South San Francisco Sales Tax Increase

California has 2,558 cities, counties, and special districts that collect a local sales tax in addition to the california state sales tax.click any locality for a full breakdown of local property taxes, or visit our california sales tax calculator to lookup local rates by zip code. All persons operating or doing business within the city limits of south san francisco are required to obtain a business license and pay the applicable fee per the municipal code, including businesses that.

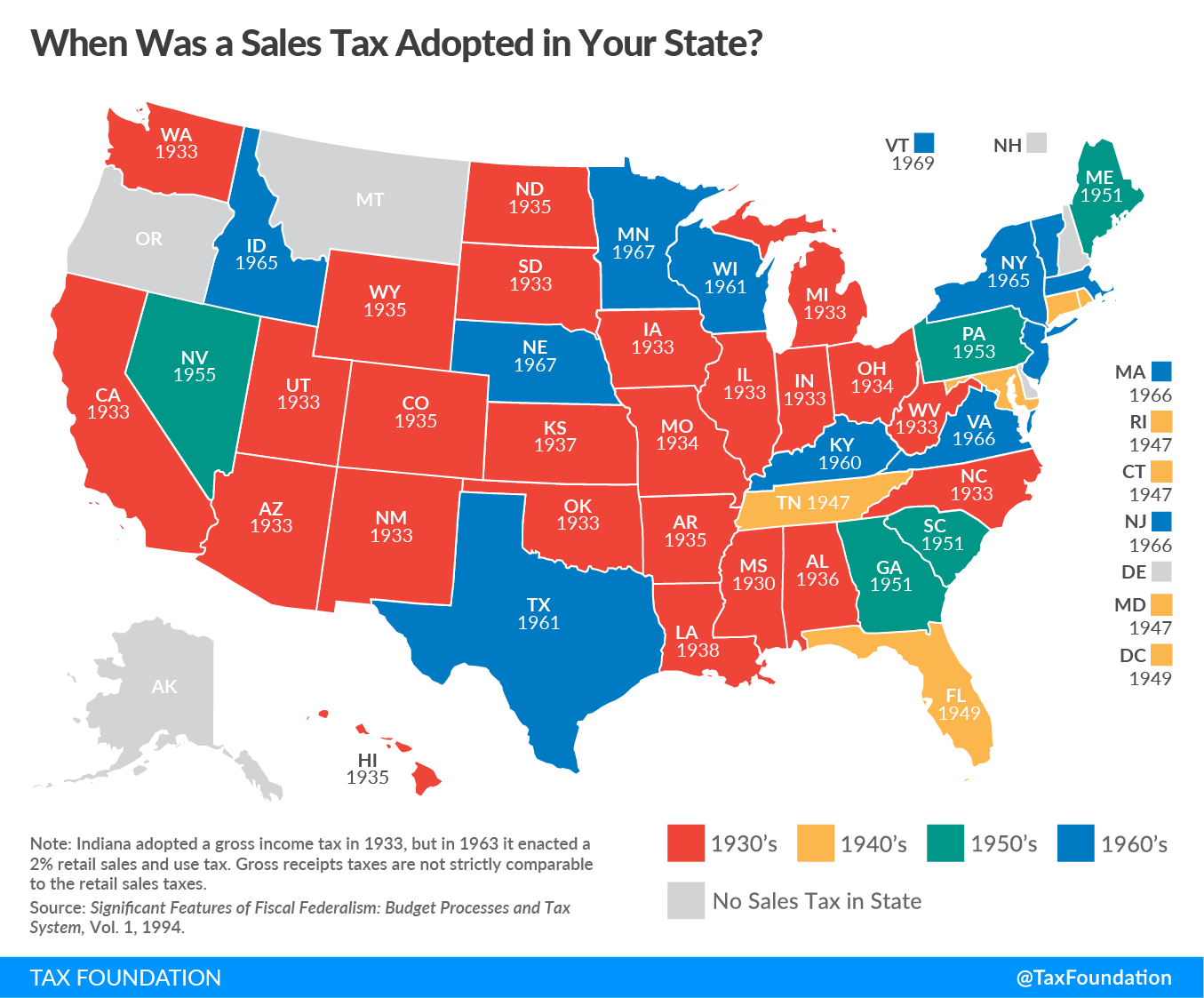

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

29 rows san francisco (kron) — several cities will have a sales & use tax hike go.

South san francisco sales tax increase. An amgen sign is seen at the company's office in south san francisco, california october 21, 2013. The san francisco's tax rate may change. Georgetown, kentucky vs south san francisco, california.

South whittier, ca sales tax rate: This is the total of state, county and city sales tax rates. The california sales tax rate is currently %.

The minimum combined sales tax rate for san francisco, california is 8.5%. A “yes” vote supported authorizing an additional sales tax of 0.125% for 30 years generating an estimated $100 million per year for the caltrain rail service, thereby increasing the total sales tax rate in san francisco from 8.5% to 8.625%. South san francisco, ca sales tax rate:

South san gabriel, ca sales tax rate: The south san francisco sales tax rate is %. The finance department collects annual business license fees.

For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. That means they all share the distinction of having the highest sales tax in california, at least for the moment. There is no applicable city tax.

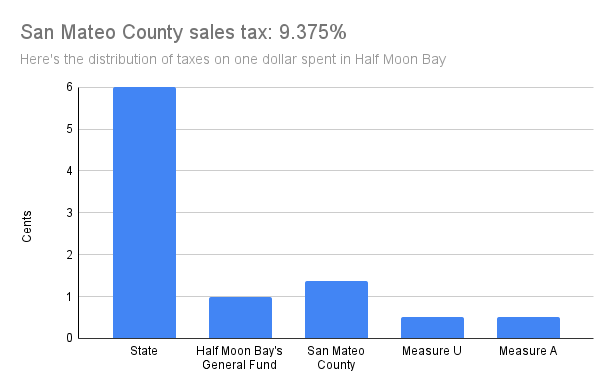

The 9.875% sales tax rate in south san francisco consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.5% south san francisco tax and 3.125% special tax. File monthly transient occupancy tax return. 2 the new district tax was approved by voters in the november 2018 election.

You can print a 9.875% sales tax table here. San francisco imposes a 14% transient occupancy tax on the rental of accommodations for stays of less than 30 days. California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated.

Every 2021 combined rates mentioned above are the results of california state rate (6.5%), the county rate (0.25% to 1%), and in some case, special rate (1.25% to 3%). Union city is among the six alameda cities with a sales tax of 10.75%. South san jose hills, ca sales tax rate:

The assessor must annually assess all taxable property in the county to the person, business, or legal entity owning, claiming, possessing, or. South taft, ca sales tax rate: San mateo voters approved measure s in november 2015, which extended measure l, a.

South pasadena, ca sales tax rate: Spring hill township, kansas vs south san francisco, california change places a salary of $50,000 in spring hill township, kansas should increase to $109,497 in south san francisco, california (assumptions include homeowner, no child care, and taxes are not considered. There is no city sale tax for san francisco.

The transient occupancy tax is also known as the hotel tax. Therefore, there is no change to the tax rate. Download the ktvu mobile apps.

3 the city approved a new 0.50 percent tax (srtu) consolidating the two existing 0.25 percent taxes (srgf and satg) by repealing these taxes and replacing them with a new 0.50 percent tax. Sales taxes increase in san mateo county, as well as in the cities of belmont, burlingame, east palo alto, redwood city, san mateo and south san francisco. Look up the current sales and use tax rate by address

The county sales tax rate is 0.25%. The current total local sales tax rate in south san francisco, ca is 9.875%. 2021 cost of living calculator:

The california sales tax rate is currently 6%. The county sales tax rate is %. South woodbridge, ca sales tax rate.

According to the united states census bureau, the city has a total area of 30.2 square miles (78 km 2), of which 9.1 square miles (24 km 2) of it is land and 21.0 square miles (54 km 2) of it (69.69%) is water. South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city, colma. The december 2020 total local sales tax rate was 9.750%.

This is the total of state, county and city sales tax rates. The sales tax jurisdiction name is san francisco tourism improvement district (zone 2), which may refer to a local government The minimum combined 2021 sales tax rate for south san francisco, california is.

The san francisco sales tax rate is 0%. The 8.5% sales tax rate in san francisco consists of 6% california state sales tax, 0.25% san francisco county sales tax and 2.25% special tax. If you need access to a database of all california local sales tax rates, visit the sales tax data page.

Depending on the zipcode, the sales tax rate of san francisco may vary from 6.5% to 9.25%. South shore, ca sales tax rate: A salary of $40,240 in georgetown, kentucky should increase to $105,291 in south san francisco, california (assumptions include homeowner, no child care, and taxes are not.

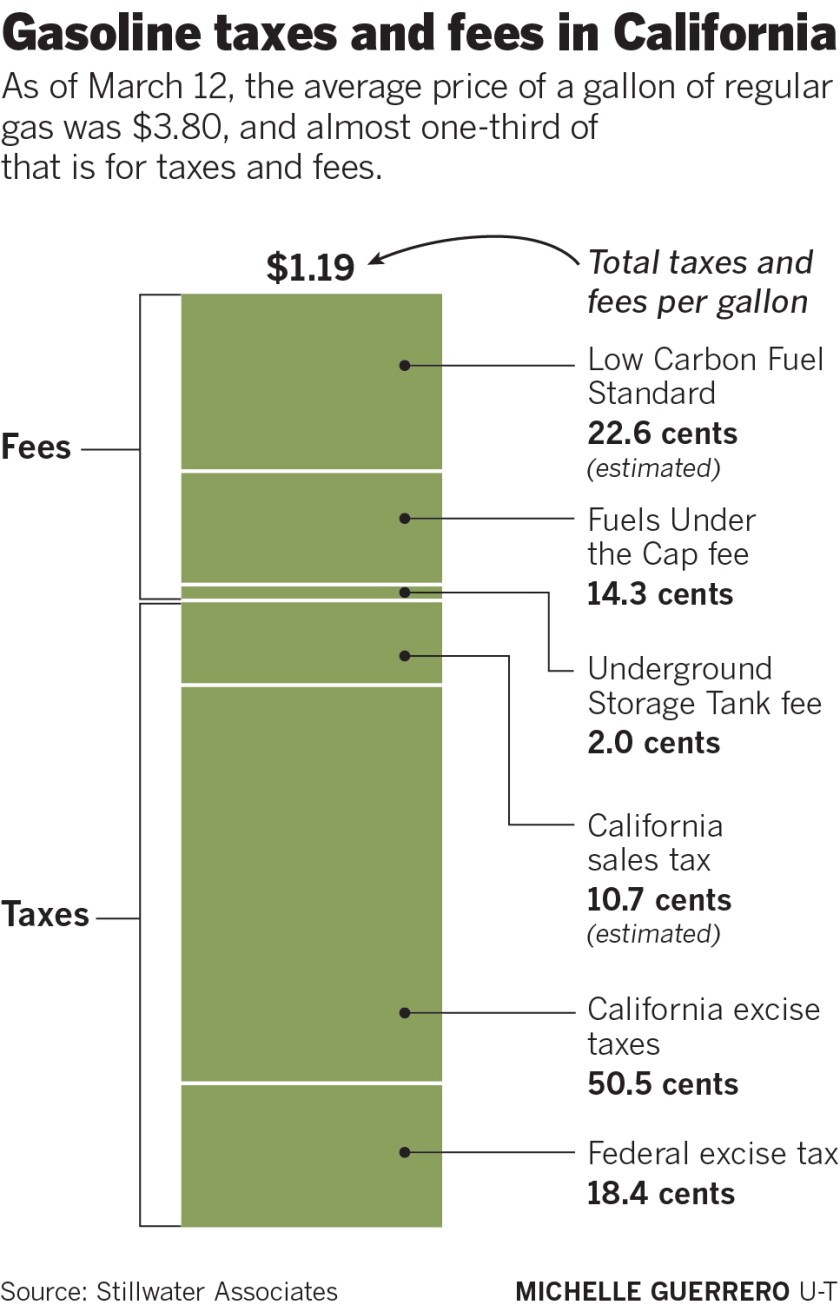

Sales Gas Taxes Increasing In The Bay Area And California

Three Big Problems With The Sales Tax Today Tax Foundation

Frequently Asked Questions City Of Redwood City

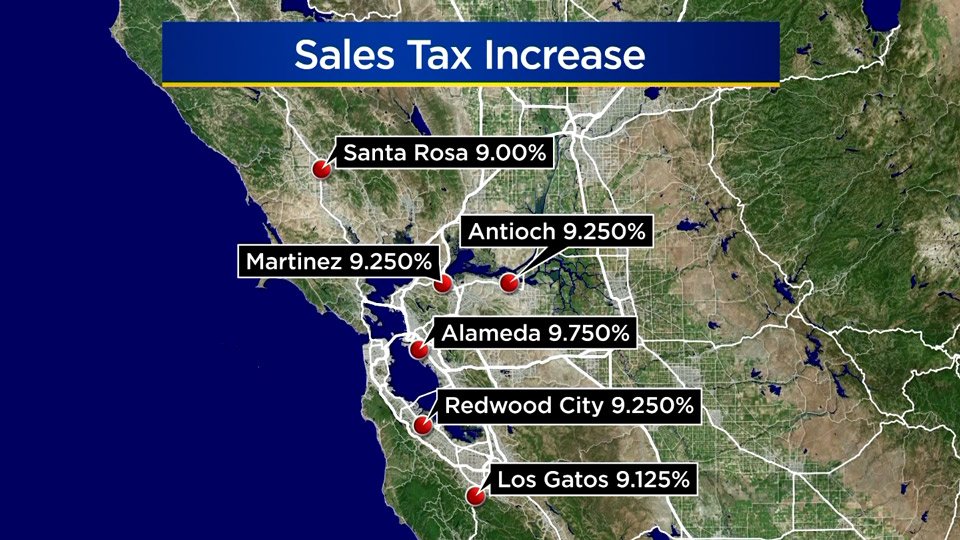

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Prop K - Sales Tax For Transportation And Homelessness Spur

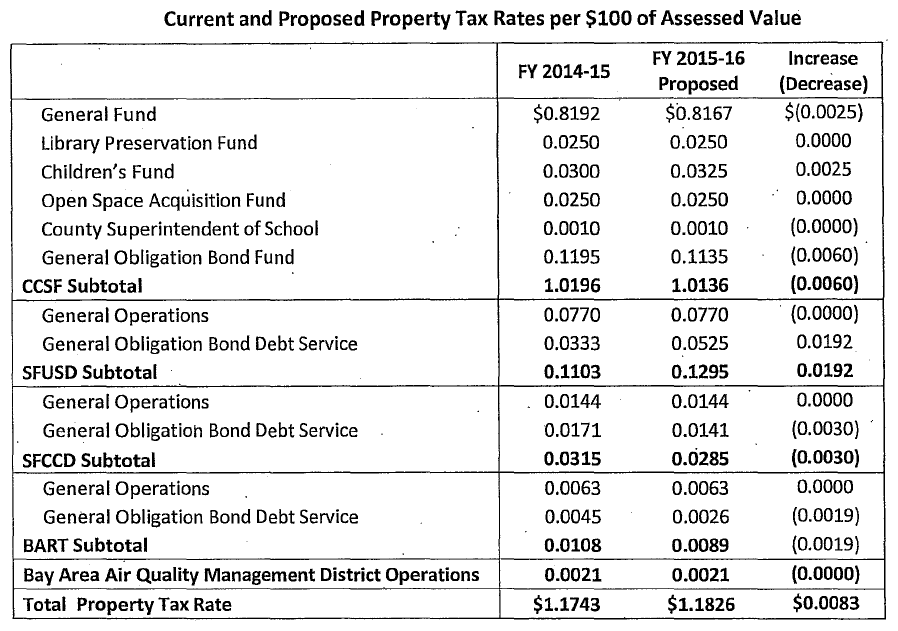

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

Understanding Californias Sales Tax

South San Francisco Residents To Vote On Measure W Sales Tax Increase - Abc7 San Francisco

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

San Francisco Sales Tax Rate And Calculator 2021 - Wise

Prop K - Sales Tax For Transportation And Homelessness Spur

California Sales Tax Rate Changes In December 2021

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom

California City And County Sales And Use Tax Rates - Cities Counties And Tax Rates - California Department Of Tax And Fee Administration

Sales Tax Rates Rise Up To 1075 In Alameda County Highest In California Cbs San Francisco

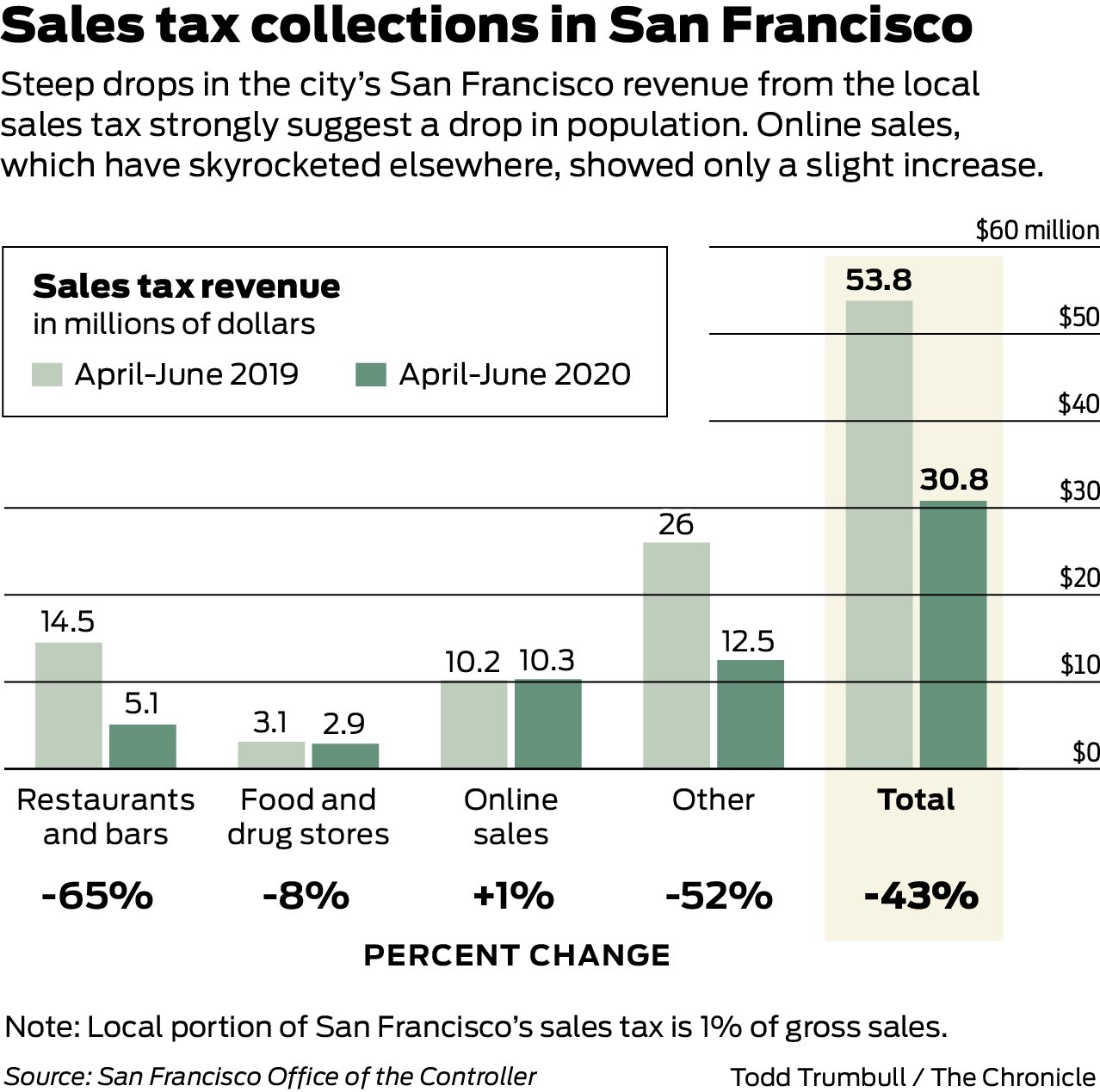

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week