B&o Tax Form

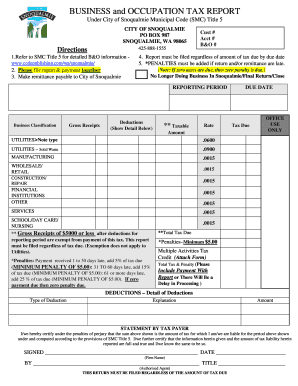

Please write this department if you have questions concerning completing this form or concerning your taxability. *penalties must be added if return and/or remittance are late.

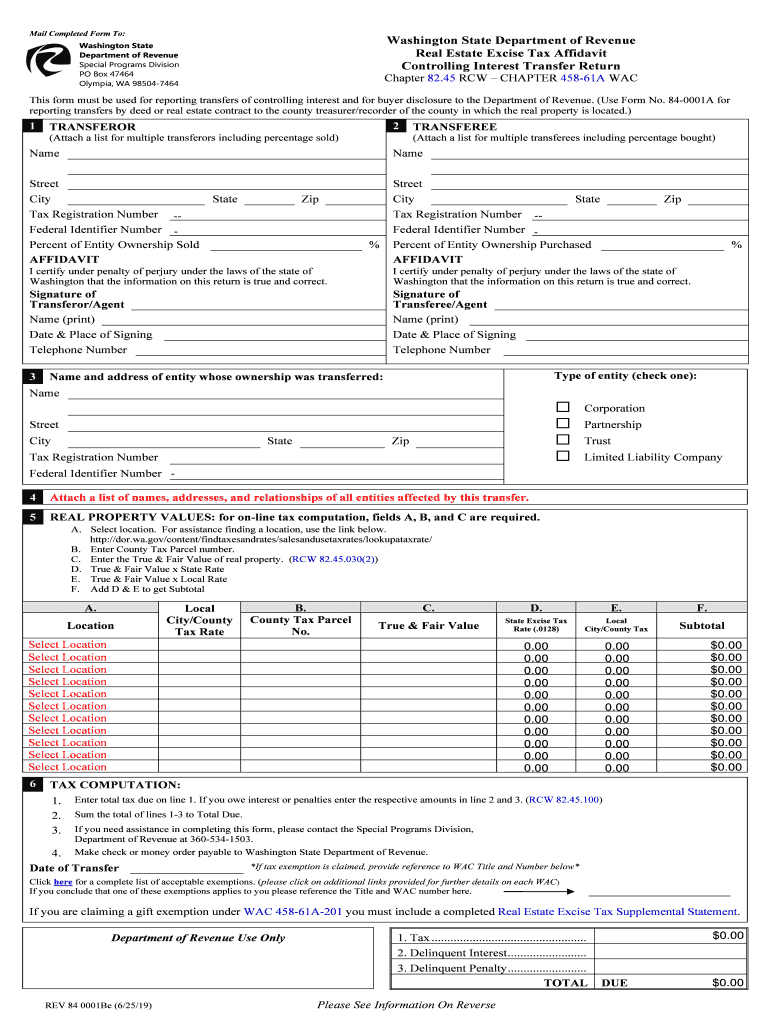

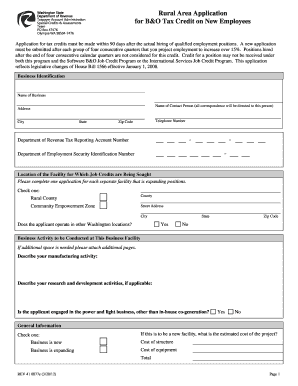

Wa Dor 84-0001b 2019-2021 - Fill Out Tax Template Online Us Legal Forms

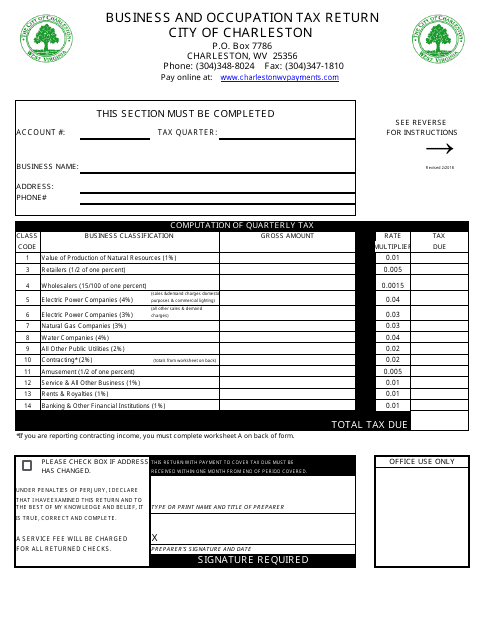

B & o tax form | ravenswood west virginia.

B&o tax form. Please include your customer number. For products manufactured and sold in washington, a business owner is subject to both the manufacturing b&o tax and the wholesaling or retailing b&o tax. See the fees & penalties to calculate penalties for reports received after the due date.

The manufacturing b&o tax rate is 0.484 percent (0.00484) of your gross receipts. Rental property registration form ; Determine your business classification(s) and corresponding rate(s) from the tax table.

States of washington, west virginia, and, as of 2010, ohio, and by municipal governments in west virginia and kentucky. Report must be filed regardless of amount of ta x due by due date 5. Mail or deliver completed tax return to:

A generic report is provided below for your convenience. Sign the form and mail in a check payment for the total taxes due by the quarterly due date. Please file your city b&o taxes on the filelocal portal.

Furnishing electricity, carrying or furnishing natural or manufactured gas, furnishing water/sewer service, furnishing garbage or refuse collection, furnishing garbage or recycling service (public). This means there are no deductions from the. Penalties please provide the following information if there has been a sale or closure of your business during this tax period:

If you are unable to file or renew using the filelocal portal then you can print and mail the tax return. What is the business and occupation (b&o) tax? B&o tax payment procedures the tax return form must be completed and postmarked by the last day of the month following the reporting period.

Those taxpayers earning in excess of $1.0 million a year will be required to remit quarterly b&o tax returns. Tax payers are required to file an annual b&o tax return at the end of each calendar year. The city mails a personalized b&o tax report to our businesses on or around the first week of january of each year.

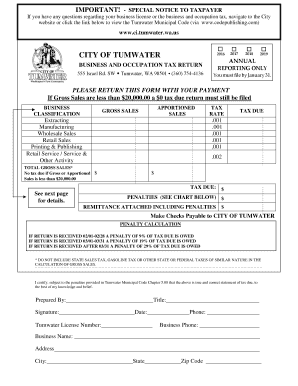

B&o tax reports and tax payments are due by april 15th of each calendar year. The business and occupation tax rates, as established by city resolution, are as follows: Mail the form and payment to the city of ruston 5117 n winnifred street ruston wa 98407.

Business and occupation tax p. Washington’s b&o tax is calculated on the gross income from activities. It is measured on the value of products, gross proceeds of sale, or gross income of the business.

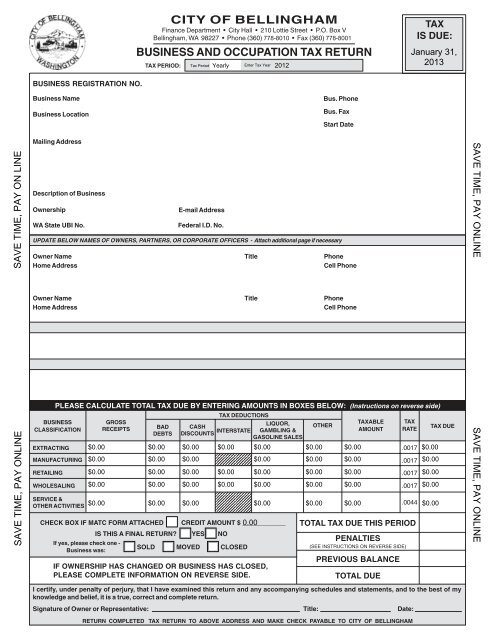

Washington, unlike many other states, does not have an income tax. City of bellingham finance department 210 lottie street Businesses that are required to pay b&o tax do not pay the per employee fee.

To submit your b & o tax form follow these instructions: If you do not receive your form or you are a new business that is not in our system, you can download a form below. All businesses must file a business and occupational tax report.

The state b&o tax is a gross receipts tax. B&o tax return form ; You may also reach us at 360.442.5040.

Download the b &o tax form below. Under city of north bend municipal code chapter 5.04, 5.05, & 5.06. The b&o tax form is mailed at the end of each calendar quarter.

(contracting class instructions are listed below.) 3. City of north bend business and occupational tax report. How to file your b&o taxes.

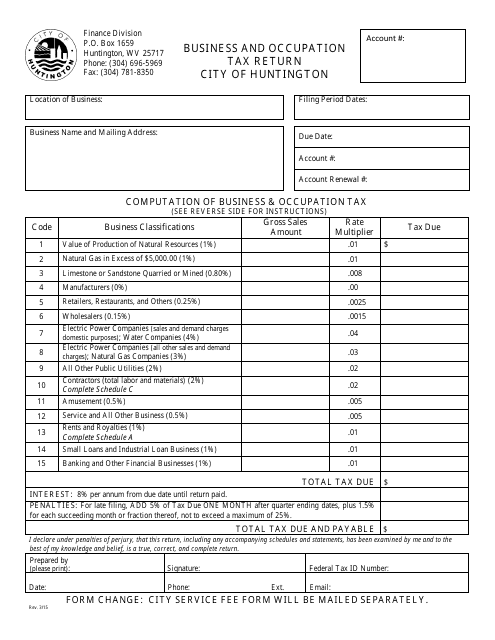

Determine your taxes due by multiplying the rate by the taxable income. B&o tax classifications and rates vary according to the type of business. Determine you charleston b&o taxable gross income for each of the classifications and enter it in the appropriate box.

If you would like assistance navigating the filelocal system, please call filelocal directly at: Please review our telephone business tax form. Column 1 business classification column 2 gross receipt amount column 3 deductions column 4 taxable amount column 5 x rate column 6 tax due utilities 1.06

Please be aware some of our tax rates decreased july 1, 2017 so you must choose the correct form depending on what time period you are filing for. However, you may be entitled to the. Utility tax form (pdf) this form includes the following:

Businesses with gross receipts of $1.5 million or more per year, earned within the city of renton, will be required to file and pay b&o tax. See codified ordinances of the city of wheeling, part 7, chapter 5, article 787; Address your inquiries to city of longview, b & o tax department, 1525 broadway, po box 128, longview wa, 98632.

It is a type of gross receipts tax because it is levied on gross income, rather than net income.while deductions are not permitted for labor,. The business and occupation tax (often abbreviated as b&o tax or b/o tax) is a type of tax levied by the u.s.

B O Tax Blog Seattle Business Apothecary Resource Center For Self-employed Women

City Of Olympia B O Tax Form - Fill Online Printable Fillable Blank Pdffiller

Dorwagov

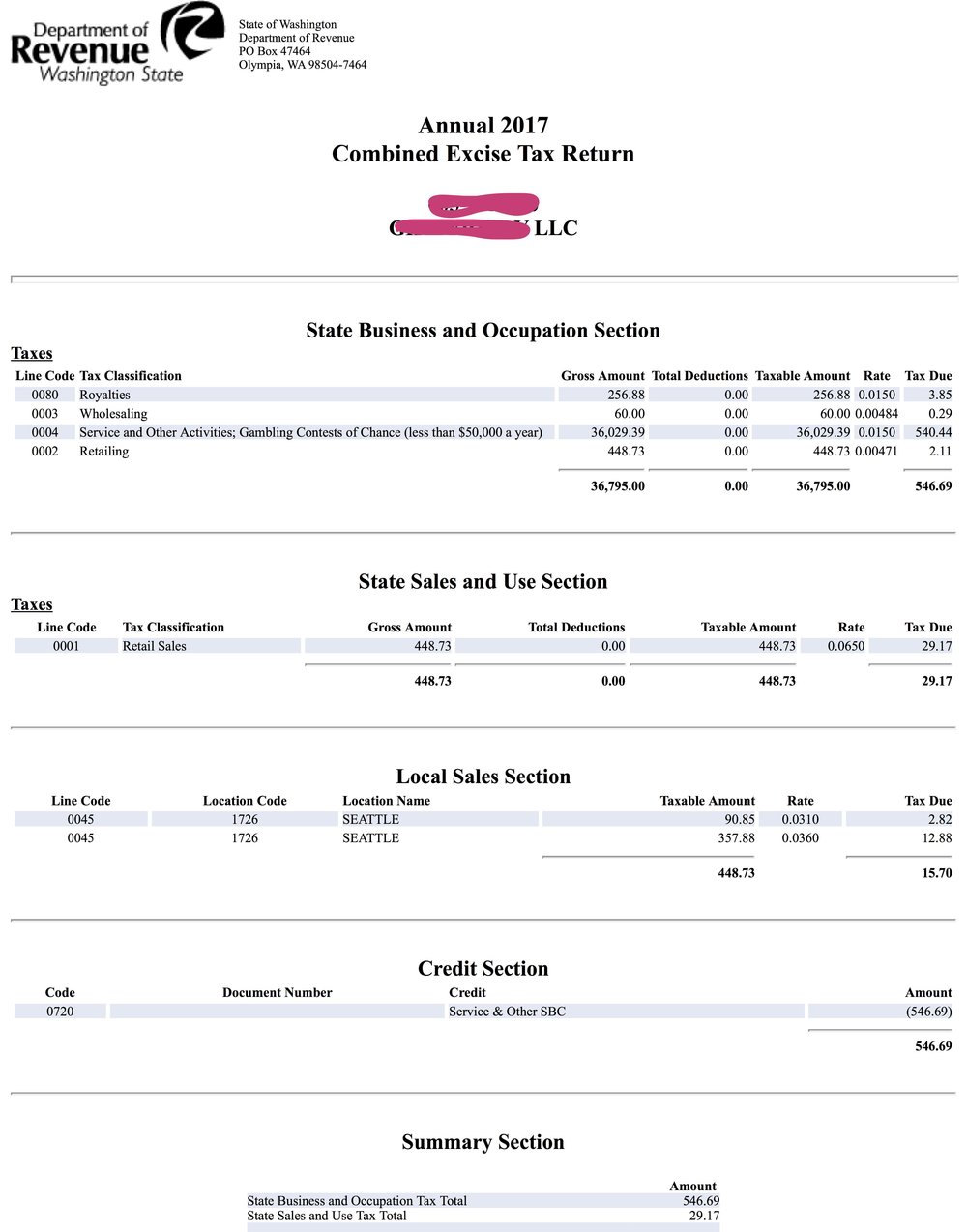

Wa Sales Boand Use Tax

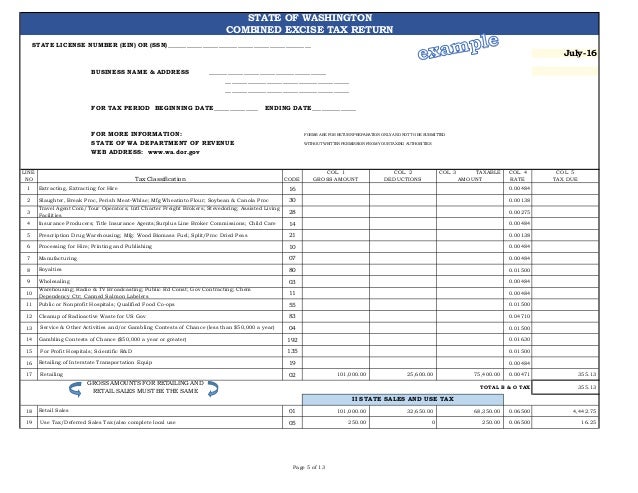

Wa Dor Combined Excise Tax Return 2016 - Fill Out Tax Template Online Us Legal Forms

City Of Everett B O Tax Form - Fill Online Printable Fillable Blank Pdffiller

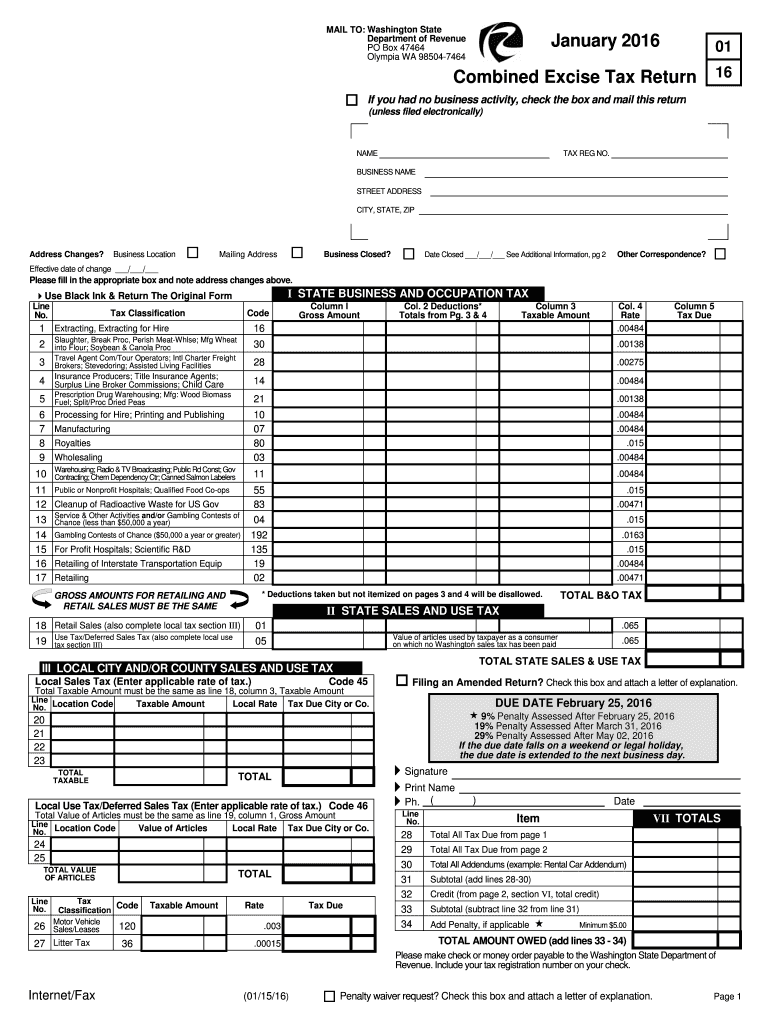

Wa Dor Combined Excise Tax Return 2020-2021 - Fill Out Tax Template Online Us Legal Forms

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

City Of Olympia Business And Occupation Tax Report - Fill Online Printable Fillable Blank Pdffiller

Tax Everett Form - Fill Online Printable Fillable Blank Pdffiller

Wa B O Tax Form - Fill Online Printable Fillable Blank Pdffiller

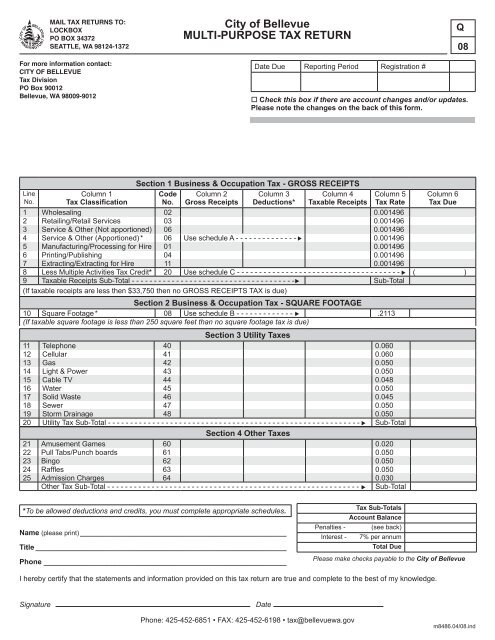

Bo Tax Return - City Of Bellevue

Fillable Online Generic Bo Tax Form For Webdocx Fax Email Print - Pdffiller

City Of Tumwater B O - Fill Online Printable Fillable Blank Pdffiller

Business And Occupation Tax Form - City Of Bellingham Wa

Quarterly Multi-purpose Tax Return - City Of Bellevue

Beckleyorg

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Bellevuewagov