Nanny Tax Calculator Texas

They will create the forms you need to send in to the government and remind you when your taxes are due, but you have the responsibility of arranging payment and submitting the forms. Ad a tax advisor will answer you now!

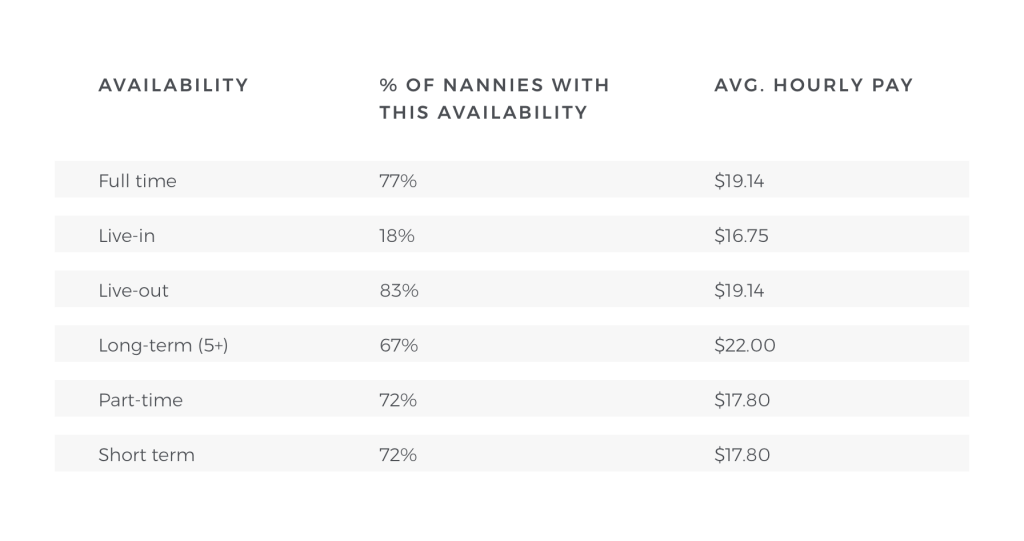

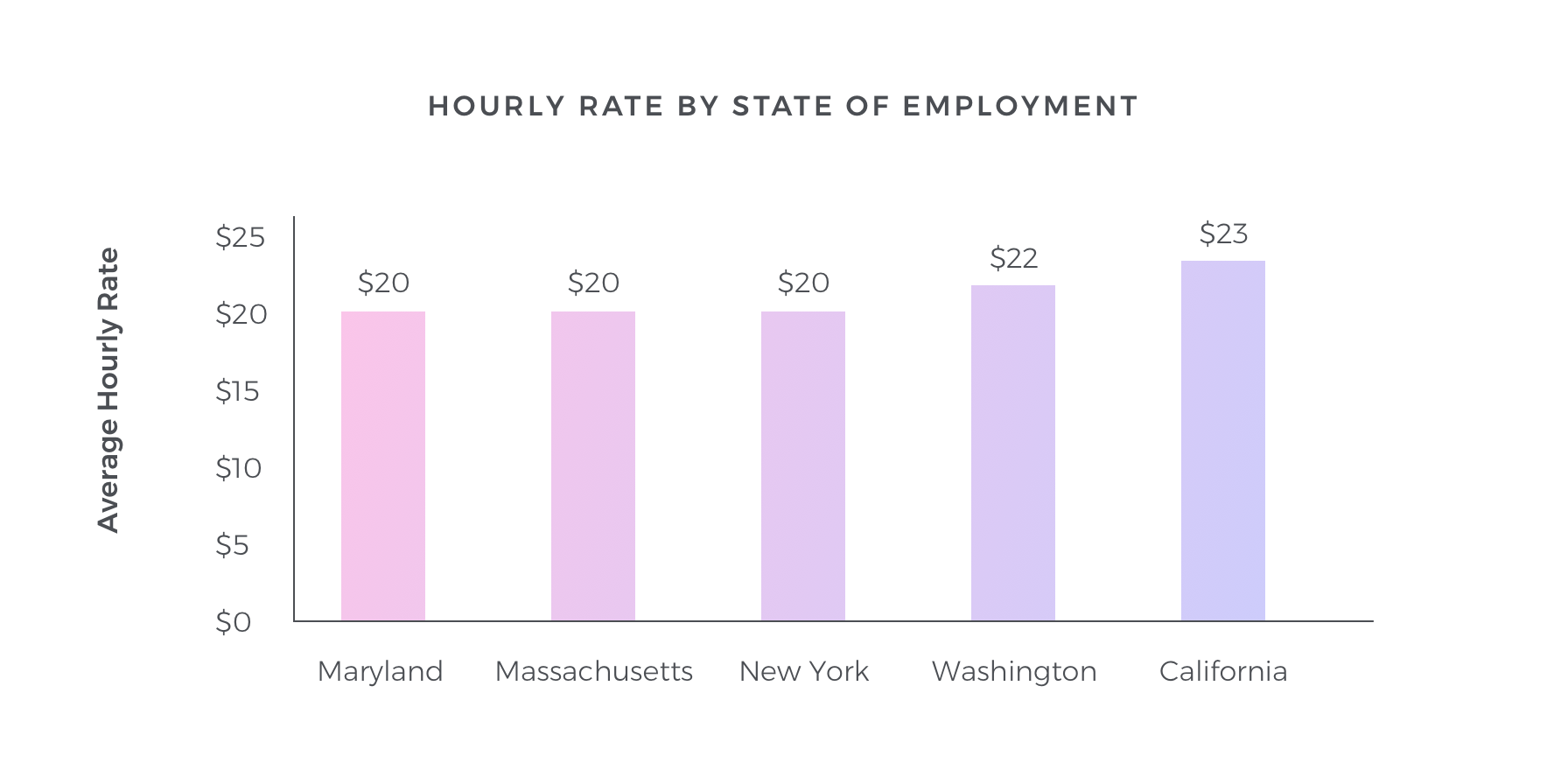

How Much Do I Pay A Nanny Nanny Lane

The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or senior caregiver:

Nanny tax calculator texas. Yearly tax (but can be quarterly if there is a high amount of payroll tax due). You are responsible for paying (7.65%) yourself and withholding (7.65%) from the employee’s paycheck. Hourly calculator calculate wages and payment for an employee who is paid by the hour.

Questions answered every 9 seconds. The average nanny salary in texas, united states is $30,410 or an equivalent hourly rate of $15. Once a domestic employer becomes liable, they must pay state unemployment taxes on all wages paid as of january 1 of that entire year.

Enter the total on line 6. Use the “pay adjustment” field to make up for any additional wages you paid (or withheld) for things such as a holiday bonus or an unpaid day off. What is the nanny tax?

You can also print a pay stub once the pay has been calculated. Use salary vs overtime to calculate employee overtime pay. Or you can pay the entire 15.3% yourself as a “bonus” for the nanny (so the nanny still gets a full paycheck).

Taxes paid by the employee: The nanny tax calculator for 2015 and 2016 taxes you will need to enter your nanny’s gross weekly pay and the number of weeks you paid your nanny. Use gross/net to estimate your federal and state tax obligations for a household employee.

5) calculating what you owe in nanny taxes. Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees. Use our nanny tax calculator to help determine your nanny tax.

You should withhold the employee's share of social security and medicare taxes if you expect to pay your household employee social security and medicare wages of $2,300 or more in 2021. Ad a tax advisor will answer you now! These taxes can cost you about 10% over and above what you’ve agreed to pay for services.

Federal and state income taxes as well as fica taxes (social security and medicare) taxes paid by the employer: Enter your employee’s information and click on the calculate button at the bottom of the nanny tax calculator. Questions answered every 9 seconds.

The instructions are provided in the. They will do all the calculations as far as how much to withhold from your nanny’s check and how much you owe in taxes. An employer becomes liable to pay unemployment taxes under the texas unemployment compensation act if the employer pays gross wages of $1,000 or more in a calendar quarter for domestic services.

Fica taxes as well as federal and state. Take the “total amount due to irs” from the tax calculator and divide it by the number of pay periods left in the year. Or if you need more help talking it through, get a free phone consultation with one of our household experts:

Here are 5 helpful ways to use a nanny tax calculator. Salary estimates based on salary survey data collected directly from employers and anonymous employees in texas, united states. Tax calculator for freelance nannies & childcare providers.

Tax calculator for families of charlotte's best nanny. If you pay a household employee such as a nanny, babysitter, caregiver or house manager more than $2,300 a year or $1,000 in a quarter to perform work in your home (or occasionally even out of your home such as in a nanny share), you are a household employer. If you withhold the taxes but then actually pay the employee less than $2,300 in social security and medicare wages for the year, you should repay the employee.

Answer 3 questions and get an instant estimate of your tax liability for 2021 (federal and state) let us do the math for you! How to negotiate your salary as a nanny march 1, 2021 Enter your caregiver's payment info.

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer, whether paying a nanny, a senior care worker, or other household employees.*. They—and you—will owe the government employment taxes, often referred to as “nanny” taxes, when the individual is classified as an employee according to tax rules.

How Much Do I Pay A Nanny Nanny Lane

Verifying Your Nannys Work Eligibility Status - Nanny Tax Tools

Differences In Managing In-home Senior Care Versus Child Care - Carecom Homepay

Nanny Taxes And Payroll Services Poppins Payroll

Texas Instruments 1795 Sv Basic Calculator For Sale Online Ebay Basic Calculator Calculator Basic

We Paid Moms Senior Caregiver Off The Books - A Case Study

Finra Investment Firms And Broker-dealers Face Significant New Background Check Requirements - Imperative

Online Business And Technology

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Calculator Ti 30xb Other Electronics Computers Gumtree Australia Free Local Classifieds

Nanny Taxes And Payroll Step-by-step Instructions For Setting It Up - Carecom Resources

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

Calculator Ti 30xb Other Electronics Computers Gumtree Australia Free Local Classifieds

Offering A Nanny A Salary What You Need To Know

Offering A Nanny A Salary What You Need To Know

Nanny Salary Pension Calculator - Gross To Net - Nannytax

Unemployment Insurance Taxes What Families Hiring Caregivers Need To Know - Carecom Homepay

How Much Do I Pay A Nanny Nanny Lane

Hr Block Tax Preparation Office - Custer Virginia Market Place Mc Kinney Tx