What Is A Tax Lottery

Contact us now to know your federal & state lottery tax rates for lottery prize winnings in the usa. Winnings are taxed the same as wages or salaries are, and the total amount the winner receives must be reported on their tax return each year.

Get That Omg Feeling With The Lottery Office Over 750 Million In Combined Jackpots And Growing Grab Your Tickets Today In 2021 Lottery Jackpot How To Apply

There is no way you can work around this—the u.s.

What is a tax lottery. Find out more about how the lotto america jackpot works. This means your income will be pushed into the highest federal tax rate, which is 37%. Russia has a unique approach to taxing lottery winnings.

With mega millions fever sweeping the country, today we released a short report on state lottery withholding taxes. The tax brackets are progressive, which means portions of your winnings are taxed at different rates. It is common to find some degree of regulation of lottery by governments.

What is the tax rate for lottery winnings? Are lottery winnings taxed in the uk? Your lottery winnings are taxed just as if they were an ordinary income bonus.

The same tax applies to all citizens of russia. Everyone who spends at least 184 days every year in russia has to pay “only” 10% on lottery winnings as taxes. Therefore, you won’t pay the same tax rate on the entire amount.

You pay tax on your winnings whenever you receive them, either the lump sum or if it’s over a period of time, with each payment you receive. Next in line is the federal tax bill. Lottery duty is a duty on taking a chance or ticket in a lottery promoted in the uk.

How tax reform affects lottery winnings in the usa? 6 % new york state tax on lottery winnings in usa. Depending on where you live, you may need to pay taxes on lottery winnings to your state and local governments in addition to the federal government.

If you spend most of the year in russia (184 days), you are entitled to a favorable lottery tax of 10%. In south africa, lotto prizes are not taxed. Under both the federal and state tax system, they are considered ordinary taxable income.

Lottery tax rates vary greatly by state. If you win more than €40,000, or basically any. Under section 194b of the income tax act, 30% tax is deducted on any lottery winnings above rs 10,000.

The federal tax on lottery winnings 2018, the top tax rate was lowered down from 39.6% to a total of 37%. The most common regulation is prohibition of sale to minors, and vendors must be licensed to sell lottery. 8.82 % north carilona state tax on lottery winnings in usa.

When it comes to federal taxes, lottery winnings are taxed according to the federal tax brackets. If you take the payment in a lump sum, you'll pay taxes on your lottery winnings only in the year you receive them. The irs considers net lottery winnings ordinary taxable income.

Lottery winnings are not treated as income by hm revenue & customs, which is the government department responsible for taxation. 10 crores you will receive rs. 7 crores and the government will take rs.

How many times do you pay taxes on lottery winnings? How much exactly depends on your tax bracket, which is based on your winnings and other sources of income, so the irs withholds only 25%. Lottery winnings are not taxed twice.

This will depend on how you choose to receive your winnings. So after subtracting the cost of your ticket, you will owe federal income taxes on what remains. 8 % new maxico state tax on lottery winnings in usa.

Lottery winnings of $600 or less are not reported to the irs; This means that tax is not payable on any amounts won through a lottery. We've created this calculator to help you out with lottery taxes.

It means that is you luckily win a lottery in the usa this year; For prizes between $600 and $5,000, you do not owe any federal tax but you are still required to report your winnings on a federal income tax form. If you win a jackpot of rs.

What is the tax rate for lottery winnings? How are lottery winnings taxed? A portion of this information has been provided by usamega.com , and all figures are subject to fluctuation resulting from (but not limited to) changes in tax requirements, lottery rules, payout structures, personal expenditures, etc.

Lottery taxes are anything but simple, the exact amount you have to pay depends on the size of the jackpot, the state you live in, the state you bought the ticket in, and a few other factors. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. If you spread your payment out over a period of years, you'll pay taxes on the lottery payments you receive each year.

Spain has great lottery games like la primitiva and el gordo, but players of big winnings should be aware of its taxes. Government does not give tax breaks to even the luckiest people in the country. Winnings in excess of $5,000 are subject to a 25 percent federal withholding tax.

Despite the amount won in the sa lotto, it is considered capital in nature which is exempted from income tax.prizes won through south african lotteries also have the benefit of special exemption from capital gains tax. You will pay a lesser amount of taxes. However, if you don’t spend most of the year (184 days) in this country, the tax rate will be harsh.

If you win £2.50 or £125 million, you will be paid the full amount. However, staying less than that result in a harsh tax of 30%, lottery winning taxes in spain. As well as federal withholding, you will also owe state taxes on prizes above $5,000 in most participating jurisdictions.

Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. Federal taxes on lottery wins. A lottery is a form of gambling that involves the drawing of numbers at random for a prize.

Tax on the sale of lots or on the receipt of prizes after the drawing of lots. New jersey state tax on lottery winnings in usa. All lawful lotteries are exempt from the duty except the national lottery.

All calculated figures are based on a sole prize winner and factor in an initial 24% federal tax withholding. Right off the bat, lottery agencies are required to withhold 24% from winnings of $5,000 or more, which goes to the federal government. You can’t expect to win millions in the lottery and owe absolutely nothing in taxes.

Usa Mega Lotto - Real Tickets - The Lottery Office In 2021 Lottery Lotto Lottery Numbers

Lottery Pool Agreement Sample Template Lottery Lottery Numbers How To Find Out

Dave Ramsey - Timeline Photos Lottery Financial Budget Leadership Development

How Does It Sound To Be A Winner Every Tax Client Will Be Entered Into Tax-n-go 24 Lottery Winners Will Lottery Numbers Tax Preparation Lottery

You Thought You Could Forget About These Babies We Think Not Start Your Weekend Off Right With Shares In Our Stunning Lotto Syndi In 2021 Lottery Lotto How To Apply

Betsoi Online Casino Thailand

We Cant Believe It Its Jackpot Again To A Sky-high 722 Million Giving You Yet Another Chance Of A Lifetime Get Your Tickets In 2021 Lotto Lottery Lottery Numbers

Maryland Winner Steps Forward To Claim Share Of Mega Millions Jackpot - Cnn Mega Millions Jackpot Winning The Lottery Lottery Tickets

The Lottery Is Really A Tax On The Poor Lottery Poor Math

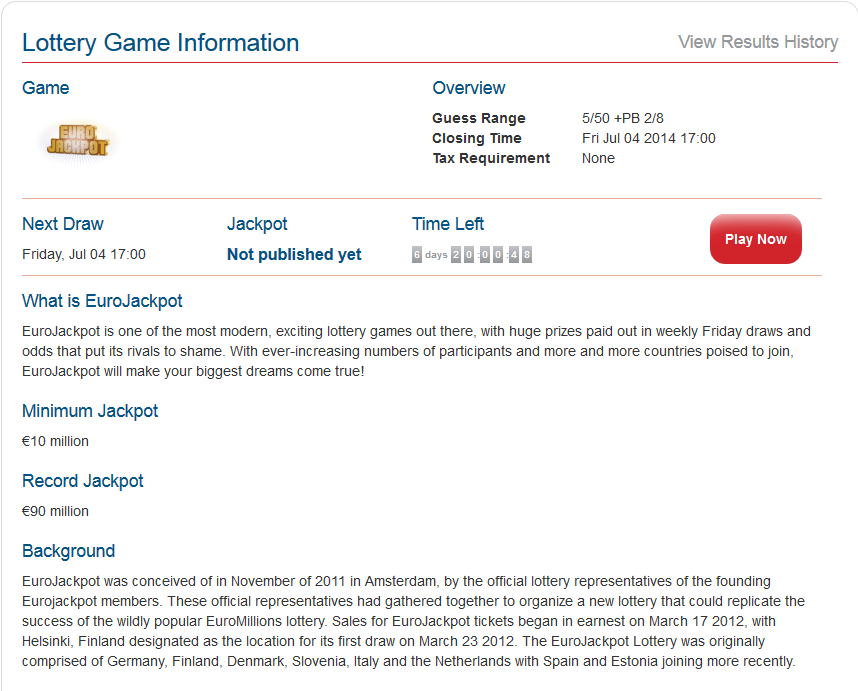

Eurojackpot Reviewv - Play Eurojackpot Lottery Online Online Lottery Lottery Lottery Games

Lottery Bonds For Fair Ticket Selling And Timely Tax Payments Lottery Tax Payment Fair Tickets

Pin By Janice Reijnaert On Things That Make Me Laugh Funny Quotes Funny Confessions Accounting Humor

Fancy More Chances For Less Then The Lotto Syndicates Are For You Jump In Now Grab Your Shares And A Major Win Could Be Right Aroun In 2021 Lottery Syndicate Lotto

Every Receipt At Every Store In Taiwan Is A Ticket For A Government Lottery With Top Prizes Worth Over 300000 Usd It Was I Unbelievable Facts Receipt Lottery

If You Hit The Jackpot In Either Mega Millions Or Powerball You Can Count On Paying 37 Percent On Your Income To The I Mega Millions Jackpot Jackpot Powerball

Are Lotteries A Tax On The Poor Lottery Winner Lottery Strategy Winning The Lottery

Lottery A Tax On People Who Are Bad At Math Lottery Math Bad

Taxes On Lottery Winnings In Uk Tax Debt Tax Debt Relief Lottery

Taxation Of Lottery Income Tax Deducted At Source Finance Lottery