Fidelity Tax-free Bond Fund By State 2019

Learn more about mutual funds at fidelity.com. Here are the best muni single state long funds.

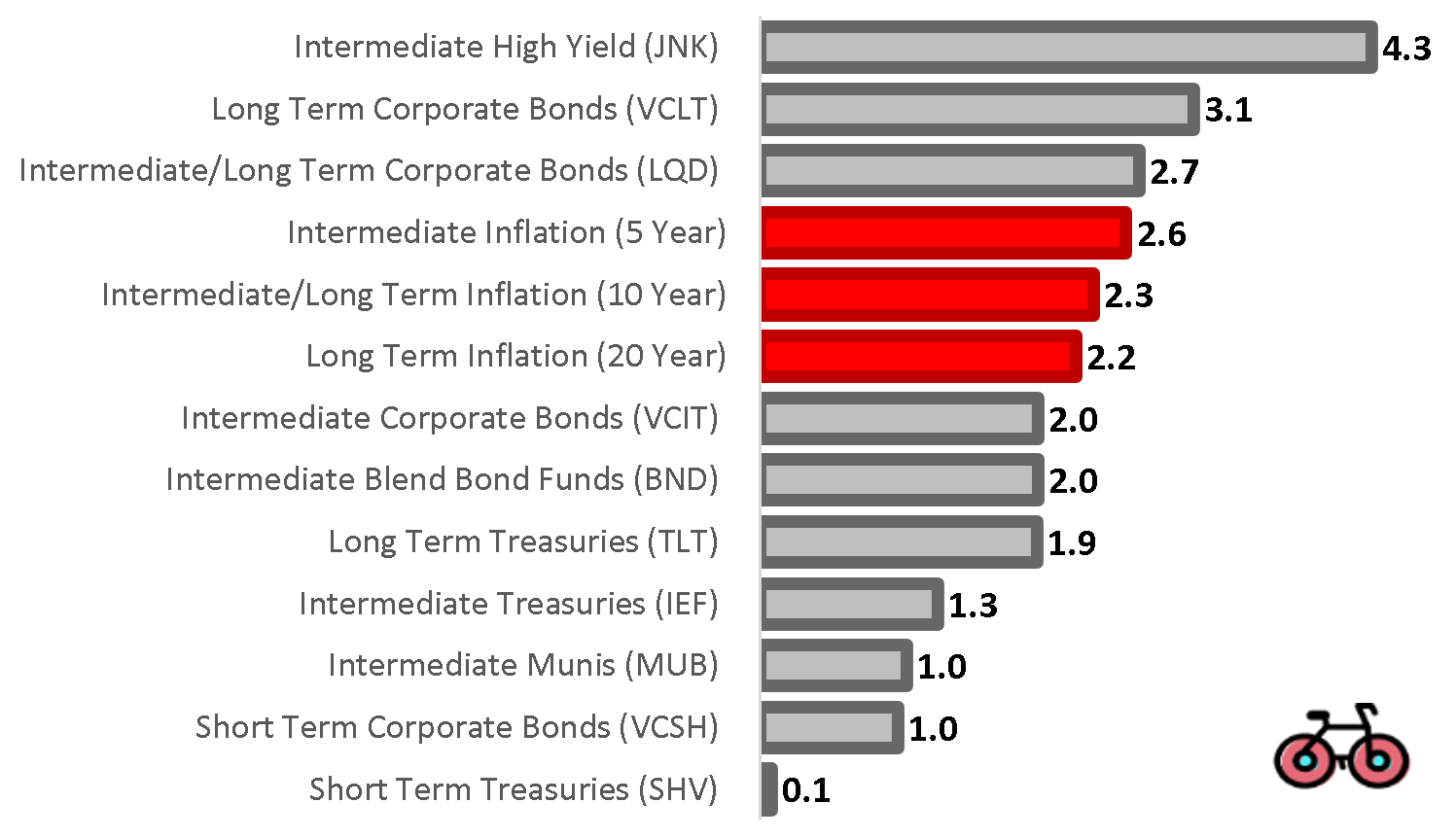

How To Invest In Bonds White Coat Investor

Those living within these states may choose to use these funds to take advantage of state tax benefits.

Fidelity tax-free bond fund by state 2019. Conservative income municipal bond fund (fuemx) fidelity flex. Municipal income fund (fuenx) fidelity® intermediate municipal income fund (fltmx) alabama 1.10% 1.73% 0.90% 1.27% Muni new york long portfolios invest at least 80% of assets in new york municipal debt.

We suggest that you consult your tax advisor, who is most familiar with your circumstances and the laws of the state in which you reside, to determine how you should. The fund does not invest in municipal securities whose interest is subject. Contact your investment professional or visit i.fidelity.com for a prospectus or, if available, a summary prospectus containing this information.

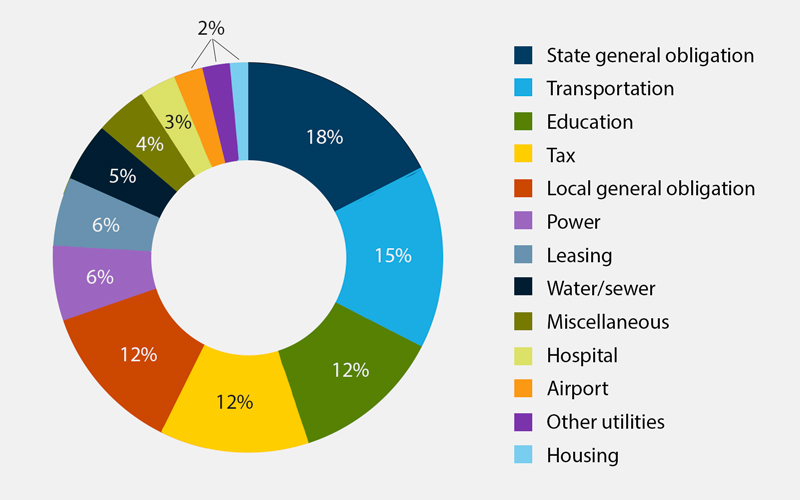

It potentially invests more than 25% of total assets in municipal securities that finance similar types of projects. Learn more about mutual funds at fidelity.com. Nuveen missouri municipal bond fund;

Because the income from these bonds is generally free from federal taxes and new york state taxes, these portfolios are most appealing to residents of new york. Analyst rating as of apr 19, 2021. The expense ratio is 0.25%;

The minimum initial investment is $25,000. Capital gain 12/02/2019 1.57% ordinary income 12/02/2019 3.66%. Before investing, consider the fund’s investment objectives, risks, charges, and expenses.

View mutual fund news, mutual fund market and mutual fund interest rates. Nuveen wisconsin municipal bond fund As of august 18, 2021, the fund has assets totaling almost $4.74 billion invested in 1,368 different holdings.

These portfolios have durations of more than 6.0 years (or average maturities of more than 12 years).: State fidelity® conservative income municipal bond fund: The fund has a slightly high annual expense ratio of 0.68%, or $68 for every.

Interest earned on muni bonds is generally free from federal income tax and may even be exempt from state and local taxes, depending on where you live. However, as state income tax laws vary, we are not able to advise you of the state tax status of your 2019 dividends and suggest that you consult a professional tax advisor. Nuveen la municipal bond fund;

That means a $100,000 investment in munis will. Alabama 1.86% 1.14% alaska 0.23% 0.55%

Us Fund Flows Set A New Record In The First Half Of 2021 Morningstar

Familiar Themes Dominate October Us Fund Flows Morningstar Fund Bond Funds Fund Management

Share Buybacks Companies Buying Their Own Shares Fidelity Corporate Bonds Finance Debt Inflection Point

How To Invest In Bonds White Coat Investor

How To Choose The Best Us Bond Etf Bankeronwheelscom

Fidelity Expands Esg Lineup - Adviser Investments

Retirement Bucket Approach Cash Flow Management Fidelity Cash Flow Saving Goals Cash

Market Watch 2021 The Bond Market Fidelity

Bond Funds Are Hotter Than Tesla

Should You Build A Bond Ladder Or Buy A Bond Fund Bond Funds Bond Corporate Bonds

What Is A Bond Fund And How To Start Investing In Bond Funds - Fidelity Bond Funds Investing Start Investing

How To Invest In Bonds White Coat Investor

Long-term Fund Outflows Amid Volatility Triple 08 Figures Morningstar

Best Mutual Funds Awards 2020 Best Muncipal Bond Funds Investors Business Daily

How To Invest In Bonds White Coat Investor

How To Invest In Bonds White Coat Investor

Oppenheimer International Bond Fund

The Fund Industry In Charts - A Wealth Of Common Sense Investment Companies Stock Market Fund

Long-term Fund Outflows Amid Volatility Triple 08 Figures Morningstar