How Are Property Taxes Calculated In Polk County Florida

Polk county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections. The percentage is based on the classification, determined by the type of property or how it is used.

How To File A Florida Sales Tax Return - Youtube

The florida property tax calculator is based on property appraisals, considering just value and assessed value.

How are property taxes calculated in polk county florida. Once value has been determined, the assessor calculates a percentage of that value to arrive at assessed value. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. Taxable property value of $75,000 / 1,000 = 75.

The rates are expressed as millages (i.e the actual rates multiplied by 1000). Polk county sales tax rates for 2022. To get your exact property tax liabilities, contact the polk county tax assessor.

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Polk county collects, on average, 0.9% of a property's assessed fair market value as property tax. If the taxpayer resolves the matter of a vab petition with the property appraiser, the taxpayer must immediately notify the vab that the petition is withdrawn by submitting a withdrawal form.

3) multiply line 1 by line 2 (equals your gross taxable value) $56,410. What is the property tax rate in polk county florida? 4) enter the tax levy for your tax district 2.

Automating sales tax compliance can help your business keep compliant with. If the taxable value of a property is $75,000 and the taxing authority’s millage rate is 7.2 mills, then the taxes due would be calculated as follows: As you make your way through our website, please know we want to hear about your experience, including how we can improve.

The polk county sales tax rate is %. Has impacted many state nexus laws and sales tax collection requirements. 2) enter the rollback 1.

The property appraiser sends an annual notice of proposed property taxes in august to each property owner. Actual property tax assessments depend on a number of variables. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Rates vary widely across the country, typically ranging from less than 1% at the low end, to about 5% at the high end. The florida state sales tax rate is currently %. The median property tax (also known as real estate tax) in polk county is $1,274.00 per year, based on a median home value of $141,900.00 and a median effective property tax rate of 0.90% of property value.

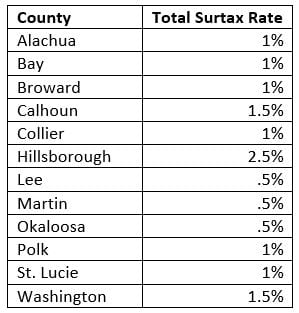

197.472 (4), the part described in the tax lien certificate. The florida state tax rate is 6% plus a discretionary rate applied per county. The current rates of tax are for lake, monroe, orange, osceola, & polk county are as follows:

Please note that we can only estimate your property tax based on median property taxes in your area. County property appraisers assess all real property in their counties as of january 1 each year. Your property tax is calculated by first determining the taxable value.

So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). The taxable value is your assessed value less any exemptions. The rental income that you collect on your own bookings is subject to both sales & use tax and tourist development tax.

You can find more tax rates and allowances for polk county and. The 2018 united states supreme court decision in south dakota v. There are 3 assessor offices in polk county, florida, serving a population of 652,256 people in an area of 1,797 square miles.there is 1 assessor office per 217,418 people, and 1 assessor office per 598 square miles.

Base tax is calculated by multiplying the property's assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Appraisers determine florida property tax rates by county, and each county property appraiser assesses all real property by jan. 197.4725 (2) interest on the polk county held florida tax lien.

In florida, polk county is ranked 45th of 67 counties in assessor offices per capita, and 25th of 67 counties in assessor offices per square mile. Thank you for visiting polktaxes.com, the official website of the tax collector’s office for polk county, florida. After the local governments determine their annual budgets, the county tax collector sends a tax bill to each property owner in late october or november.

The median property tax in polk county, florida is $1,274 per year for a home worth the median value of $141,900. Mh decals are issued by the department of highway safety and motor vehicles and purchased from your local county tax collector’s office. The purchaser of the polk county held florida tax lien certificate must pay the polk county florida tax collector the face amount plus all interest, costs, and charges or, subject to f.r.s.

The total of these two taxes equals your annual property tax amount. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in polk county.

At polktaxes.com we are focused on providing quick access to online payment services and information. What is the property tax in polk county fl? How property tax is calculated in polk county, florida polk county, florida property taxes are typically calculated as a percentage of the value of the taxable property.

75 x 7.2 mills = $540 in city taxes due. Polk county calculates the property tax due based on the fair market value of the home or property in question, as determined by the polk county property tax assessor. The tax collector collects all ad valorem taxes levied in polk county.

Polk county in florida has a tax rate of 7% for 2022, this includes the florida sales tax rate of 6% and local sales tax rates in polk county totaling 1%.

Property Search

Groveland Fl New Home Builders Communities - Realtorcom

Hernando-county Property Tax Records - Hernando-county Property Taxes Fl

New Smyrna Beach Fl New Home Builders Communities - Realtorcom

Floridians Planning A Flight On Or After October 1 2021 Should Make Sure Theyre Real Id Compliant - Orange County Tax Collector

2

Property Search

339 Howard Ave Lakeland Fl 33815 Realtorcom

Hernando-county Property Tax Records - Hernando-county Property Taxes Fl

3842 Sleepy Hill Oaks Loop Lakeland Fl 33810 Realtorcom

1515 New Jersey Oaks Ct Lakeland Fl 33801 - Realtorcom

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home Home Buying Process First Home Buyer

2

Hammock Reserve

Changes Ahead The 2019 Sales Tax Rates Are Out - James Moore

Changes Ahead The 2019 Sales Tax Rates Are Out - James Moore

Hernando-county Property Tax Records - Hernando-county Property Taxes Fl

Hammock Reserve

Hernando-county Property Tax Records - Hernando-county Property Taxes Fl