Tn Vehicle Sales Tax Calculator Hamilton County

The sales tax rate for hamilton county was updated for the 2020 tax year, this is the current sales tax rate we are using in the hamilton county, tennessee. Titles vi, vii, and ix of the civil rights act of 1964, section 504 of the rehabilitation act of 1973, americans with disabilities act and the age discrimination act of.

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

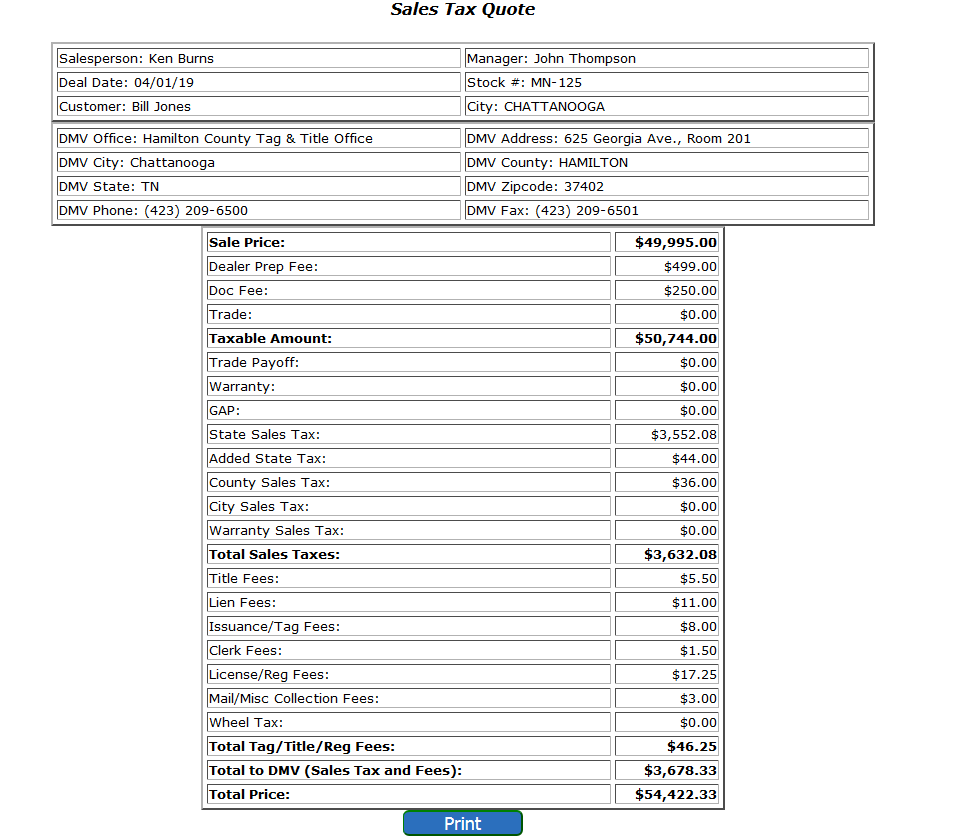

If sales tax value is greater than $1600 but less than $3200 your single article tax is 2.75% after $1600 if sales tax value is more than $3200 your single article tax is $44.00 disclaimer:

Tn vehicle sales tax calculator hamilton county. Sales tax calculator | davidson county clerk. This is the total of state and county sales tax rates. The current tax rate is 2.25 per $100 of assessed valuation.

For purchases in excess of $1,600, an additional state tax of 2.75% is added up to a maximum of $44. Purchaser needs to have in their possession (mso) manufacturer statement origin, completed by dealer and purchaser. Hamilton county, tn sales tax rate.

The assessed value is $25,000 (25% of $100,000), and the tax rate has been set by your county commission at $3.20 per hundred of assessed value. Occasional and isolated sales of motor The minimum combined 2021 sales tax rate for hamilton county, tennessee is.

Montgomery county government | 1 millennium plaza | clarksville, tn 37040 | contact directory. The attorneys then file suit in chancery court of hamilton county and court costs are charged in addition to interest, penalties, and collection fees. The total sales tax you pay for a car in tennessee is a combination of state and local taxes, calculated by adding together:

Residential and commercial properties are assessed at 25% and 40% of appraised value. Hamilton county, tennessee sales tax rate 2021 up to 9.25%. Also, need bill of sale stating tax collected and lienholder (if any).

The tax rate is set by city council each year as part of the annual budget process. The sales tax calculator is for informational purposes only, please see your motor vehicle clerk to confirm exact sales tax amount. Proof of residency is required by the state of tennessee dept.

Tn auto sales tax calculator. The 2018 united states supreme court decision in. Total purchase price multiplied by the 7 percent state sales tax rate the first $1,600 multiplied by the sales tax of the city and county where you purchase the car

Tennessee collects a 7% state sales tax rate. The chattanooga, tennessee, general sales tax rate is 7%. The hamilton county sales tax rate is %.

The hamilton county sales tax is 2.25%. The tennessee state sales tax rate is currently %. If vehicle is purchased out of state and sales tax is lower than tn, then the difference will be collected at time of registration.

The maximum charge for county or city sales tax in tennessee is $36 on the first $1600 of a car's purchase price. State sales tax is 7% of the purchase price, plus any additional fees charged by the dealership. The one stop shop for the citizens of davidson county tennessee to renew their driver's license, get a business license, get a marriage license, and much more.

None of the cities or local governments within hamilton county collect additional local sales taxes. Montgomery county government complies with the following civil rights statutes; To calculate the tax on your property, multiply the assessed value by the tax rate.

Depending on the zipcode, the sales tax rate of chattanooga may vary from 7% to 9.25%. Every 2021 combined rates mentioned above are the results of tennessee state rate (7%), the county rate (2.25%). Greene county is home to a workforce second to none.

A single article tax is another state tax to consider when purchasing a car. • total vehicle sales price = $25,300 • $25,300 x 7% (state general rate) = $1,771 • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if county clerk has received the payment from dealer. The current total local sales tax rate in hamilton county, tn is 9.250%.

There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. Assume you have a house with an appraised value of $100,000. Hamilton county tennessee register of deeds commands return to home.

Local collection fee is $1. Local sales tax is 2.25% and is capped at $36.00. How 2021 sales taxes are calculated in chattanooga.

The december 2020 total local sales tax rate was also 9.250%. In addition to taxes, car purchases in tennessee may be subject to other fees like registration, title, and plate fees. Below is titling information if you already purchased a vehicle or are a new tennessee resident.

Sales Taxes In The United States - Wikiwand

Tennessee County Clerk - Registration Renewals

Sales Tax On Cars And Vehicles In Nebraska

Tennessee County Clerk - Registration Renewals

Tennessee Sales Tax - Taxjar

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Home - Quick Tax Quote

Tennessee Sales Tax And Other Fees - Motor Vehicle - County Clerk - Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Car Sales Tax Everything You Need To Know

Tennessee County Clerk - Registration Renewals

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Clerk - Registration Renewals

Tennessee County Clerk - Registration Renewals

Tennessee Sales Tax Rates By City County 2021

Tennessee County Clerk - Registration Renewals

Tennessee Sales Tax - Small Business Guide Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue