How To File Taxes For Coinbase

You can generate your gains, losses, and income tax reports from your coinbase investing activity by connecting your account with cryptotrader.tax. Coinbase has partnered with cointracker, a portfolio tracking, and tax calculating platform, to make the process of declaring their crypto taxes.us citizens have just three months to declare their crypto losses and gains to the irs.

Coinbase 1099 What To Do With Your Coinbase Tax Documents - Lexology

How to file tax coinbase.

How to file taxes for coinbase. There are some limitations though. That will tell you your capital gain/loss. A us person for tax purposes;

Fortunately for each us person eligible for taxes, coinbase does issue the irs form necessary for rewards, fees, and other transactions. You were a coinbase pro or coinbase prime customer; Calculate your gains and losses.

If you want to prepare your gains and losses on coinbase for taxes, the recommended procedure is to download your transaction history on coinbase by using the method in this guide. How to determine your gains on coinbase and or gemini. Its business model is simple:

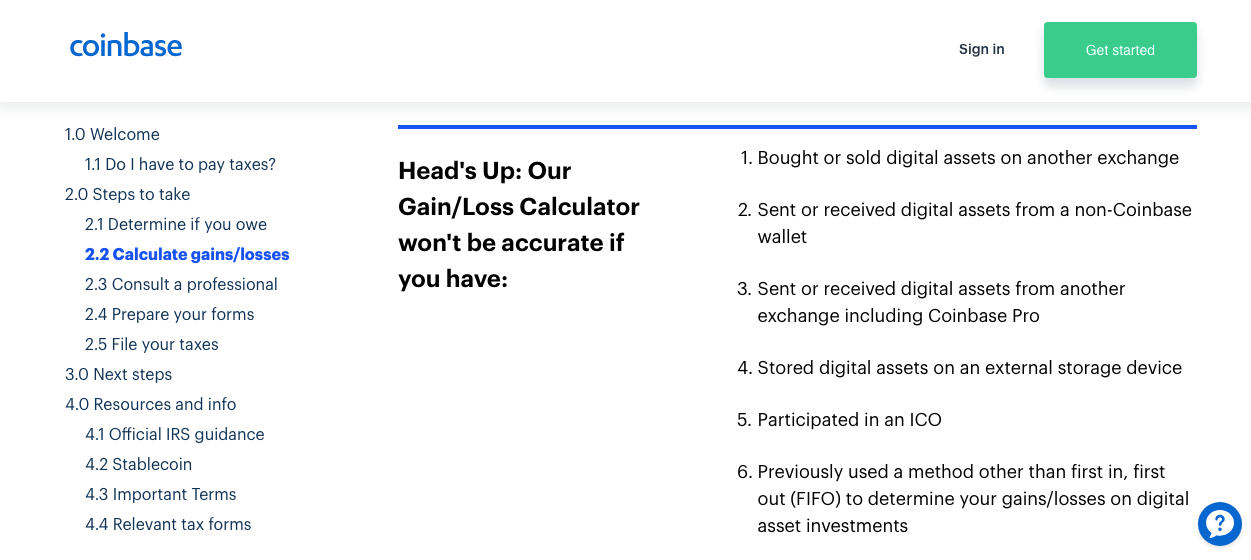

Take how much you paid for the currency and subtract that from how much it was worth when you sold it for fiat. However, it only includes your coinbase gains/losses, and not other cryptocurrency exchanges. Simply follow the steps below to connect your coinbase account with coinpanda and your tax forms will be ready shortly.

💲 try cointracker for your cryptocurrency tax calculations 💲 💲 get a 10% discount when you use my link!! This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year, using our calculations. Report each gain/ loss on form 8949.

The company operates from a remote location and does not have employees. Create the appropriate tax forms to submit to your tax authority. If you have a ton of transactions, then summarize them and attach a copy of the transaction report you have.

Achieve peace of mind rest assured that cointracker is the most trusted and accurate crypto tax and portfolio tracking solution, featuring 300+ exchange/defi integrations and 8,000+ cryptocurrencies. There’s a lot of conflicting content out there, but make no mistake: Find your tax data file (.tax file) in windows.

How to do your coinbase taxes. You can file with turbotax free edition if you only have the following situations: This tax season, coinbase customers will be able to generate a gain/loss report that details capital gains or losses using a hifo (highest in, first out) cost basis specification strategy.

Filing your coinbase wallet tax reports. Earned income tax credit (eic) You are required to report gains and losses on each transaction or when you earn cryptocurrency, even if the gain or loss is not.

You can also upload a csv/excel file instead of connecting your account with api by following the steps explained below. Coinbase provides the info you need on their site so long as you access your records on your account at the end of the year. You can only upload a maximum of 1000 transactions into turbo tax and the gains loss calculator will not include any transactions that were on coinbase pro.

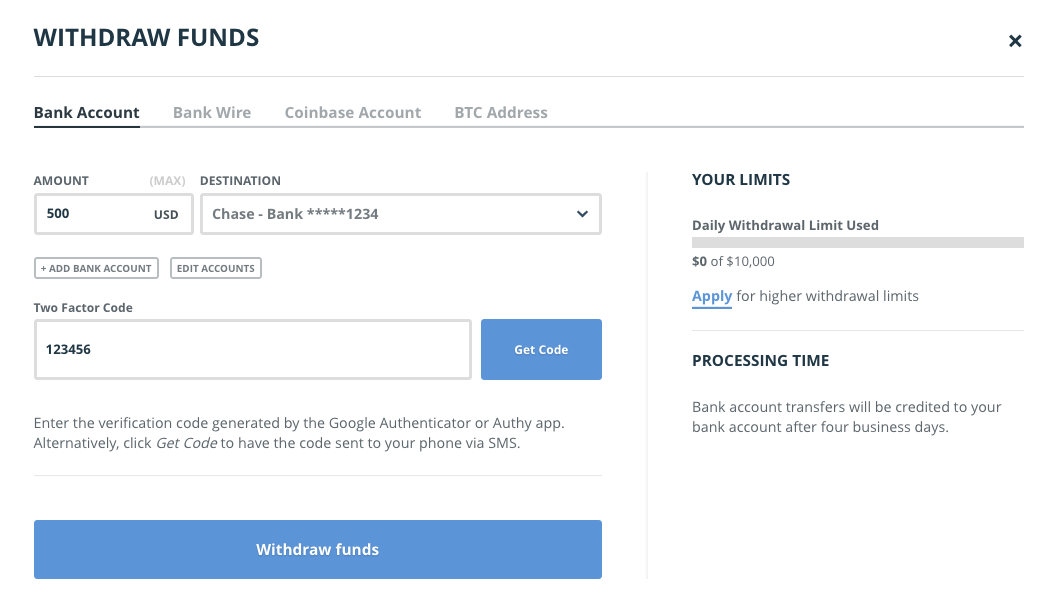

Download your transaction history csv file. Yes, you'll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not, coinbase does report your crypto activity to the irs if you meet certain criteria (you should be a coinbase customer; Effortlessly calculate your coinbase wallet taxes and create the correct tax forms to send to your tax authority.

You have to be eligible and file for the form. How to do your coinbase taxes. The company recommends connecting all the accounts with cointracker, so they are able to calculate your income as well as the cost basis for your transactions.

Coinbase pairs with koinly through api or csv file import to make reporting your crypto taxes easy. You need to download your transaction history from the coinbase website and use them to upload into turbotax. How do i file a coinbase tax return?

The safest thing would be to itemize each transactions, this includes buying and selling between cryptos, those are taxable events. Upload a csv file to coinpanda. The good news is, while coinbase might not provide tax forms and documents, coinbase does offer 2 easy ways to export transaction and trade history!

There should be a button for exporting your entire wallet history in coinbase wallet as a csv file. When you have this ready, simply import the file into coinpanda to generate your tax report. Cryptotrader.tax imports coinbase data for easy tax reporting.

Koinly completely integrates with coinbase wallet and makes tax reporting a walk in the park. The coinbase exchange is an independent platform without an official headquarters. Should have earned $600 or more in rewards or fees from coinbase earn, usdc rewards, and/or staking).

Cointracker will now be available to coinbase customers to prepare their tax returns for crypto. This guide is our way of helping you better understand your crypto tax obligations for the 2020 tax season and detail coinbase resources available to you that makes the process easier. The website allows people to buy, sell, and trade cryptocurrency.

Even if you don’t receive one, you need to make sure to use your account history to download an invoice so you can file your cryptocurrency transactions properly this tax season. Coinbase recommends using cointracker to calculate your cryptocurrency gains and losses and to access your csv file. Coinbase no longer supports the direct upload of your csv file to turbotax, resulting in an error message for some users.

Preparing Your Gainslosses For Your 2020 Taxes Coinbase Help

Coinbase 1099 Guide To Coinbase Tax Documents - Gordon Law Group

Coinbase Is Committed To Helping Our Customers During Tax Season By Coinbase The Coinbase Blog

Coinbase Wallet App Transaction History

The Coinbase Conundrum Providing Accurate Tax Information To Users By Lucas Wyland Hackernooncom Medium

Coinbase Releases Cryptocurrency Tax Calculator - Europe World News

Does Coinbase Report The Irs Koinly

3 Steps To Calculate Coinbase Taxes 2022 Updated

Coinbase To Stop Reporting Form 1099-k To Irs And Customers Cryptotrader Tax

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Coinbase Transaction Fee Calculator How Do I Account For Mined Crypto On Taxes Marco Cena

3 Steps To Calculate Coinbase Taxes 2022 Updated

Best Coinbase Tax Calculator - How To Calculate Your Coinbase Taxes

Understanding Crypto Taxes Coinbase

Coinbase Issues 1099s Reminds Users To Pay Taxes On Bitcoin Gains

Coinbase Transaction Fee Calculator How Do I Account For Mined Crypto On Taxes Marco Cena

Coinbase - Downloading Tax Reports Beta - Youtube

3 Steps To Calculate Coinbase Taxes 2022 Updated

3 Steps To Calculate Coinbase Taxes 2022 Updated