Wisconsin Used Car Sales Tax Calculator

Consumers use, rental tax, sales tax, sellers use, lodgings tax and more. Publication 202 (5/17) printed on recycled paper.

States With Highest And Lowest Sales Tax Rates

Sales of motor vehicles, aircraft and truck bodies (including semitrailers) to nonresidents who do not use the property other than to remove it from wisconsin, are exempt from wisconsin sales and use tax.

Wisconsin used car sales tax calculator. Some dealerships also have the option to charge a dealer service fee of 99 dollars. Multiply the net price of your vehicle by the sales tax percentage. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

Stats., and aircraft are taxed, for county and stadium sales tax purposes, based on the county in which the item is customarily kept. You may be penalized for fraudulent entries. While tax rates vary by location, the auto sales tax rate typically ranges anywhere from two to six percent.

However, if a vehicle purchased in another state, the district of columbia, or the commonwealth of puerto rico is subject to sales tax in that jurisdiction, a credit against wisconsin sales or use tax due is allowed for sales tax paid to that jurisdiction, up to the amount of wisconsin tax due (sec. The total amount represents the various taxes and fees, which are used to build and maintain wisconsin’s roads. Reserve your car with £99 deposit, choose contactless click & collect or home delivery.

Sales of boats, recreational vehicles as defined in sec. Important changes • menominee county tax begins april 1, 2020 • baseball stadium district tax ends march 31, 2020 • outagamie county tax begins january 1, 2020 • calumet county tax begins april 1, 2018 Wisconsin has a 5% statewide sales tax rate , but also has 265 local tax jurisdictions.

The national average state and local sales tax, by. Wisdot collects sales tax due on a vehicle purchase on behalf of dor. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator.

Once you have the tax rate, multiply it with the vehicle's purchase price. Wisconsin car payment calculator with amortization to give a monthly breakdown of the. Motor vehicle sales, leases, and repairs.

101 rows how 2021 sales taxes are calculated for zip code 54016. Wisconsin state rate(s) for 2021. While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking.

There are also county taxes of up to 0.5%, and a stadium tax of up to 0.1%. 6.35% for vehicle $50k or less. Dealership employees are more in tune to tax rates than most government officials.

$2,000 x 5% = $100. For more information, see wisconsin tax bulletin #157 or publication 207, sales and use tax information for contractors. Dmv fees are about $ 318 on a $ 39750.

$30,000 × 8% = $2,400. Purchases of motor vehicles, boats, recreational vehicles as defined in s. All calculations are estimates based on all known state excise, sales, and environmental taxes and fees levied on gasoline, plus vehicle registration renewal fees as of january 1, 2021.

Wisconsin residents must pay a 5 percent sales tax on car purchases, plus county taxes of up to 0.5 percent.some counties also charge a stadium tax of 0.1 percent , notes the wisconsin department of revenue.for example, the state and local sales tax on vehicles registered in bayfield county is 5.5 percent. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Wisconsin collects a 5% state sales tax rate on the purchase of all vehicles.

You can use our wisconsin sales tax calculator to look up sales tax rates in wisconsin by address / zip code. See our manual car tax calculator, and use the override option to fine tune your auto loan quote. In addition to taxes, car purchases in wisconsin may be subject to other fees like registration, title, and.

Wisconsin auto loan calculator is a car payment calculator with trade in, taxes, extra payment and down payment to calculate your monthly car payments. Reserve your car with £99 deposit, choose contactless click & collect or home delivery. Remember to convert the sales tax percentage to decimal format.

The wisconsin's tax rate may change depending of the type of purchase. Some of the wisconsin tax type are: 7.75% for vehicle over $50,000.

4.25% motor vehicle document fee. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. The wisconsin department of revenue (dor) reviews all tax exemptions.

Find your state below to determine the total cost of your new car, including the car tax. Sales tax is charged on car purchases in most states in the u.s. If you are unsure, call any local car dealership and ask for the tax rate.

5% is the smallest possible tax rate (brookfield, wisconsin) Any taxes paid are submitted to dor. Please refer to the wisconsin website for more sales taxes information.

For example, if your state sales tax rate is 4%, you would multiply your net purchase price by 0.04. Businesses, individuals, press releases, tax pro: Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

You can do this on your own, or use an online tax calculator. Texas has a 6.25% statewide sales tax rate , but also has 815 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.377% on top.

Sales Tax Calculator

Tennessee Sales Tax - Small Business Guide Truic

Mka7r8ijnvvd2m

Nj Car Sales Tax Everything You Need To Know

Origin-based And Destination-based Sales Tax Rate - Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Minnesota Sales Tax On Cars

Illinois Used Car Taxes And Fees

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Connecticut Sales Tax Calculator Reverse Sales Dremployee

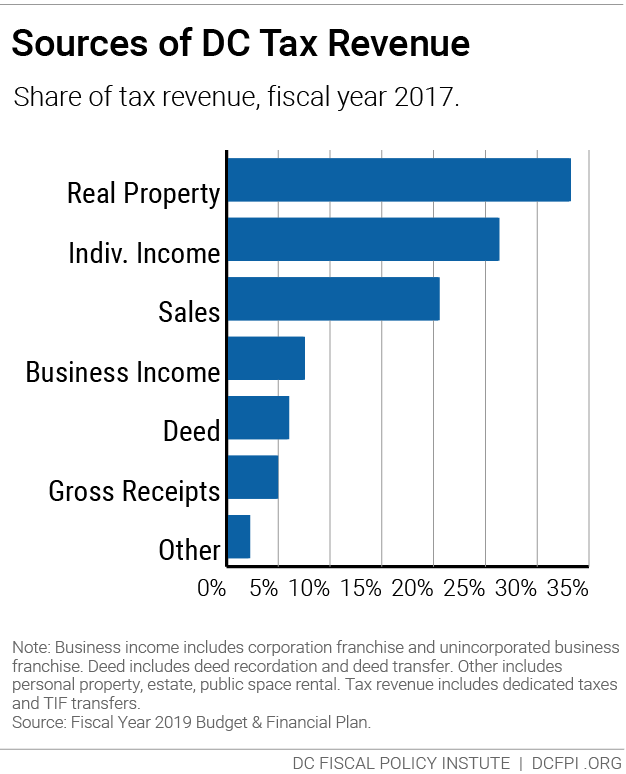

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Understanding Californias Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Origin-based And Destination-based Sales Tax Rate - Taxjar

Understanding Californias Sales Tax

Sales Tax Calculator