Nj Property Tax Relief Check 2021

Phil murphy and lawmakers agreed to in september, about 800,000 garden state residents could receive a $500 rebate check within a few. Former new jersey governor brendan byrne had a similar idea.

New Jersey Tax Forms 2020 Printable State Nj-1040 Form And Nj-1040 Instructions

By south jersey times letters.

Nj property tax relief check 2021. We began mailing approved 2020 payments on july 15, 2021. News 12 staff new jersey property owners could see a $500 property tax rebate under an agreement that state officials announced on monday. Pay online with no fee if paid thru your checking account or a 2.65% fee if paid with a credit card.

In new jersey, localities can give. Tax amount varies by county. Posted wed, jul 14, 2021 at 4:00 pm et | updated thu, jul 15, 2021 at 10:22 am et replies (26) the state has mailed 200,000 rebate checks, worth up to $500, to eligible families.

This tax applies to both class 2 and class 4a commercial properties. This includes residential properties (including single. The user is on notice that neither the state of nj site nor its operators review any of the services, information and/or content from anything that may be linked to.

New jersey — as part of a $319 million package that gov. New jersey has one of the highest property taxes, ranking 4th in the nation. This will put more money in the pockets of.

The state budget for fy2022 has been finalized and there were no changes made to the income limit established in the 2020 eligibility requirements. On top of inheritance taxes, new jersey residents could also owe estate taxes to the federal government. The mansion tax applies to real estate purchases over $1 million.

Federal estate tax in new jersey. Counties in new jersey collect an average of 1.89% of a property's assesed fair market value as property tax per year. We will continue to issue rebates to eligible recipients as 2020 tax returns are processed through december 31, 2021.

New jersey will update homestead benefit payments, which will now be based on the most recent property tax information from 2017, instead of 2006. The division will waive penalties for qualified companies that pay back corporation business taxes for certain years that they had nexus with new jersey but failed to. We began mailing checks july 2 and anticipate it will take about six weeks for all of the initial checks to be processed.

The most anyone can get back is $500. Be a new jersey resident for all or part of 2020; All property tax relief program information provided here is based on current law and is subject to change.

Yes, that’s murphy’s name attached, in an election year. The 2021 property tax credits are based on one’s 2017 income and property taxes paid. Mailed/dropped off at 400 witherspoon st., attn:

New jersey’s senior freeze program. The median property tax in new jersey is $6,579.00 per year for a home worth the median value of $348,300.00. Tax office, princeton, nj 08540.

The homestead benefit program provides property tax relief to eligible homeowners. However, there are different ways you might be able to reduce your nj property taxes. I went to the new jersey division of taxation website, where there.

Tax rebate checks arriving soon. When his administration launched the homestead benefits program, which provides property tax rebates to homeowners, his name appeared on checks — worth about $900 today — homeowners received about a month out from election day. Sending over 760,000 families a rebate of up to $500 as part of the 2020 agreement to levy a higher income tax on people who earn more than $1.

For example, if an eligible family paid $250 in taxes, they would get a $250 rebate check. The garden state is home to the highest levies on property in the nation, with a mean effective property tax rate of 2.21%, according to the tax foundation. This program originally scheduled to expire on october 15, 2021, is now extended to january 3, 2022.

If a reimbursement has been issued, the system will tell you the amount of the reimbursement and the date it was issued. Check the status of your new jersey senior freeze (property tax reimbursement). All property tax relief program information provided here is based on current law and is subject to change.

It is a 1 percent tax imposed on such purchases, which means that you or your buyer will pay a minimum of $10,000 to satisfy the new jersey mansion tax. Even before you receive your yearly tax notice from your county, you should begin the process of trying to lower your property tax bill. Determine if you are eligible for nj property tax relief

Jun 22, 2021, 1:12am updated on jun 22, 2021 by: Drop off in the police lobby drop box located at 1 valley rd. For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes.

500 Stimulus Check In New Jersey When Is It Coming - Ascom

Office Of The Governor Governor Murphy Signs Fiscal Year 2022 Appropriations Act Into Law

The Official Website Of The Township Of Belleville Nj - Tax Collector

Tax Finance Dept - Sparta Township New Jersey

Nj Property Tax Relief Program Updates Access Wealth

Property Taxes Wyckoff Nj

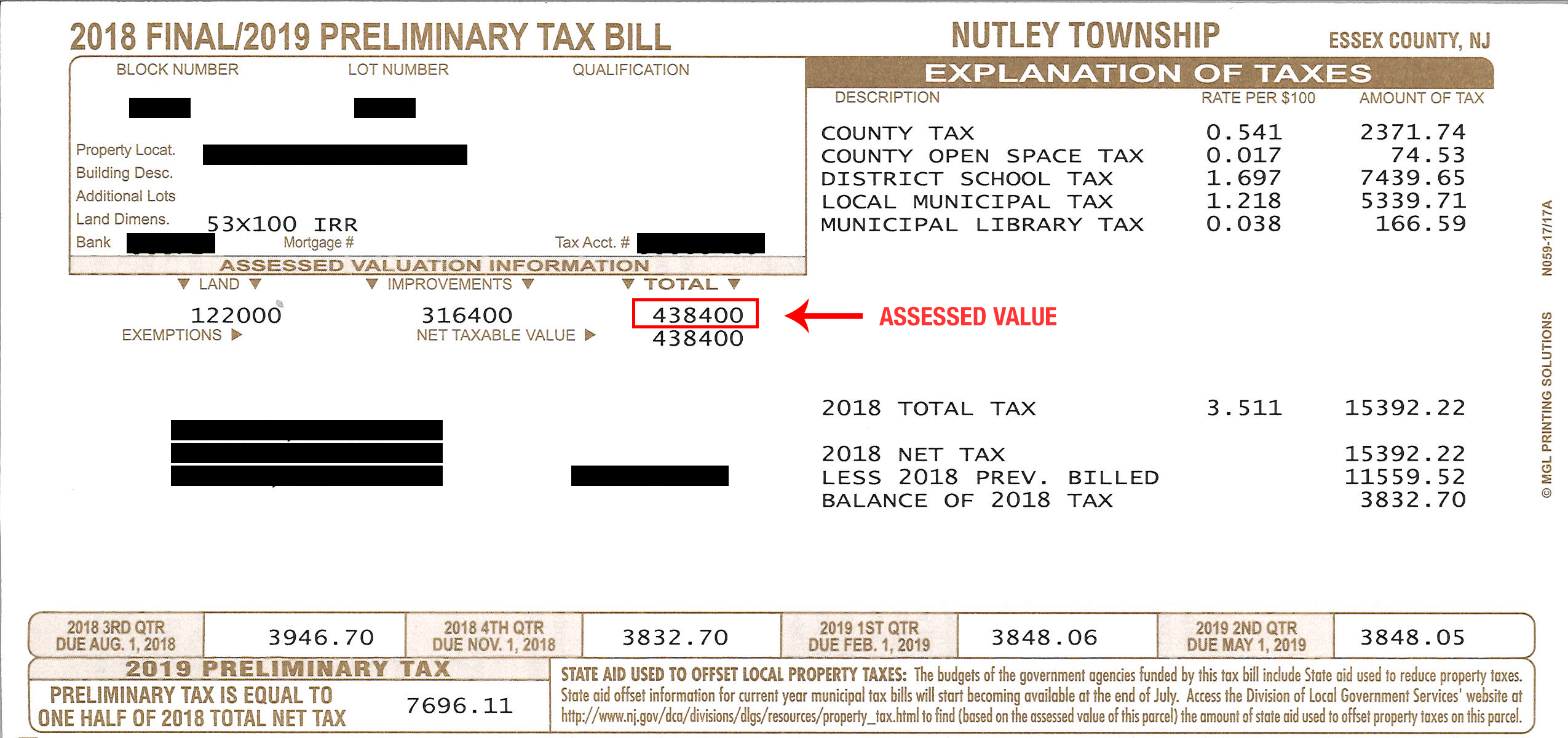

Freehold Township Sample Tax Bill And Explanation

Tax Collector Clayton Nj

500 Rebate Checks Coming For Nj Residents What We Know Mendham Nj Patch

Nj Div Of Taxation Nj_taxation Twitter

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

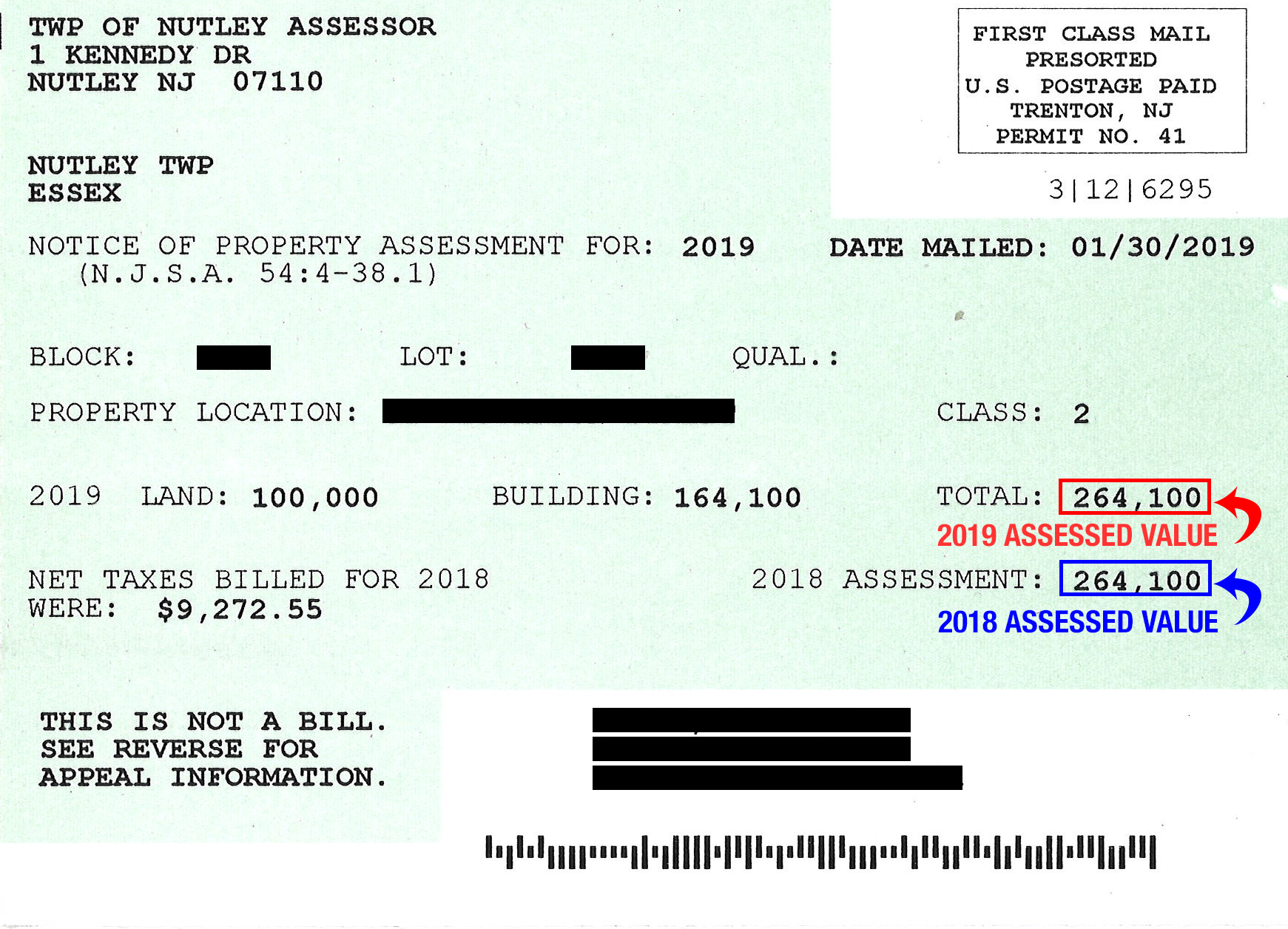

Nutley New Jersey - Property Tax Calculator

Freehold Township Sample Tax Bill And Explanation

Nutley New Jersey - Property Tax Calculator

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Tax Assessor Township Of Franklin Nj

Tax Collectors Office - City Of Englewood Nj

The Official Website Of The Borough Of Roselle Nj - Tax Collector