Are Funeral Expenses Tax Deductible In Ontario

Funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. This includes things child support payments, legal fees for divorces or separations, funeral expenses, wedding costs, loans to family members and losses on the sale of a home.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/red-rose-on-gravestone-in-cemetery-173299137-5bdedb67c9e77c0051f5bc79.jpg)

How Much Can You Claim For Funeral Expense Deductions

If you have questions about the deductibility of any donations, please reach out to a tax professional.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/red-rose-on-gravestone-in-cemetery-173299137-5bdedb67c9e77c0051f5bc79.jpg)

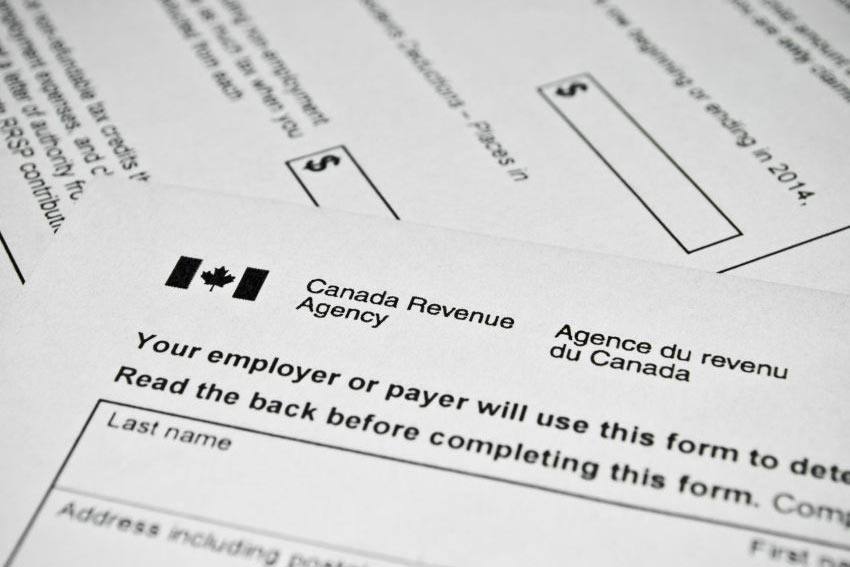

Are funeral expenses tax deductible in ontario. To qualify for the death benefit, the deceased must have made contributions to the canada pension plan ( cpp) for at least: • each individual resident in canada is allowed to make a contribution of up to $35,000 into an efa that covers funeral and cemetery services. The average price varies by city and province, and that cost does not include cemetery property or burial charges.

If you’re wondering, “ are funeral expenses tax deductible?” you’re not alone, but unfortunately a ccording to irs regulations, most individuals will not qualify to claim a tax deduction for funeral expenses. Even if it were to be found that the taxpayer had a source of income, the cra argued that the expenses should have been capitalized and were therefore not currently deductible as a current rental. While most funeral expenses are not tax deductible for individuals, the rules change when the estate pays for the burial costs.

While the irs allows deductions for medical expenses, funeral costs are not included. Those taxes include income taxes, property taxes, estate taxes, etc. Do tax exemptions apply to costs like burial, cremation and floral arrangements?

In other words, if you die and your heirs pay for the funeral themselves, they will not be able to claim any deductions for those expenses on their taxes. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Transfer of the loved one from home, hospital or hospice and into the funeral home’s care at any time, on any day

Funeral costs in canada can be as low as $1,000 or as high as $20,000, with the average around $9,150. One of the questions that i am asked is whether or not prepaid funeral payments can be deducted on personal tax returns. You may even work with the writer of the will to get things in order before.

Individual taxpayers cannot deduct funeral expenses on their tax return. Funeral expenses documents (receipts, funeral home contract, etc.) that include the applicant's name, the deceased person's name, the amount of. Although funeral expenses aren’t tax deductible in the traditional sense, there are ways to avoid the heavy burden of funeral costs.

The canada revenue agency (cra) has designated that funds held in a prepaid funeral account called an eligible funeral arrangement (efa) must be guaranteed to $100,000.00 and earns tax exempt interest. According to internal revenue service guidelines, funeral expenses are not deductible on any individual tax return, including the decedent's final. Funeral expenses tax deductible for estates only.

The 1040 tax form is the individual income tax form, and funeral costs do not qualify as an individual deduction. The answer unfortunately is no and here’s why. Expenses that cannot be covered by the estate include:

Legal fees you paid to get a separation or divorce or to establish custody for a child, funeral expenses, wedding expenses, loans to family members (that presumably went “bad”) and a loss on the sale of your home. It’s possible an estate can deduct these and other types of funeral expenses, but check with your tax professional first. Plan ahead, consider options in green burial or cremation , and ask for funeral payment plans from the funeral home of your choice.

Family, child care, and caregivers deductions and credits. Then there are the cases where people make claims that are simply not deductible. In short, these expenses are not eligible to be claimed on a 1040 tax form.

Sb Financial Services - Home Facebook

3 Of The Tax Mistakes Youre Most Likely To Make According To The Cra - National Globalnewsca

Ppt - Estate Planning Taxation Powerpoint Presentation Free Download - Id4367009

Are Funeral And Cremation Expenses Tax Deductible National Cremation

Reid Funeral Home Leamington - Are Funeral Expenses Tax Deductible

Deductible Expenses Under The Proposed Council Directive And Deviation Download Table

Financial Planning John Kehoe Cfp A Financial Co-operative Owned By Our Members A Financial Co-operative Owned By Our Members Established In 1945 Established - Ppt Download

Are Funeral Expenses Tax Deductible Claims Write-offs Etc

3 Of The Tax Mistakes Youre Most Likely To Make According To The Cra - National Globalnewsca

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2011/04/02/how_to_avoid_a_canada_revenue_agency_audit/tax_questions_you_were_afraid_toask.jpeg)

How To Avoid A Canada Revenue Agency Audit The Star

3 Of The Tax Mistakes Youre Most Likely To Make According To The Cra - National Globalnewsca

Does Life Insurance Cover Funeral Expenses Canada Protection Plan

How To Apply For The Canada Pension Plan Cpp Death Benefit - Loans Canada

Are Funeral Expenses Tax Deductible Claims Write-offs Etc

Financial Planning John Kehoe Cfp A Financial Co-operative Owned By Our Members A Financial Co-operative Owned By Our Members Established In 1945 Established - Ppt Download

2021 Breakdown Of Average Funeral Costs

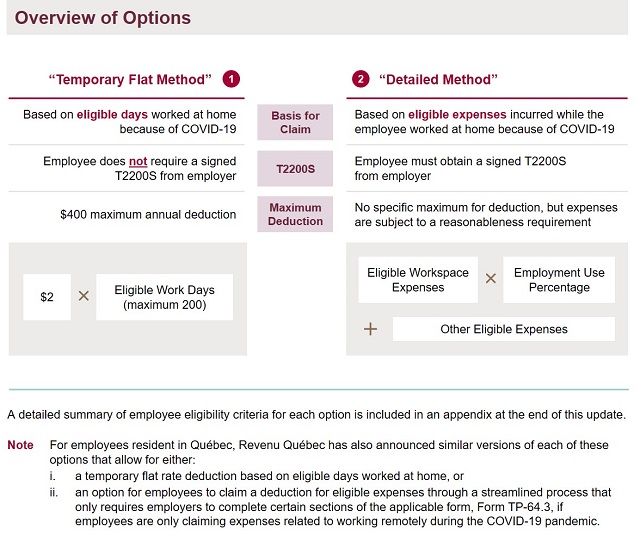

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra - Employment And Hr - Canada

Health Insurance Premiums Tax Deduction - Ontario Blue Cross