Workers Comp Taxes For Employers

6.2% social security tax, 1.45% medicare tax, and 0.9% for anyone who earns more than $200,000. Wage and salary costs averaged $25.89 and accounted for 70.6 percent of employer costs, while

How To Reduce Workers Compensation Insurance Costs - Employers Resource

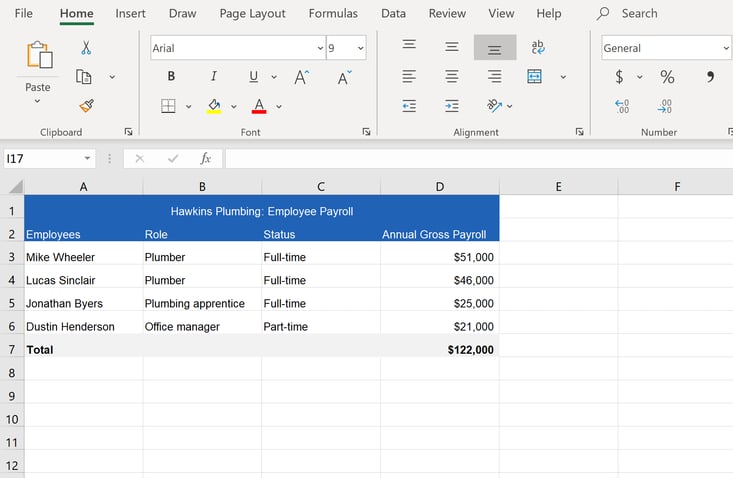

Figuring out how to calculate your workers’ comp cost per employee means connecting with an insurance provider to determine your annual premium.

Workers comp taxes for employers. However, each state specifies its own tax rates. A partnership (or llc that chooses to be taxed as a partnership) could but if somebody is offered a spot as a partner he or she must have the offer reviewed by. A workers' compensation insurance company.

Fica (federal insurance contributions act) is a federal law that requires employers to withhold three taxes from their employees’ wages: The quick answer is that, generally, workers’ compensation benefits are not taxable. Employers who don't have legally required insurance may also face criminal charges and steep fines.

Your workers’ comp benefits aren’t usually taxable, so you don’t have to report workers’ compensation benefits on your income tax return or pay state or federal taxes on them. The federal unemployment tax rate is 6.2 percent of the first $7,000 in wages paid each employee. However, that amount is usually not significant enough for taxation.

A credit of up to 5.4 percent may be allowed for state unemployment taxes paid for a normal net tax of 0.8 percent. Federal tax rates, like income tax, social security (6.2% each for both employer and employee), and medicare (1.45% each), are set by the irs. The funds may then go after the employers to seek reimbursement for the cost of those benefits.

It doesn’t matter if they’re receiving benefits for a slip and fall accident, muscle strain, back injury, tendinitis or carpal tunnel. Some states have special funds to provide workers' comp benefits for injured employees of illegally uninsured employers. A higher number or greater severity of workplace injuries typically leads to higher premiums.

Both employers and employees are responsible for payroll taxes. If the employee is totally disabled, they would typically receive 60% of this wage, or $485.82 per week. Labor classifications for 1099 workers.

To figure out how to calculate your workers’ comp cost per employee, you’ll need to connect with an insurance. Once you have a policy, your insurer will perform an audit to ensure you are paying the correct amount based on how many employees you have and what activities they perform. This means that the employee would be entitled to benefits on $42,104.40 per year, or $809.70 per week.

This is down from $1.05 in 2020. It wouldn’t work for a corporation. 2 but in california, the average premium in 2021 is $1.56 per $100 of payroll.

In addition to fica taxes, you must also cover unemployment taxes and workers’ compensation. A corporation must still pay salaries/wages. Wages paid to a spouse or child under age 21 who.

With our emphasis on financial stability and fast, efficient claims service, we now serve clients in 46 states and the district of columbia. Without getting too technical, a tax situation could arise if you receive both workers comp and ssdi. 1 on average, employers will pay $1 per $100 of payroll for workers’ comp in 2021.

The primary direct cost to employers is the expense of workers’ compensation insurance premiums. However, nolo points out, “some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers’ comp premiums for them.” However, you may not owe any taxes even when a portion of your workers’ comp benefits is taxable due to the offset.

In most cases, they won’t pay taxes on workers’ comp benefits. If your employee is truly an independent contractor, you are not legally obligated to pay payroll taxes or workers’ compensation benefits. Employers remains focused on keeping america’s main street.

Worker compensation costs for employers averaged $36.64 per hour worked in june 2021. So even if part of their benefits is taxable, it’s unlikely they would owe anything to the irs. Employers generally are liable for both federal and minnesota unemployment taxes.

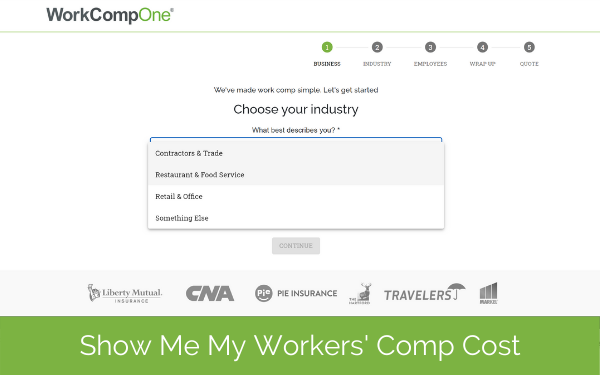

Finding workers compensation insurance for your business The fund is financed by premiums paid by employers and employees, not by general revenue taxes. In return for premium payments, employers get insurance coverage.

That’s because most people who receive social security and workers comp benefits don’t make enough to owe federal taxes. The amount reduced in your ssdi or ssi payments due to your workers’ comp benefits will be taxable.

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

How Much Does An Employee Cost Infographic Patriot Software Accounting Education Entrepreneur Business Plan Business Basics

How To Calculate Workers Compensation Cost Per Employee

Steps To Take After A Workplace Accident Workplace Accident Injured On The Job Worker

Workers Compensation And Who Is Required To Have It Cps

Many People Live Paycheck-to-paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis In 2021 Paying Taxes Worker Workplace Accident

Workers Compensation - Violating Workers Comp Laws Can Be Costly For Employers - Bges Group Insurance

Workers Compensation For Self-employed Contractors The Hartford

Httpwwwajlongocomclassification-independent-contractors Independent Contractor Irs Taxes Contractors

Workers Compensation Insurance Overview Amtrust Financial

Pin On Workers Compensation Audit

Workers Compensation Archives Workers Compensation Insurance Worker Compensation

What Is Workers Compensation Fraud Fighting Fraudulent Claims

How To Calculate Workers Compensation Cost Per Employee

What Wages Are Subject To Workers Comp - Hourly Inc

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

Costratesadvisorcom Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

Under The Pennsylvania Workers Compensation Act Injured Workers Are Required To Give Their Employers Notice Of Any Work Injury Workplace Injury Paying Taxes

2