Fremont Ca Sales Tax Rate 2020

Try it now & grow your business! There is no applicable city tax.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Future job growth over the next ten years is predicted to be 37.0%, which is higher than the us average of 33.5%.

Fremont ca sales tax rate 2020. Find out what's happening in newark with. 0.75% to city or county operations. Try it now & grow your business!

The fremont sales tax rate is 0%. 101 rows the 94536, fremont, california, general sales tax rate is 9.25%. The california sales tax rate is currently %.

You can print a 10.25% sales tax table here. 94536, 94537, 94538, 94539 and 94555. The minimum combined 2021 sales tax rate for commerce, california is.

Sacramento county is located in northern california and has a population of just over 1.5 million people. 1788 rows viewing all rates location rate county; Store on 1st floor, with offices, apartments/lofts 2nd/3:

Most of the raises were approved by. The county’s average effective property tax rate is 0.81%. A new 0.50 percent tax.

Fremont, ca — sales tax rates increased a percentage point in alameda county on thursday, bringing the countywide tax rate to 10.25 percent from 9.25 percent. The tax rate here is now 10.75 percent. The expiration date of the new tax is june 30, 2031.

Store on 1st floor, with offices, apartments/lofts 2nd/3: The fremont, california sales tax rate of 10.25% applies to the following five zip codes: The us average is 6.0%.

This is the total of state, county and city sales tax rates. Revenue and taxation code section 7203.1 (operative 7/1/04) total: 9.25% [is this data incorrect?]

The minimum combined 2021 sales tax rate for fremont, california is 10.25%. Measure c in march and measure w in november. There is no city sale tax for fremont.

0.25% to county transportation funds; Create your own online store and start selling today. The california sales tax rate is currently 6%.

The county sales tax rate is 0.25%. Create your own online store and start selling today. There is no applicable city tax.

The december 2020 total local sales tax rate was 8.750%. The 10.25% sales tax rate in fremont consists of 6% puerto rico state sales tax, 0.25% alameda county sales tax and 4% special tax. Store on 1st floor, with offices, apartments/lofts 2nd/3:

Total tax rate property tax; Fremont has an unemployment rate of 5.2%. Therefore, there is no change to the tax rate.

It's also home to the state capital of california. The sales tax rate is always 9.25% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (3%). The fremont's tax rate may change depending of the type of purchase.

Revenue and taxation code sections 6051.15, 6201.15. The hike came after voters passed two 0.5 percent tax hikes in 2020: San francisco (kron) — several cities will have a sales & use tax hike go into effect on july 1.

Average effective property tax rate; There are approximately 178,340 people living in. Fremont has seen the job market increase by 1.4% over the last year.

The commerce sales tax rate is %. The fremont, california, general sales tax rate is 6%. The county sales tax rate is %.

Total tax rate property tax; At that rate, the total property tax on a home worth $200,000 would be $1,620. City of capitola is 9.00%.

This is the total of state, county and city sales tax rates.

Food And Sales Tax 2020 In California Heather

Colorado Sales Tax Rates By City County 2021

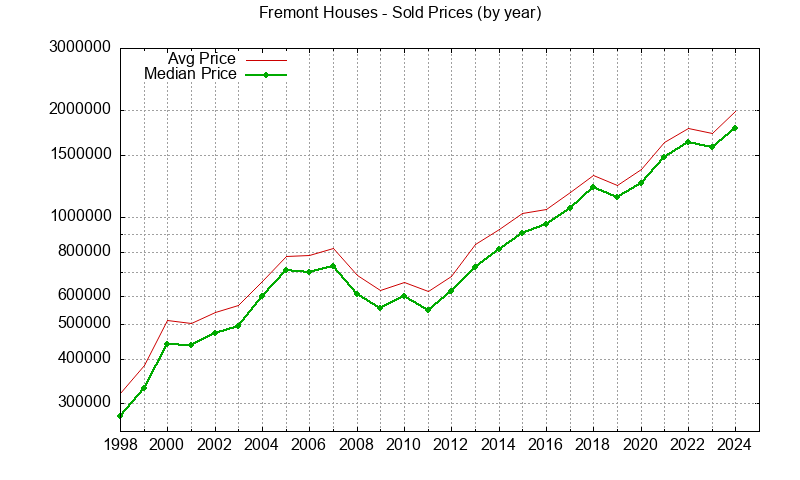

Fremont Real Estate Market Trends Home Prices

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap - Clevelandcom

Wisconsin Sales Tax Rates By City County 2021

How To Calculate Cannabis Taxes At Your Dispensary

Food And Sales Tax 2020 In California Heather

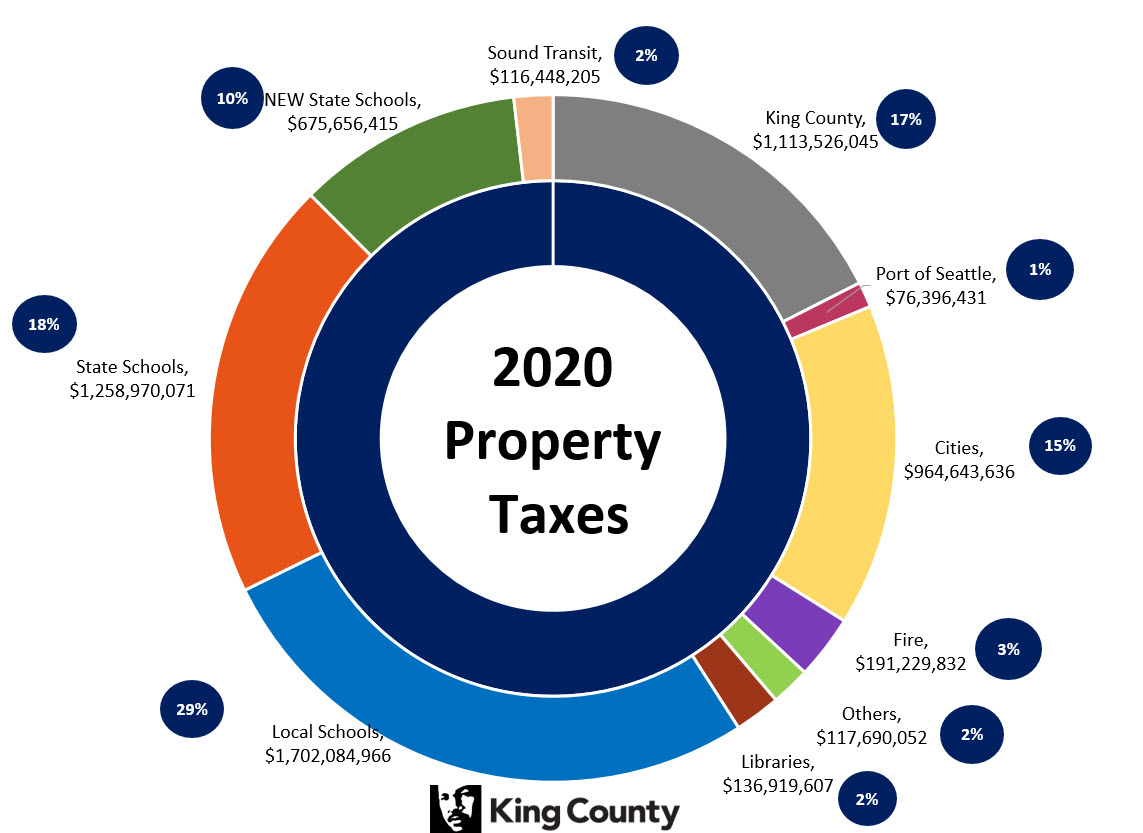

2020 Taxes - King County

Fremont Real Estate Market Trends Home Prices

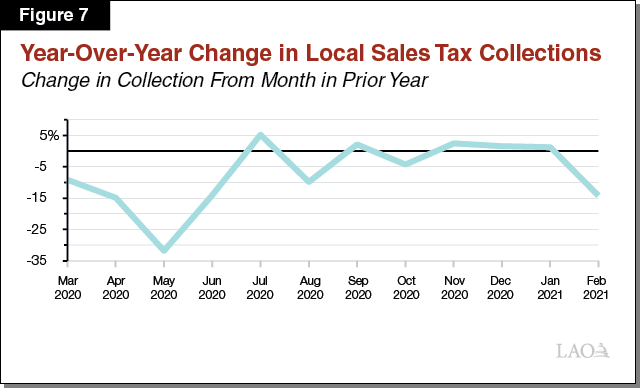

An Initial Look At Effects Of The Covid-19 Pandemic On Local Government Fiscal Condition

California Sales Tax Rates By City County 2021

Missouri Sales Tax Rates By City County 2021

Sales Tax Rates Rise Up To 1075 In Alameda County Highest In California Cbs San Francisco

2

Food And Sales Tax 2020 In California Heather

Iowa Sales Tax Rates By City County 2021

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Fremont Real Estate Market Trends Home Prices

How To Calculate Cannabis Taxes At Your Dispensary