Property Tax On Leased Car In Ri

Lets say you leased a bmw 320i sales price is 33,000, and your lease over 27 months totals $10,000 dollars, then you'd be responsible for sales tax of 6.25% on $10,000, or 625.00. When you lease a vehicle the car dealer maintains ownership.

Land Lease Agreement - Print Download Legal Templates

$13.99 per thousand *scroll down to learn about how we determine the taxable value of property.

Property tax on leased car in ri. It appears that momentum to reform the state’s most hated tax. Property tax treatment varies from state to state as well. Rhode island has some of the highest property taxes in the u.s., as the state carries an average effective rate of 1.53%.

5) new shoreham's real and personal property is assessed at 80% of fair market value at the time of revaluation/update. Property tax included in leased vehicle sales price in rhode island. Ask your honda dealer for information about the tax regulations in your state or contact the tax assessor office.

Motor vehicles in portsmouth are assessed at 70% of their value. Should the federal government be paying maricopa county property leas. In all other ri municipalities, motor vehicles are assessed at 100%, before any adjustments are made.

When you lease a vehicle, the car dealer maintains ownership. The car tax is not a real time tax! Virginia has the highest vehicle taxes, the report found.

Because of that, including property taxes in the total vehicle sales price was correct, and the full amount should be subject to rhode island's 7% sales tax. You are taxed on how many days out of 365 days of the year your vehicle is registered. Do you pay property tax on leased vehicles in ct.

When a retail customer leases a motor vehicle for use outside the state, takes possession of the vehicle in rhode island, and the vehicle is to be registered and garaged in a state which imposes a tax on the lease charges of a motor vehicle leased to nonresidents, the dealer is required to collect the tax on the first month's lease payment, including the capitalization cost reduction. If you do pay the personal property tax you can deduct it on your taxes if you itemize. There are three components that determine how much each individual

Real and personal property in all other municipalities is assessed at 100%. If you do pay the personal property tax, you can deduct it on your taxes if. Please enter either your property tax account number, or your motor vehicle tax number below.

The vehicle can be leased financed or purchased outright. When gfls receives the tax bill for the equipment you’re leasing, our team will send a copy of the bill to you at the address we have on record. Tax assessors bill the car dealer for vehicle taxes, but whether or not they pass that on to you will be delineated in your lease contract.

Vehicle, the manchester, new hampshire tax collector stated. The bigger issue for rhode island drivers, whether they lease or own their cars, is the car tax system itself. We also will remind you that the tax amount will be deducted from your bank account.

Arkansas, connecticut, kentucky, massachusetts, missouri, north carolina, rhode island, texas (haha i always found it funny how when you flip the a and the e in texas, you get taxes, lol), virginia, west virginia and orleans parish (louisiana). The median annual property tax payment here is $4,339. In rhode island the average driver pays 1133 per year while virginia averages 962 kansas.

The sales price of motor vehicle lease payments properly included personal property tax charged to the lessee by the lessor, for rhode island sales and use tax purposes. Unfortunately, the state of ri taxes **everything** associated with an auto lease, which means that when i get my bmwfs bill each year with the property tax on it, they charge 7% ri sales tax on the property tax!! Motor vehicles are assessed at 100% in all other municipalities, before any adjustments.

Property tax / motor vehicle tax id number: The motor vehicle tax (commonly known as the “ar tax”) is a property tax collected by each rhode island municipality based on the value of each motor vehicle owned. Tax rates have been rounded to two decimal places in coventry and north smithfield.

In scituate, motor vehicles are assessed at 95%. And motor vehicle registration fees in new hampshire. What is the maricopa county propery lease excise tax and how much is it for 2007?

Leased and privately owned cars are subject to property taxes in connecticut; If you are a lessee and your vehicle is garaged in one of the following states, you may be responsible for paying state or local property taxes. Because we initially pay the property tax bill, you benefit from a little extra time.

Only taxes that are legally imposed on the consumer can be excluded from the sales price. In richmond, motor vehicles are assessed at 80%. In most states, you only pay taxes on what your lease is worth.

Vehicles registered in providence, ri are taxed for the previous calendar year. For example, the 2017 tax bill is for vehicles registered during the 2016 calendar year. That comes in as the tenth highest rate in the country.

“tax bills are usually billed to the leasing company,” according to providence’s tax collector. Usually when you sign the lease, the terms state what you are responsible for. People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them, unless the lease agreement requires otherwise.

In some states, lease car tax is based on the full selling price of the vehicle. There, residents pay an effective rate of 4.05%, meaning an annual bill of $1,011. Assuming that the sales tax rate is 6%, $3,180 in sales tax would be.

Rhode island leased vehicles are subject to rhode island’s annual motor vehicle excise tax, which is based on motor vehicle values and locally set rates (r.i. Excise taxes in maine, massachusetts, and rhode island; Mississippi and rhode island have the second and third.

The federal government is exempt from sales tax. If you didn’t already know, the following states apply a “personal property tax” on all leased vehicles:

Pdf Risk Management Of Leasing Companies

2

Free 60 Lease Agreement Forms In Pdf Ms Word

2

Free 39 Sample Lease Agreement Forms In Pdf Ms Word

Local Taxes On Leased Cars

Pdf Land Leasing And Local Public Finance In Chinas Regional Development Evidence From Prefecture-level Cities

Land Lease Agreement - Print Download Legal Templates

Pdf Land Leasing And Local Public Finance In Chinas Regional Development Evidence From Prefecture-level Cities

2

Move-inmove-out Walk-through Checklist Ez Landlord Forms Being A Landlord Rental Property Rental Property Management

Pdf Land Leasing And Local Public Finance In Chinas Regional Development Evidence From Prefecture-level Cities

Commercial Lease Agreement Template 2021 Official Pdf

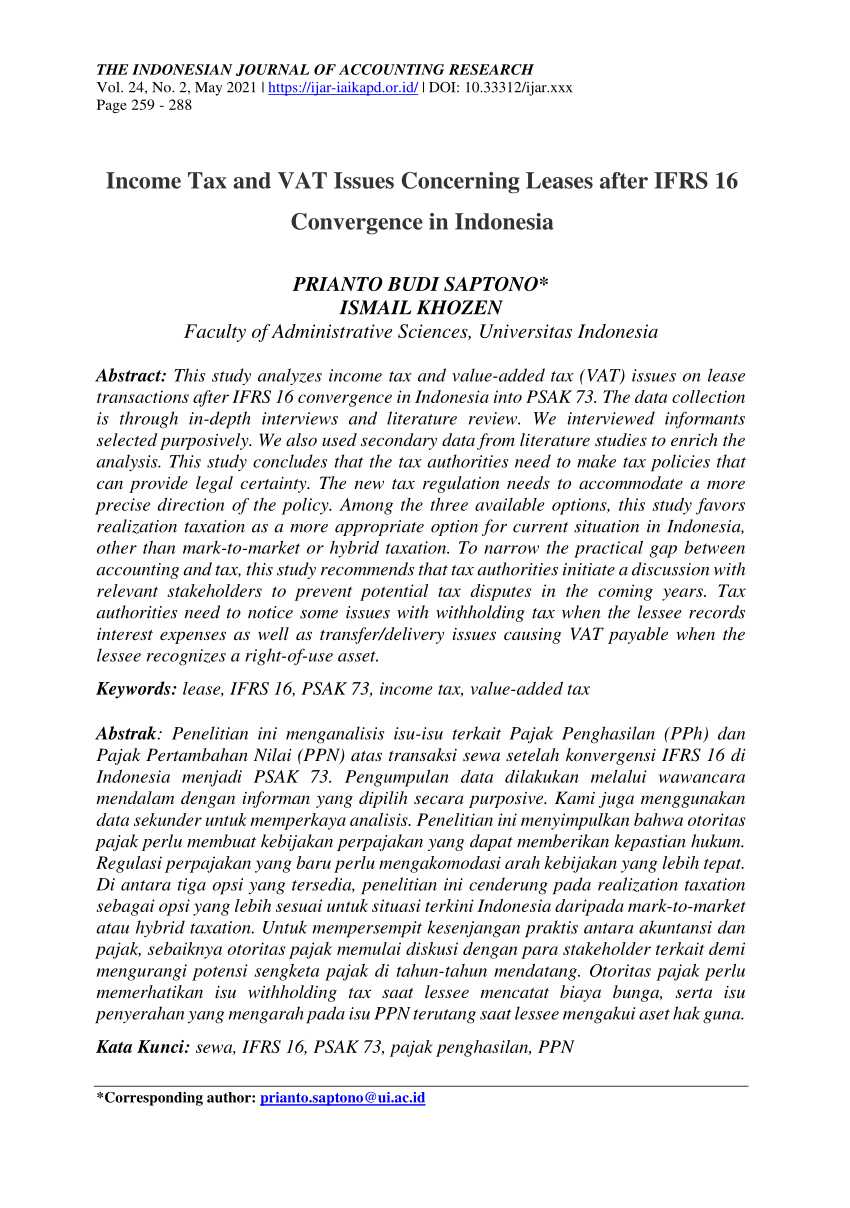

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Pdf Land Leasing And Local Public Finance In Chinas Regional Development Evidence From Prefecture-level Cities

Lk September 2020 Pt Pp Persero Tbk Pdf Equity Finance Debt

2

Pdf Land Leasing And Local Public Finance In Chinas Regional Development Evidence From Prefecture-level Cities

Free Vehicle Lease Agreement Free To Print Save Download