South Dakota Sales Tax Rates By County

This table shows the total sales tax rates for all cities and towns in perkins county, including all local taxes. Questions answered every 9 seconds.

Pin On Interestingmaps

The current total local sales tax rate in brookings county, sd is 4.500%.

South dakota sales tax rates by county. The south dakota sales tax and use tax rates are 4.5%. This is the total of state and county sales tax rates. Brookings county, sd sales tax rate.

What rates may municipalities impose? View county sales tax rates. This is the total of state and county sales tax rates.

What is south dakota's sales tax rate? View city sales tax rates. This rate includes any state, county, city, and local sales taxes.

South dakota municipalities may impose a municipal sales tax, use tax, and gross receipts tax. 365 rows combined with the state sales tax, the highest sales tax rate in south dakota is 6.5% in the cities of sioux falls, rapid city, aberdeen, watertown and brookings (and 111 other cities). The minimum combined 2021 sales tax rate for brown county, south dakota is.

The south dakota state sales tax rate is currently %. Enter a street address and zip code or street address and city name into the provided spaces. The marshall county sales tax rate is %.

Historical sales tax statistical reports are organized in the expand/collapse regions below. South dakota has a 4.5% sales tax and lake county collects an additional n/a, so the minimum sales tax rate in lake county is 4.5% (not including any city or special district taxes). Who this impacts marketplace providers are required to remit sales tax on all sales it facilitates into south dakota if the thresholds of 200 or more transactions into south dakota or $100,000 or more in sales to south dakota customers are met.

South dakota has a 4.5% sales tax and perkins county collects an additional n/a, so the minimum sales tax rate in perkins county is 4.5% (not including any city or special district taxes). 2020 rates included for use while preparing your income tax deduction. For cities that have multiple zip codes, you must enter or select the correct zip code for the address you are supplying.

As of march 1, 2019, marketplace providers who meet certain thresholds must obtain a south dakota sales tax license and pay applicable sales tax. The latest sales tax rate for rapid city, sd. The tax data is broken down by zip code, and.

Click search for tax rate. South dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax Ad a tax advisor will answer you now!

The 2018 united states supreme court decision in south dakota v. If you need access to a database of all south dakota local sales tax rates, visit the sales tax data page. The south dakota department of revenue administers these taxes.

Lincoln county collects the highest property tax in south dakota, levying an average of $2,470.00 (1.46% of median home value) yearly in property taxes, while mellette county has the lowest property tax in the state, collecting an average tax of $510.00 (1.02% of median home value) per year. Here's how codington county's maximum sales tax rate of 6.5% compares to other counties around the united states: The december 2020 total local sales tax rate was also 4.500%.

Our dataset includes all local sales tax jurisdictions in south dakota at state, county, city, and district levels. Mccook county, south dakota has a maximum sales tax rate of 6.5% and an approximate population of 4,462. The minimum combined 2021 sales tax rate for marshall county, south dakota is.

In all cases when you select a month, you will be viewing data compiled from returns filed with the department during that month. The 2018 united states supreme court decision in south dakota v. It may cover a variety of taxpayer filing periods, such as monthly, bi.

The south dakota state sales tax rate is currently %. This table shows the total sales tax rates for all cities and towns in clay county, including all local taxes. The brown county sales tax rate is %.

, sd sales tax rate. The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%. The exact property tax levied depends on the county in south dakota the property is located in.

The south dakota sales tax of 4.5% applies countywide. Sales tax rates in mccook county are determined by four different tax jurisdictions, salem, spencer, mccook and bridgewater. Some cities and local governments in codington county collect additional local sales taxes, which can be as high as 2%.

Sales tax rates in grant county are determined by three different tax jurisdictions, grant, milbank and big stone city. This rate includes any state, county, city, and local sales taxes. The latest sales tax rate for hand county, sd.

2020 rates included for use while preparing your income tax deduction. Click any locality for a full breakdown of local property taxes, or visit our south dakota sales tax calculatorto lookup local rates by zip code. Grant county, south dakota has a maximum sales tax rate of 6.5% and an approximate population of 5,696.

South dakota has a 4.5% sales tax and clay county collects an additional n/a, so the minimum sales tax rate in clay county is 4.5% (not including any city or special district taxes). Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 6%; This table shows the total sales tax rates for all cities and towns in lake county, including all local taxes.

Unaffordable California It Doesnt Have To Be This Way California Politics Government

Where Should I Retire Infographic - Blog - Boca Raton Fort Lauderdale Homes Real Estate Infographic House Prices Best Places To Retire

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax - Small Business Guide Truic

Pin On Misc Library

Pin On Lugares Que Visitar

Florida Taxpayers Deserve To Know About All Finalized Economic Development Deals The Amount Of Tax Dollars Committed Incentive Incentive Programs Infographic

Colorado Sales Tax Is Easy When You Know What Youre Doing Sales Tax Tax Colorado

These Are The Safest States To Live In Life Map States In America Us State Map

Every County In America Ranked By Scenery And Climate Beautiful Places In America North America Map Places In America

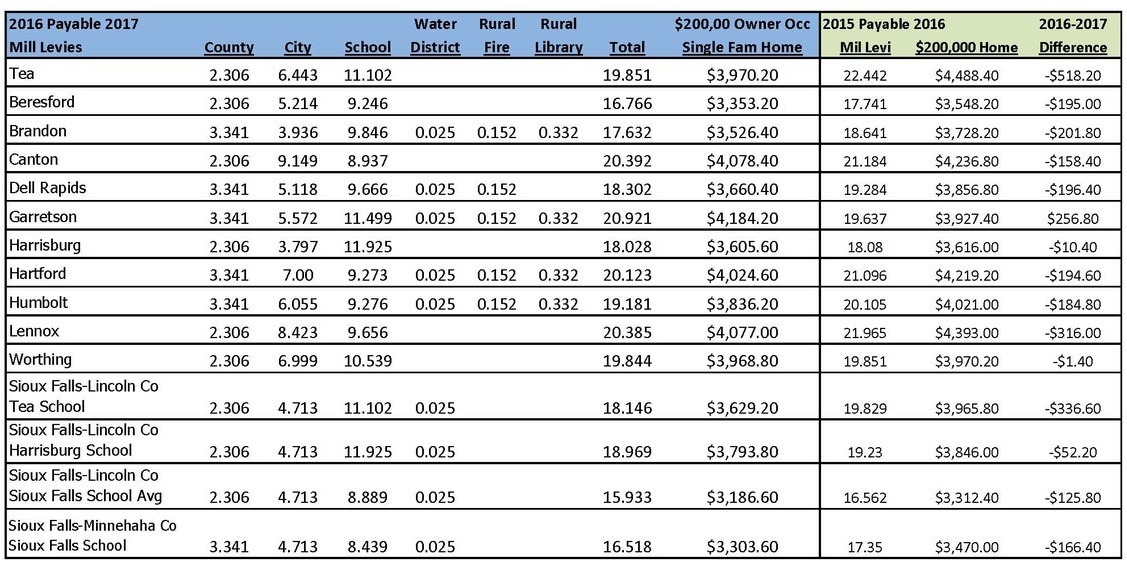

Tax Information In Tea South Dakota City Of Tea

Our Free Online Sales Tax Calculator Calculates Exact Sales Tax By State County City Or Zip Code County Sales Tax South Dakota

Americans Are Migrating To Low-tax States United States Map Native American Map States

Deer Lodge Mt Montana State Prison It Wasnt A Museum When I Lived In The Powell County Jailhouse Because My Dad W Deer Lodge South Dakota Vacation Montana

Sales Use Tax South Dakota Department Of Revenue

Tuition And Fees Over Time - Trends In Higher Education - The College Board Tuition Native American Spirituality College Board

Sales Use Tax South Dakota Department Of Revenue

States With Highest And Lowest Sales Tax Rates

South Dakota Sales Tax Rates By City County 2021