environmental and climate policy.

Local corporation tax applies at 10.3% on the corporation tax payable. (note) although the reduced tax rate of consumption tax (8%) is same as the rate that was effective until september 30, 2019, the breakdown of national consumption tax rate (from 6.3% to 6.24%) and local consumption tax rate (from 1.7% to 1.76%) has been changed. Corporate tax rates table kpmg’s corporate tax rates table provides a view of corporate tax rates around the world.

At the end of the 1980s, japan's economy enjoyed favorable conditions, with stable wholesale prices and a low unemployment rate. Outline of corporation income tax (pdf/316 kb) guidelines for notification of corporation establishment, etc. The regular business tax rates vary between 1.9% and 4.32% depending on the tax base (taxable income) and the location of the taxpayer.

32.0 total % of gdp 2018 japan % of gdp: Items covered by the reduced tax rate system. Combined corporate income tax rate.

[items subject to the reduced tax rate] Capital gains tax (cgt) rates headline corporate capital gains tax rate (%) capital gains are subject to the normal cit rate. Indirect tax rates , individual income tax rates , employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country, jurisdiction or region.

Corporate tax rate in japan averaged 40.83 percent from 1993 until 2021, reaching an all time high of 52.40 percent in 1994 and a record low of 30.62 percent in 2019. In addition, the effective corporate tax rate may be higher due to the imposition of corporate level taxes on dividend or other distributions. Data is also available for:

Beginning from 1 october 2019, corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 10.3% of their corporate tax liabilities.

At A Glance Treasurygovau

Japan General Government Gross Debt To Gdp 2021 Data 2022 Forecast

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000-2020 Historical Chart

Corporate Tax Reform In The Wake Of The Pandemic Itep

1980s In Japan - Wikipedia

Japan Government Debt Of Gdp 1994 2021 Ceic Data

Corporate Tax Reform In The Wake Of The Pandemic Itep

2

House Democrats Tax On Corporate Income Third-highest In Oecd

Another Study Confirms Us Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995-2020 Historical Chart

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006-2020 Historical

The History Of Taxes Heres How High Todays Rates Really Are

2

Another Study Confirms Us Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Personal Income Tax - An Overview Sciencedirect Topics

Mxsfijaogoafem

Micronesia Business Gross Revenue Tax 2021 Data 2022 Forecast 2020 Historical

2