South Dakota Property Tax Laws

There is no authority in state law that allows for a deferment or a delay of the property tax payment deadlines. Books, records, minutes, and member lists., s.d.

County Treasurers South Dakota Department Of Revenue

For the purposes of article xi, § 6, the term ‘property taxes’ does not apply to special assessments.

South dakota property tax laws. For example, d some states may tax trust distributions originating from. To qualify the following conditions must be met: South dakota is a common law state (not a community property state), which means that each spouse is a separate individual with separate legal and property rights.

Ad valorem refers to a tax imposed on the value of something (as opposed to quantity or some other measure). It is the purpose of this paper to evaluate the tax laws and their administration, and to make recommendations for their revision. Thus, as a general rule, each spouse owns and is taxed upon the income that he or she earns.

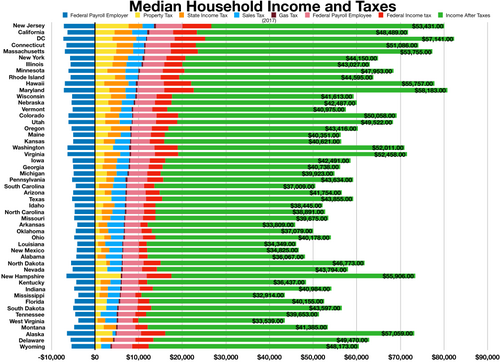

However, other states may tax people or property within south dakota baseon those states' laws. And it shields your wealth from the government, since south dakota has no income tax, no inheritance tax and no capital gains tax. If you want professional guidance for your estate planning after reading this article, the smartasset advisor matching tool can find you a.

Offshore jurisdictions tend to have no income or corporation taxes, which makes them potentially attractive to wealthy individuals and companies who don’t want to. If property is titled only in your name, you are the sole owner. South dakota is ranked number twenty seven out of the fifty states, in order of the average amount of property taxes collected.

All books and records of a corporation may be inspected by any member or agent or. Each type of property identified in article xi, § 6 and provided for full and partial exemptions from all property taxes. The median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00.

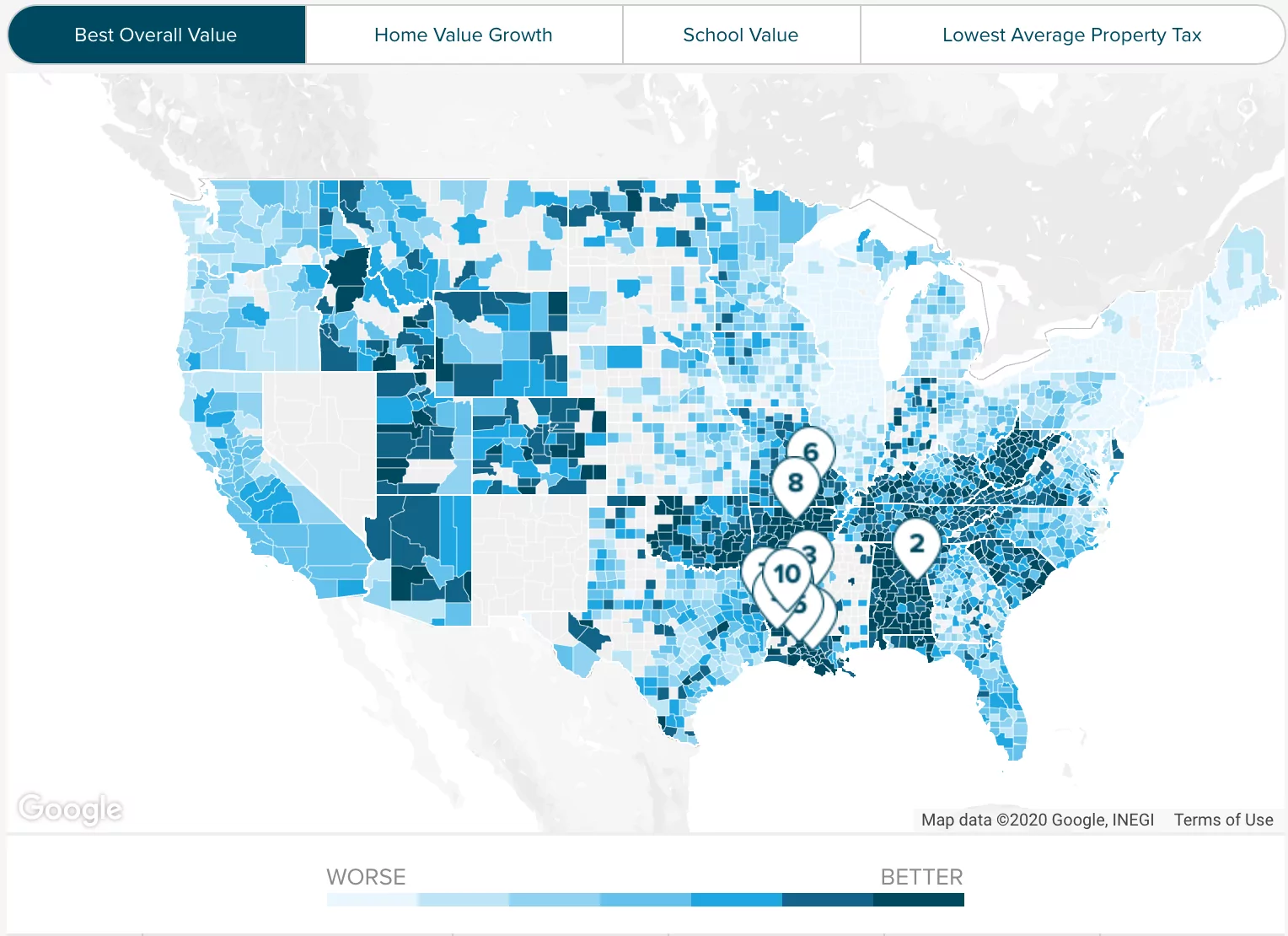

A decade ago, south dakotan trust companies held $57.3bn in. Rather, property taxes are imposed by your local cities, schools, counties, and townships, and are collected by your local county treasurer. Counties in south dakota collect an average of 1.28% of a property's assesed fair market value as property tax per year.

The law of yankton, south dakota says that everybody who owns real property has to pay taxes on it. In yankton, south dakota, property taxes. However, there are other south dakota inheritance laws of which residents should be aware, including rules governing intestate succession, probate, what makes a will valid and more.

South dakota does not levy several taxes that other states impose, such as a state income tax. South dakota, mark krogstad is a trusts and estates attorney practicing in south dakota and minnesota with davenport, evans, hurwitz & smith, llp in sioux falls, sd. South dakota allows people over the age of 70 with income below a certain level to delay payment of all property taxes until their home is sold.

Most of south dakota’s property tax laws are codified in various chapters of title 10 of the south dakota codified laws. You still owe property taxes, and. The property tax division plays a critical role in ensuring that property assessments are fair, equitable and in.

The property tax is the primary source of revenue for local governments. South dakota does not levy either an estate tax or an inheritance tax. What is the property tax?

(abc) south dakota does not levy either an estate tax or an inheritance tax. Title to property is equivalent to ownership. However, there are other south dakota inheritance laws of which residents should be aware, including rules governing intestate succession, probate, what makes a will valid and more.

The south dakota supreme court has ruled that spe cial assessments for local improvements are distinct and different • the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. The term real property refers to land and buildings, as well as anything fixed to the land, like trees and natural resources.

The property tax division is responsible for overseeing south dakota's property tax system, including property tax assessments, property tax levies and all property tax laws. The state of south dakota does not levy or collect any real property taxes. Property taxes are the primary source of funding for schools, counties, municipalities and other units of local government.

States That Do Not Tax Earned Income

Property Tax South Dakota Department Of Revenue

Property Tax Valuation In South Dakota How Is It Calculated Swier Law Firm Prof Llc

Property Tax South Dakota Department Of Revenue

South Dakota Retirement Tax Friendliness - Smartasset

South Dakota Sales Tax - Small Business Guide Truic

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Comparison By State For Cross-state Businesses

Property Tax South Dakota Department Of Revenue

Dakota County Mn Property Tax Calculator - Smartasset

Property Tax South Dakota Department Of Revenue

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax In The United States - Wikipedia

The Great American Tax Haven Why The Super-rich Love South Dakota Tax Havens The Guardian

Apply For Your Sales Property Tax Refund South Dakota Department Of Revenue

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

South Dakota Property Tax Calculator - Smartasset

Property Tax South Dakota Department Of Revenue

How South Dakota Became A Haven For Both Billionaires And Full-time Rv-ers - Marketwatch