Arizona Estate Tax Exemption 2020

This increases to $3 million in 2020) mississippi: States estate and gift tax on their worldwide assets, whether through lifetime gift or passing at death.

Arizona Inheritance Tax Waiver Form - Fill Out And Sign Printable Pdf Template Signnow

Following the federal repeal, the arizona legislature repealed the arizona estate tax provisions (laws 2006, ch.

Arizona estate tax exemption 2020. The year 2020 has been full of uncertainty. Most state residents do not need to worry about a state estate or inheritance tax. The main thing to know is this:

This exemption rate is subject to change due to inflation. Questions answered every 9 seconds. There are no inheritance taxes or estate taxes in arizona.

That means that due to this increased estate tax limit in 2021, estates valued at $11.7m or less will face no additional estate taxes. New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance. Starting in 2022, the exclusion amount will increase annually based on a cost of.

In 2019, new york’s estate tax exemption was set to match the feds, but in april new legislation was introduced to reduce the state’s estate tax exemption amount. The top estate tax rate is 16 percent (exemption threshold: No estate tax or inheritance tax.

If an estate is worth more than the estate tax exemption amount, the value over the exemption will be taxed. This year the estate tax exemption in 2021 is increasing to $11.7m. The current federal estate tax is currently around 40%.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness. The exemption is adjusted annually for inflation but is set to expire at the end of 2025. Ad a tax advisor will answer you now!

If the estate is worth less than the exemption amount, no tax liability. But that doesn’t leave you exempt from a number of other necessary tax filings, like the following: No estate tax or inheritance tax.

The 2021 exemption amount will be $11.7 million (up from $11.58 million for 2020). Ad a tax advisor will answer you now! So the increase announced yesterday by the irs means that if an estate is created (i.e., if a person dies) in 2020, there will be no estate tax imposed if the estate is worth less.

In august 2020, the dc city council enacted the “estate tax adjustment amendment act of 2020, which reduces the dc threshold to $4 million in 2021 and which will be adjusted for inflation beginning in 2022. Yahoo sports’ recent article “estate tax exemption amount goes up for 2021” says that when you die your estate isn’t usually subject to the federal estate tax, if the value of your estate is less than the exemption amount. Estate and inheritance tax federal law repealed the federal state death tax credit (upon which the arizona estate tax was based) which effectively cancelled the arizona estate tax.

The federal estate tax exemption is $11.18 million, meaning that if an estate. Click here for more information. The top estate tax rate is 16 percent (exemption threshold:

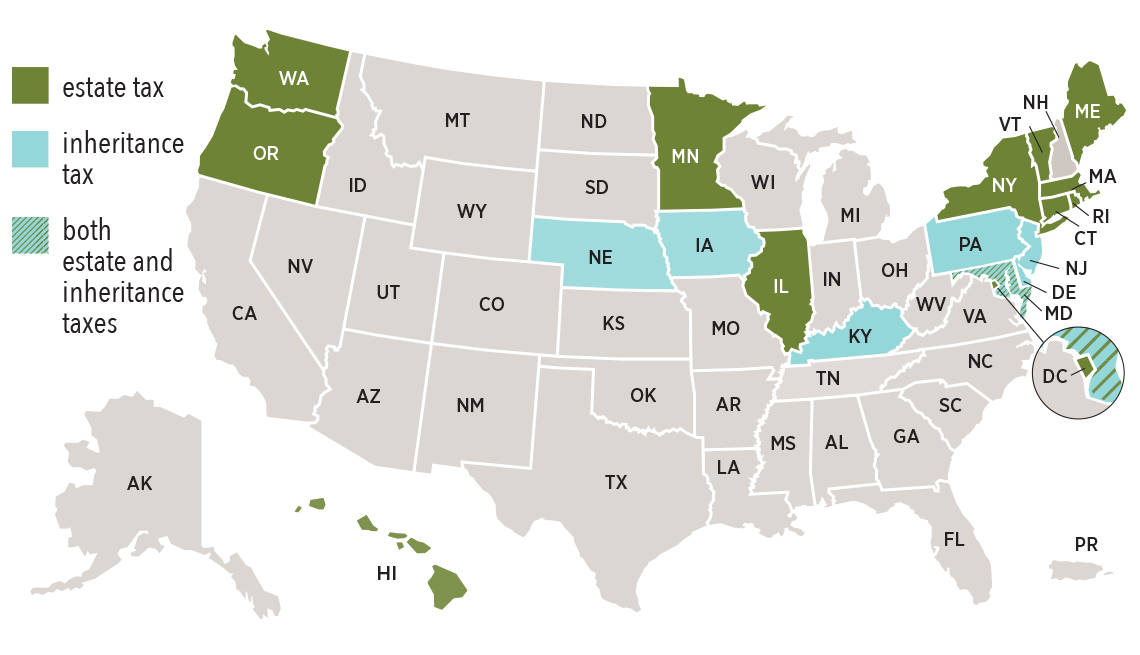

Residents and nonresidents owning property there can rejoice. But some states do have these kinds of taxes, which are levied on people who either owned property in the state where they lived (estate tax) or who inherit property from someone who lived there (inheritance tax). The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020.

The arizona department of revenue (ador) is reminding businesses that have not renewed their 2022 transaction privilege tax (tpt) license to complete the licensing renewal process. The area of taxation is no exception. While there is no arizona inheritance tax law, you may or may not be exempt from an inheritance tax based on the federal law.

Some relevant adjustments in the estate tax laws for 2020, enacted under the tax cut and jobs act of 2017, are: There is no arizona estate tax. All estates in the united states that are worth more than $5.49 million as of 2017 are required to pay an estate tax.

The amount of the federal estate tax exemption is adjusted annually for inflation. The federal inheritance tax exemption changes from time to time. The bill passed later that year, and new york’s estate tax exemption was reduced to $5,850,000 for 2020.

Even though arizona does not have its own estate tax, the federal government still imposes its own tax. The estate tax exemption in 2020 was $11.58m. Delaware repealed its estate tax at the beginning of 2018.

You’ll still pay your base tax rate, of course. In 2020, it set at $11,580,000. However the federal estate tax may apply.

No estate tax or inheritance tax Questions answered every 9 seconds. The united states is a party to a number of estate and gift tax treaties , whereby double taxation is avoided, typically on real estate.

Sales Taxes In The United States - Wikipedia

State-by-state Estate And Inheritance Tax Rates Everplans

State Corporate Income Tax Rates And Brackets For 2020

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Recent Changes To Estate Tax Law Whats New For 2019

17 States With Estate Taxes Or Inheritance Taxes

Does Your State Have An Estate Or Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The New Estate Tax Exemption For 2021 - Phelps Laclair

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do The Estate Gift And Generation-skipping Transfer Taxes Work Tax Policy Center

The Complete List Of States With Estate Taxes Updated For 2021

Do I Need To Pay Tax On My Inheritance In Arizona Phelps Laclair

Estate Tax Exemptions 2020 - Fafinski Mark Johnson Pa

2020 State Tax Trends To Watch For Tax Foundation

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Do I Need To Pay Tax On My Inheritance In Arizona Phelps Laclair