Vermont Department Of Taxes Property Valuation And Review

The division of property valuation and review (pvr) of the vermont department of taxes annually determines the equalized education property value (eepv) and coefficient of dispersion (cod) for each school district in vermont. (3) were not claimed as a dependent by another taxpayer for tax year 2019;

2

(2) were vermont resident's all of calendar year 2019;

Vermont department of taxes property valuation and review. The average vermont property tax adds up to $4,111, which is higher than in most states in the country. The primary purpose of the equalization study is to assess how close the. Pvr supports computer software programs used locally for grand list valuation and property tax.

The state education property tax is based on each municipality’s grand list of properties. Farnham, director, property valuation and review division, vermont department of taxes date: Vermont law requires a solar plant to be valued using the discounted cash flow method as described in 32 v.s.a.

Questions answered every 9 seconds. The availability of support enhances the reliability of property assessments and results in greater standardization of assessment practices throughout the state. This year’s equalization study was based on the assessed value of property as established by each

Ad a tax advisor will answer you now! Ad before you sell, get 5 free estimates from the top data sources online. We also provide additional support to local officials with assistance from a department attorney and other centrally located staff with expertise in property assessment, property tax administration, and property tax law.

The information comes from the vermont department of taxes which publishes this data from the vermont property transfer tax returns the state collects. The division of property valuation and review (pvr) of the vermont department of taxes annually determines the equalized education property value (eepv) and coefficient of dispersion (cod) for each municipality in vermont. Searchable online database of vermont real estate sales & appraisal values this web site contains a searchable database of real estate sales in vermont from 1986 to the present.

The property tax credit assists vermont residents to pay property tax and is based on a percentage of household income. This voluntary program is a tool that helps maintain vermont’s productive agricultural land and forestlands. Questions answered every 9 seconds.

The division of property valuation and review (pvr) of the vermont department of taxes annually determines the equalized education property value (eepv) and coefficient of dispersion (cod) for each school district in vermont. Act 60 / income tax: Review the error correction page for the specific cases that fall under this filing type.

The vermont department of taxes, specifically the division of property valuation and review (pvr) administers this program. The division of property valuation and review (pvr) annually determines the equalized education property value (eepv) and coefficient of dispersion (cod) for each school district in vermont. Homeowners eligible for a credit are those who (1) owned the property as a principal home on april 1;

The eepvs determined as part of the 2019 equalization study are a measure of the property dollar value of a municipality. Ad a tax advisor will answer you now! Use this form to correct errors in your property assessment or property tax.

Appeals to the director of property valuation and review | department of taxes. Solar plants with a plant capacity of less than 50 kw, and that do not qualify for any of the three exemptions described above, will also be valued for education property tax purposes. Vermont raises education funds through several tax sources including a state education property tax.

Ad before you sell, get 5 free estimates from the top data sources online. Farnham property task force ii. After you file, you will receive a notice advising you of the department’s decision.

You can contact the town of wilmington assessor for: The division of property valuation and review (pvr) conducts an annual equalization study of all the municipal grand lists. Waste water commission agendas and minutes.

The division of property valuation and review (pvr) staff which includes both office staff and traveling district advisors provides support to municipalities in developing and administrating property tax policies and related programs at the local level. This form cannot be used to dispute your property’s valuation. Honorable mitzi johnson, speaker of the house honorable tim ashe, senate president pro tem from:

§ 3481(1)(d) and designated by the department’s division of property valuation and. The median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00.

Taxvermontgov

Ftpact60taxstatevtus

Vermonters Unemployed In 2020 Could Get Additional Tax Refund - Vtdigger

Vermont Property Tax Appeal Attorney Msk Attorneys

2

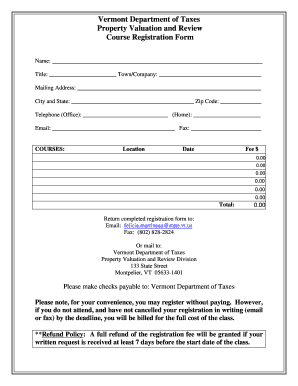

Fillable Online Tax Vermont Vt Form Property Valuation And Review Pvr - Taxvermontgov Fax Email Print - Pdffiller

Home Valuation Form - Fill Online Printable Fillable Blank Pdffiller

Fillable Online Tax Vermont Property Valuation Review Annual Report Department Of Taxes Fax Email Print - Pdffiller

2

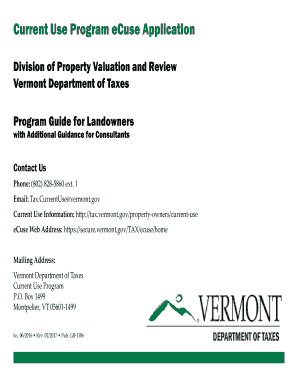

Ecuse Vt - Fill Online Printable Fillable Blank Pdffiller

Vermontjudiciaryorg

Vermontjudiciaryorg

2

2

Townwillistonvtus

2

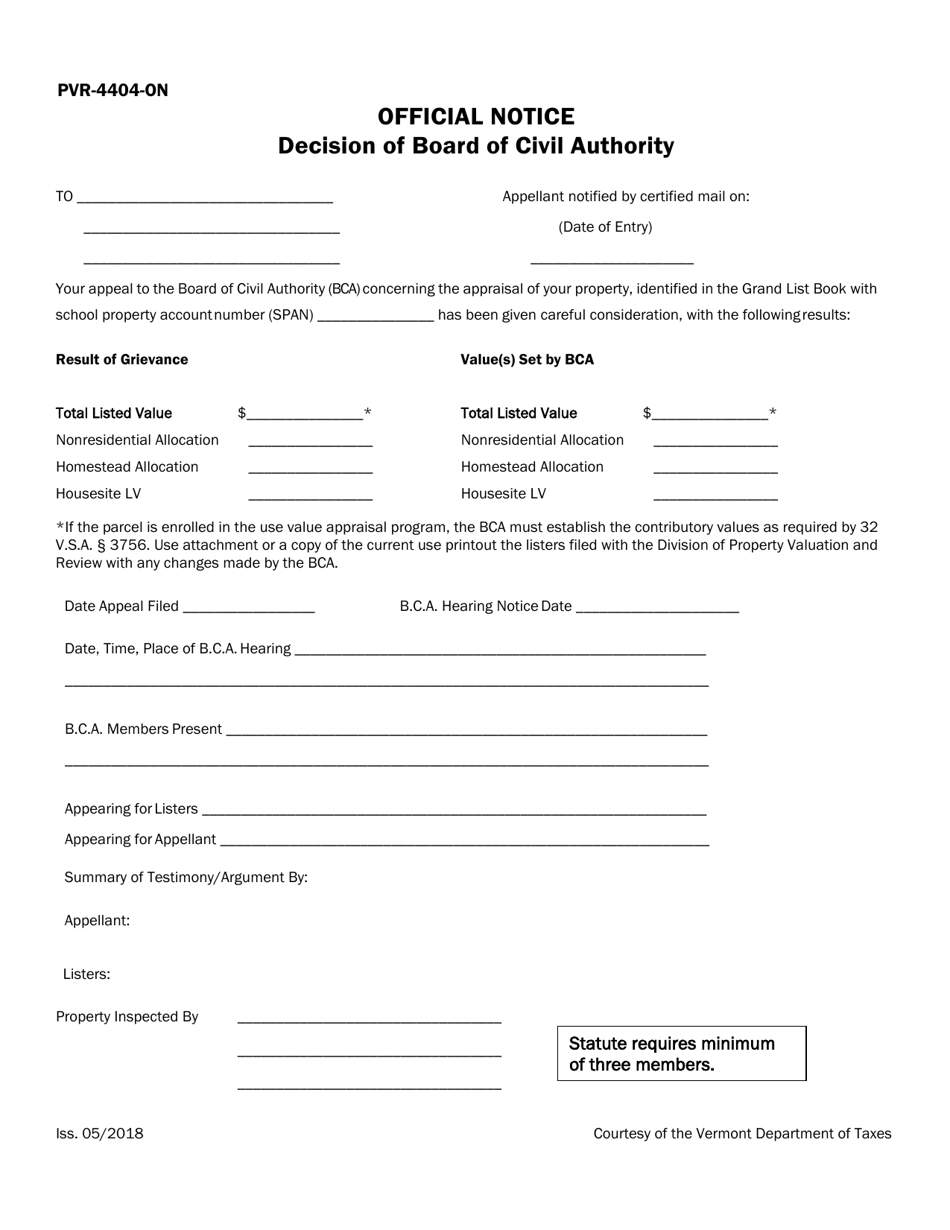

Vt Form Pvr-4404-on Download Printable Pdf Or Fill Online Official Notice Decision Of Board Of Civil Authority Vermont Templateroller

Vermont Department Of Taxes Facebook

2