The Tax Shelter Aspect Of A Real Estate Syndicate

Most investors don’t think they are involved in a tax shelter but as we look at the definition of a syndicate, things begin to change. The benefits include the cash method of accounting, exemption from unicap rules, exemption from some inventory accounting requirements, and.

2

A syndicate is defined as a partnership or other entity (excluding c corporations) where more than 35 percent of the entity’s losses are allocable to “limited partners or limited entrepreneurs.

The tax shelter aspect of a real estate syndicate. C)has remained unchanged since 1980. Cost segregation (bonus/accelerated depreciation) cost segregation is a strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded, or remodeled any kind of real estate to increase cash flow by accelerating depreciation deductions and deferring income taxes. However, taxpayers could be subject to the limits if they’re considered tax shelters.

The tax cuts and jobs act, p.l. The tax shelter aspect of real estate syndicates no longer exists. What is the definition of a syndicate?

The tax shelter aspect of a real estate syndicate: Selected tax considerations, 1973 wis. 20 in addition, a tax shelter is any enterprise if interests have been offered for sale in any.

Holds '69 tax reform act, which limits amt of depreciation on commercial. For these purposes, a tax shelter which, even with revenue of less than $25 million, that will be subject to the §163(j) business interest limits would include: Tax shelter has the meaning provided by sec.

Open end fund mutual fund whose shares are issued and redeemed by the investment company at the request of investors B)is strengthened by the tax reform act of 1986. Because of this, the tax shelter definition is important.

19 as one might expect, the term includes a partnership or other entity if a significant purpose is the avoidance or evasion of federal income tax. Perhaps the largest drawback of direct real estate investments is the absence of large, liquid, and relatively efficient markets for them. Andrea and the others can only lose their initial investment.

According to practitioners, the proposed section 163(j) regulations did little to address that concern. Resolving problems raised by the 1969 act, 29 n.y.u. A broker/dealer specializing in the syndication of real estate tax shelters and other real estate projects.

Thea kruger of berdon llp said the broad definition of what constitutes a tax shelter in the code could produce some odd results. In its commonest form, this shelter involves one. Is considered a syndicate, and thus a tax shelter, in year 1 for purposes of sec.

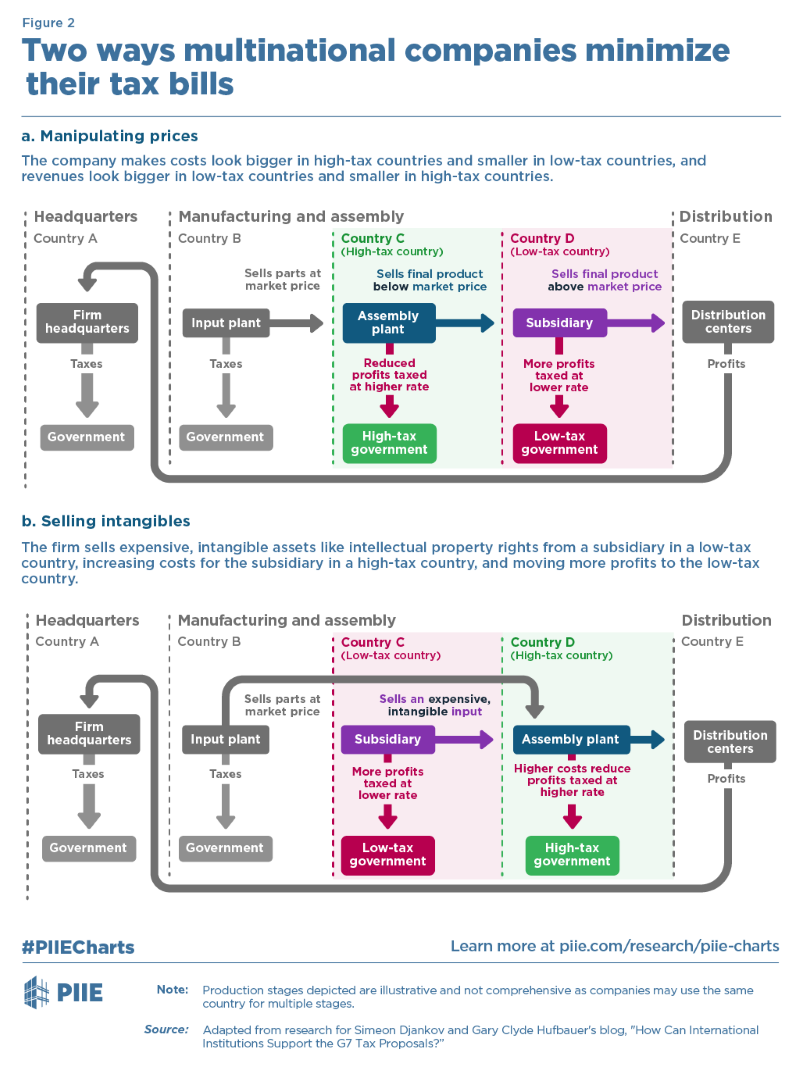

The definition of a tax shelter includes ‘a syndicate,’ which is defined as any partnership or other entity (other than a c corporation) with more than 35% of the losses during the tax year allocated to limited partners or limited entrepreneurs. Think of tax shelters as your financial bottom line’s best friend. Any tax shelter (as defined in section 66629d)(2)(c)(ii).

It introduces the concept of a “syndicate” as a tax shelter. For purposes of clause (i), the term “tax shelter” means— (i) a partnership or other entity, (ii) any investment plan or arrangement, or 461 because more than 35% of the loss will be allocated to b, who is considered a limited entrepreneur.

However, an investor in a real estate syndication can defer taxes further if they trade their share of the investment into another asset via a 1031 exchange. Your cpa or tax advisor is the best person to. They have passive activity gains and need a shelter.

You can avoid storage and assaying problems by investing in gold bullion coins. Real estate syndications real estate syndications are the most popular of the tax shelter vehicles. S l benzer article on real estate syndication notes wealthy individuals can deal themselves enormous tax shelters;

This regulation will provide much needed relief to many small businesses and will allow them to qualify to use the. Andrea mitchell has joined a real estate syndicate. In short, the tax shelter aspect of real estate syndicates no longer exists.

The individual who sold the participation units has unlimited liability and manages the property. The syndicate she belongs to was formed by one individual who sold participation units to andrea and several others. The tax shelter aspect of real estate syndicates no longer exists due to the tax reform act of 1986.

Any syndication (with the meaning of section 1256(e)(3)(b), and. E)is available only to limited partners. High interest rates depress gold prices because they make it very expensive to carry gold as an investment.

Of course, if the investor elects to sell their property, taxes will be collected through depreciation recapture and capital gains taxes. Since the tax status of the limited partnership is of such basic concern, he should in most instances limit his investments to those limited partnerships that have received a favorable tax ruling. D)improves the liquidity of real estate syndicates.

Does not receive a deduction in year 1 for its $10 of. 461(i)(3), including a specific rule for farming activities. What has practitioners most concerned is that smaller clients may fall.

Many people look to real estate syndication for tax purposes.

Is 1301 - Pdf Format - Inland Revenue Department

2

Pdf Does Reit Offer A Better Risk And Return Contour To The New Zealand Residential Property Investors

2

Pdf Crowdfunding Tax Incentives In Europe A Comparative Analysis

2

2

2

Pdf Goodwill And Taxation Issues

Ppid Angkasa Pura 2

Arca Agastya - Museum Nasional

What Is The Definition Of Tax Shelter Business Interest Expense

Taxation Of Annuities Ameriprise Financial

2

Pdf Venture Capital Taxation In Australia And New Zealand

How Four Small Successful Economies Improved Upon The Standard Growth Recipe Center For Global Development

Printable Rent Receipts Check More At Httpsnationalgriefawarenessdaycom37371printable-rent-receipts Receipt Template Templates Printable Free Words

2

Full Article The Use Of Civil Administration Budgets By The Japanese Military Government Of The Micronesia Territory From 1914 To 1922