Interest Tax Shield Example

In this exercise, we’ll be comparing the net income of a company with vs without interest expense payments. (4) ∑ = + = n t 1 t f f s (1 r) r dt e it is assumed.

Invoice Template For Builders And Australian Tax Beholddance Throughout Invoice Template Invoice Template Word Microsoft Word Invoice Template Invoice Example

Loan interest is paid before income tax is charged.

Interest tax shield example. Operating expense (opex) = $5m The classic example of a tax shield strategy for an individual is to acquire a home with a mortgage. For example, for a company with a 15% loan of $200000 and a tax rate as 25%, the tax shield approach will be 15% x $200000 x 25% = $7500.

This is how interest tax shield work. Interest expenses (via loan and mortgages) are tax deductible, meaning they lower the taxable income. For example, if a business is analysing whether to lease or purchase a building.

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Lets take a example of 2 companies. A tax shield is a certain effect that occurs when restructuring financial capital.

Cost of goods sold = $10m; Example (page 460) earnings before interest and tax (ebit) were $1.25 billion in 2005, interest expenses were $400 million, and its marginal corporate tax rate was 35%. An interest tax shield may encourage a company to finance a project through debt because dividends paid on stock issues are never deductible.

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. (use these articles to find and calculate the corporate tax rate and individual tax rates for the current year.) The taxable income for company b is less than company a.

Multiply the interest expense by the tax rate assumptions to calculate the tax shield; Interest tax shield example continued. So the cash outflow which will consider for discounting would be.

Therefore, xyz ltd enjoyed a tax shield of $12,000 during fy2018. Calculate the present value (pv) of each interest tax shield amount by dividing the tax shield value by (1 + cost of debt) ^ period number; However company b have a debt of $50 of 20% so the taxable income i.e pbt is $100 and $90 for company a and company b respectively.

For example, a mortgage provides an interest tax shield for a property buyer because interest on mortgages is generally deductible. As you will see below, the interest tax shield formula is nearly the same as with the depreciation tax shield. Thus, interest expenses act as a ‘shield’ against the tax obligations.

For both companies, we’ll be using the following operating assumptions: For example, if you expect interest on a mortgage to be $1,200 for the year, and your tax rate is 20%, the amount of the tax shield would be $240. Loan is to be amortized.

Tax shield example for individual. Interest tax shield calculation example. There is a decrease in the volume of corporate tax due to an increase in the part of the borrowed capital.

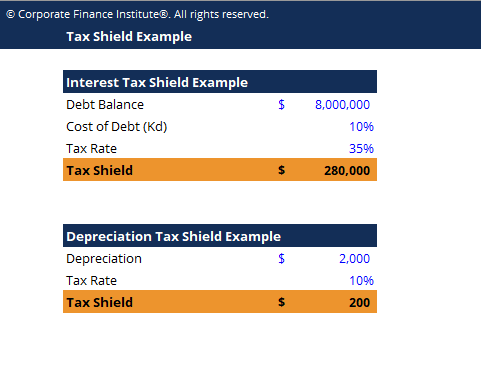

We can interpret that the company a and company b has ebit of $100. Interest tax shield example a company carries a debt balance of $8,000,000 with a 10% cost of debt cost of debt the cost of debt is the return that a company provides to its debtholders and creditors. For example, if a company has cash inflows of usd 20 million, cash outflows of usd 12 million, its net cash flows before taxation work out to usd 8 million.

The taxes saved due to the interest expense deductions are the interest tax shield. To calculate the interest tax shield , you. The tax savings are calculated as the amount of interest multiplied by the tax rate.

For instance, suppose company a has earned a profit before interest and tax of $40000 for a year. Companies pay taxes on the income they generate. Depreciation does not really cause cash flow.

This is also termed as an interest tax shield approach which will be studied in brief later. The interest expense associated with the mortgage is tax deductible, which is then offset against the taxable income of the person, resulting in a. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation.

Note that the rate used to discount the free cash flows and its is the capm rate, rather than the wacc used in a dcf analysis. Therefore, for such choices, the business has to keep in mind the tax benefits it would gain by taking a mortgage for the same which is. Let us take the example of another company, pqr ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and.

Lets calculate the effect of leverage on safeway’s net income by considering two scenarios: Without leverage and with leverage as it is now.

Interest Tax Shields Meaning Importance And More Business Valuation Financial Strategies Budgeting Money

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Vel Consulting Logo In 2021 Consulting Logo Consulting App Logo

Tax Shield Formula Step By Step Calculation With Examples

Best Mutual Funds To Invest In 2013 In India - Infographic Mutuals Funds Investing Investing Money

The Interest Tax Shield Explained On One Page - Marco Houweling

Business Quote Templates - Colonarsd7 For Blank Estimate Form Template - Best Sample Template Quote Template Professional Quotes Word Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Menionnet - Bonds Certificate Templates Corporate Bonds Gift Certificate Template

Interest Tax Shield Formula And Calculation - Wall Street Prep

Free Quotation Template Excel Word - Excel Tmp Quotation Format Quotations Invoice Template Word

Tax Shield Meaning Importance Calculation And More In 2021 Accounting And Finance Accounting Education Finance Investing

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculation - Wall Street Prep

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Example Template - Download Free Excel Template

Tax Shield Formula Step By Step Calculation With Examples