Pay Indiana State Estimated Taxes Online

This form is for income earned in tax year 2020, with tax returns due in april 2021. File & pay online file your taxes online.

Tax Year 2020 Changes To Irs Form 1040 - Taxslayer Pros Blog For Professional Tax Preparers

There's nothing better than knowing your state estimated taxes.

Pay indiana state estimated taxes online. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. There are no fees but you. This means you may need to make two estimated tax payments each quarter:

Pay online using mastercard, visa or discover at the indiana state government epay website (see resources). This includes making payments , setting up payment plans, viewing refund amounts,. You may even earn rewards points from your card.

Rates do increase, however, based on geography. Visit irs.gov/payments to view all the options. Indiana has a flat state income tax rate of 3.23% for the 2020 tax year, which means that all indiana residents pay the same percentage of their income in state taxes.

We will update this page with a new version of the form for 2022 as soon as it is made available by the indiana government. You can also use the eftps system. To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov.

With department of revenue approval, you can also set up a tax payment plan or file a payment under a deadline extension through the epay system. Pay state estimated quarterly taxes online & on time. Only break out your spouse’s estimated county tax if your spouse owes tax to a county other than yours.

Intime offers a quick, safe and secure way to submit payments at your convenience. Set up a payment plan, if you owe more than $100, using intime. Update your address ensure we have your latest address on file.

Pay with american express at officialpayments.com. For additional information, refer to publication 505, tax withholding and estimated tax. The tax bill is a penalty for not making proper estimated tax payments.

To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov. You should also know the amount due. If the amount on line i also includes estimated county tax, enter the portion on lines 2 and/or 3 at the top of the form.

Learn about state requirements for estimated quarterly tax payments. You're not restricted on the frequency or timing of any estimated payments you make during the year, as long as they're received by the due date of the return. Individual income tax filers can use form 51, estimated payment of idaho individual income tax, and businesses can use form 41es, quarterly estimated tax / extension of time payment.

Intime offers a quick, safe and secure way to submit payments at your convenience. Set up a recurring debit payment for an existing payment agreement. When prompted, provide your taxpayer identification number or social security number and your liability number or warrant number.

One to the irs and one to your state. Using the indiana epay system, you can now make all of your tax payments (including estimated tax payments if required), online. To get started, click on the appropriate link:

Overview of indiana taxes indiana has a flat tax rate, meaning you’re taxed at the same 3.23%. If you did make estimated tax payments, either they were not paid on time or you did not pay enough to. It's fast, easy & secure, and your payment is processed immediately.

If you owe $1,000 or more in state and county tax that's not covered by withholding taxes, or if not enough tax was withheld, you need to be making estimated tax payments. Estimated indiana income tax due, enter the amount from line i on line 1, state tax due, at the top of the form. Unlike the federal income tax system, rates do not vary based on income level.

Some states also require estimated quarterly taxes. Intax supports the ability to file and pay electronically for the following taxes: Aside from mailing the payment, you can pay taxes online using a debit or credit card.

Estimated payments may also be made online through indiana's dorpay website. Make a payment online with intime by credit card or electronic check. Makes it easy to pay state estimated quarterly taxes using your favorite debit or credit card.

Dor Stages Of Collection

Can I Get Suddenlink In My Area In 2021 Internet Packages Cheap Internet Broadband Internet

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Best Tax Software For 2021 Turbotax Hr Block Jackson Hewitt And More Compared - Cnet

Vintage 1970s Style Evansville Indiana Skyline Canvas Print By Awesomeart - Medium Evansville Evansville Indiana Indiana

Look Uppay Property Taxes

Inside The Digital Revolution The Power Behind Persi Digital Revolution Genealogy Revolution

How Much Are Americas Poor Road Conditions Costing You State Road Conditions Cost Your Car Surprising To See How Much Per Road Conditions Auto Repair Repair

Dor Keep An Eye Out For Estimated Tax Payments

Sample Tax Specialist Resume Resume Summary Resume Examples Resume

Ron Hinshan Sold Kachinas Httpwwwicollectorcommini-hopi-kachinas_i15563936 American Indian Art Indian Art American Indians

Indiana Glass Marigold Carnival Glass Set Of 4 Water Wine Etsy Carnival Glass Blue Carnival Glass Glass

Form Es-40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form - 2021 Indiana Templateroller

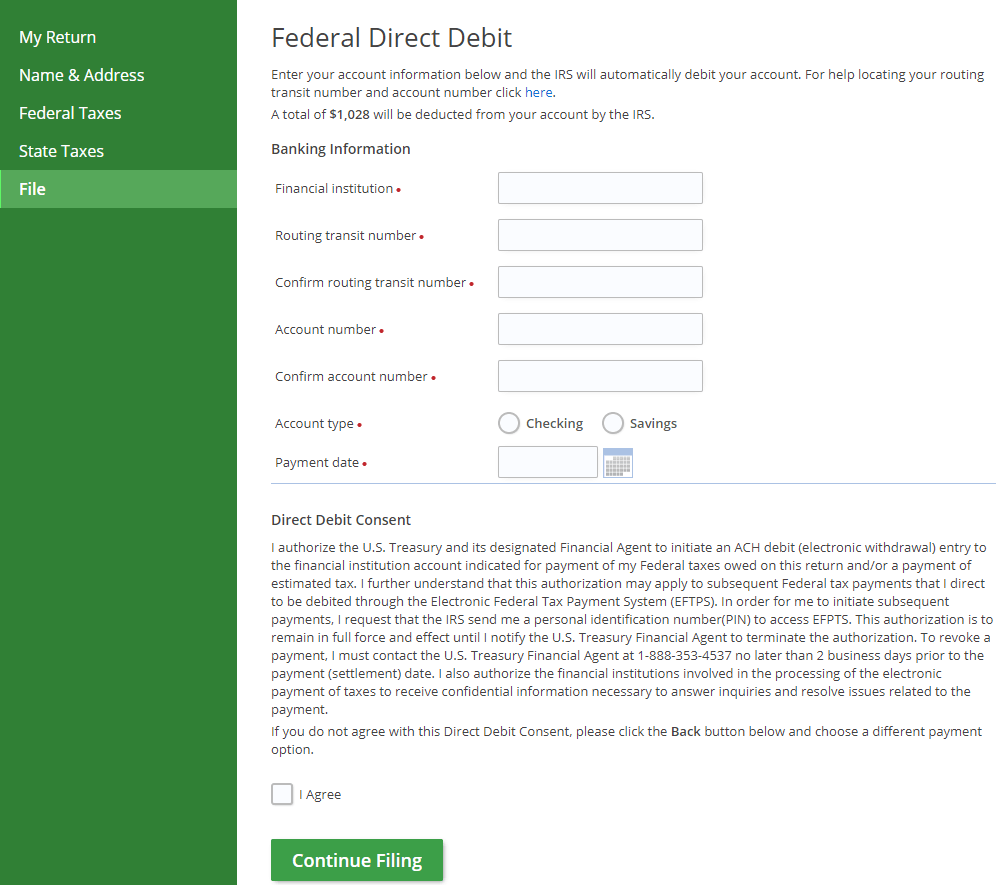

Pay Your Federal State Taxes On Efilecom Debit Check

Get Our Image Of Auto Repair Shop Receipt Template Estimate Template Auto Repair Estimates Auto Repair

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Shop Womens Plus Size Womens Plus Size Bella Rosa Maxi Dress - Ivory Jeulia Chicwish Ray Bans

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition