Japan Corporate Tax Rate 2022

The general income tax rate for corporations and other legal entities is 33% for 2019. For example, the 2020 taxes are paid in four installments in june, august and october 2021 and january 2022.

Doing Business In The United States Federal Tax Issues Pwc

Scheduled corporate tax rate changes in the oecd 4 among oecd countries, france, the netherlands, and sweden have announced they will implement changes to their statutory corporate income tax rate over the coming years.

Japan corporate tax rate 2022. However, the lower tier tax bracket will be reduced to 15 per cent. The rate is increased to 10% to 15% once the tax audit notice is received. 2021, and 30 percent from 2022 onwards.

With a corporate tax of 40%, the country’s tax rate remained steady between 2017 and 2019. Of cit tax rate until 2022. Corporate tax rate in japan is expected to reach 30.62 percent by the end of 2021, according to trading economics global macro models and analysts expectations.

The law increases the corporate income tax to 35% as from 1 january 2022 (currently, the corporate income tax rate is. The content is current on 1 january 2021, with exceptions noted. Corporate tax rates table kpmg’s corporate tax rates table provides a view of corporate tax rates around the world.

To help with local job creation, the budget would also suspend corporate income tax for manufacturers of ceramic products. A previously promised reduction of the top corporate income tax rate has been postponed and the top rate remains at 25 per cent. We would welcome the following in budget 2022:

Corporate tax rates in 2017 for comparison. The country with the lowest tax rate in 2017 was a tie between… the bahamas; Indirect tax rates , individual income tax rates , employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country, jurisdiction or region.

Then, the cit tax rate will be 32% in 2020; Tax policy alert 130 countries agree on a new international corporate tax framework. In 2017, the united arab emirates was the country with the highest corporate tax rate across the globe.

Law 2010 of 2019 approved in december 2019 kept the adjustments introduced by law 1943 on the income tax. What do you think should be the biggest issue on the government’s budget 2022 agenda? Spain’s lower chamber has given a green light to the 2022 budget proposal, which comes with a new minimum corporate tax rate of 15 percent for large companies with annual revenue over €20 million (us $23 million), while banks and energy firms must pay a minimum of 18 percent.

If prefectural and municipal income taxes are not withheld by the employer, they are to be paid in quarterly installments during the following year. 0.6 net annual growth rate (%) In the case that a corporation amends a tax return and tax liabilities voluntarily after the due date, this penalty may not be levied.

An agile and nimble approach to tax policy is crucial to maintain our competitiveness in the ever changing tax environment. The irish government announced in connection with budget 2022, released october 12, a planned increase in the corporate tax rate to 15% in line with last week’s oecd tax agreement. Continued commitment to retain the 12.5% corporate tax rate for the vast majority of taxpayers.

A tapered rate will also be introduced for profits above £50,000, so that only businesses with profits of £250,000 or greater will be taxed at the full 25% rate. And 30% as from 2022 onwards. A reduced rate of 15 percent on profits up to eur 38,120 may apply to smes

* tax rates shown in parentheses do not include local corporate special tax or special corporate business tax. In addition the lower tier tax bracket will be raised to eur 245,000 and this will be. On july 1, 130 countries of the 139 members of the oecd inclusive framework on base erosion and profit shifting (‘if’) committed to fundamental changes to the international corporate tax system.

Chapter by chapter, from albania to zimbabwe, we summarize corporate tax systems in more than 160 jurisdictions. Data is also available for: Personal income tax rate in japan is expected to reach 55.97 percent by the end of 2021, according to trading economics global macro models and analysts expectations.

Deloitte us | audit, consulting, advisory, and tax services

Japan General Government Gross Debt To Gdp 2021 Data 2022 Forecast

Is The Us The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

2

Corporate Tax Reform In The Wake Of The Pandemic Itep

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995-2020 Historical Chart

House Democrats Tax On Corporate Income Third-highest In Oecd

Corporate Tax 2021 Laws And Regulations Japan Iclg

Corporate Tax Trends In Europe 2018-2021 Tax Foundation

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Cayman Islands Corporate Tax Rate 2021 Data 2022 Forecast 2005-2020 Historical

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006-2020 Historical

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Material On Individual Income Taxation Ministry Of Finance

2022 Tax Plan - Outline Of Corporate Income Tax And Dividend Witholding Tax

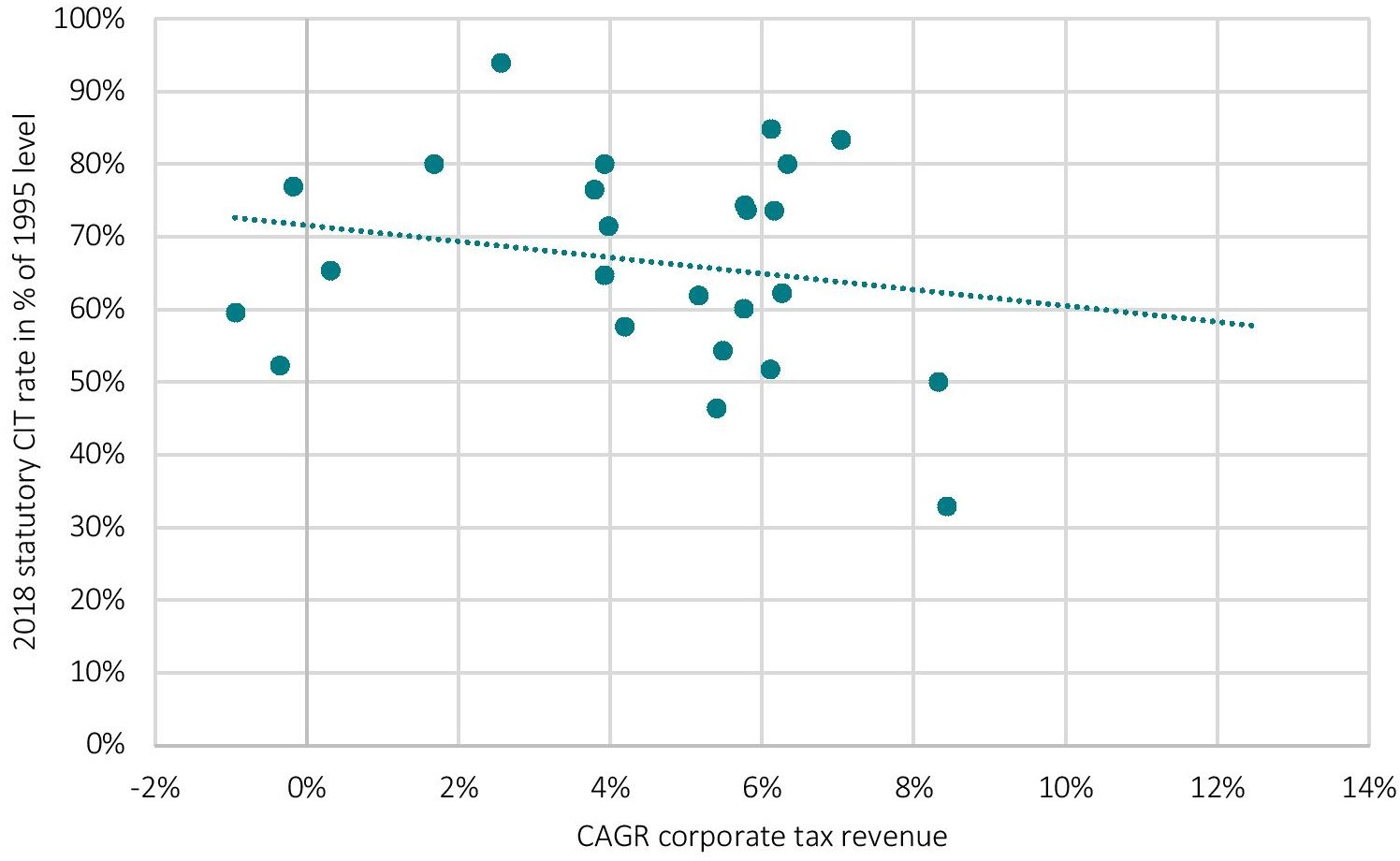

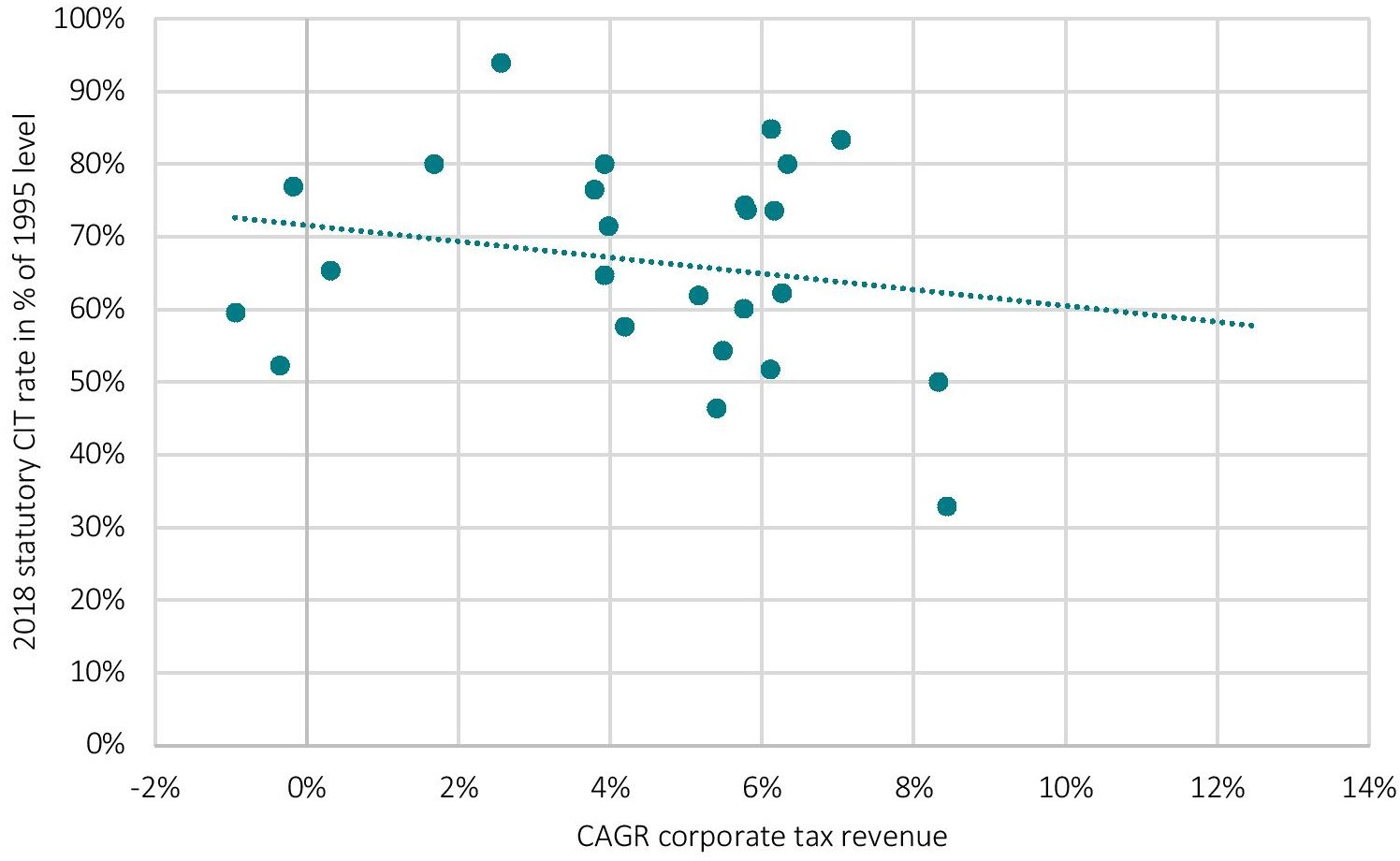

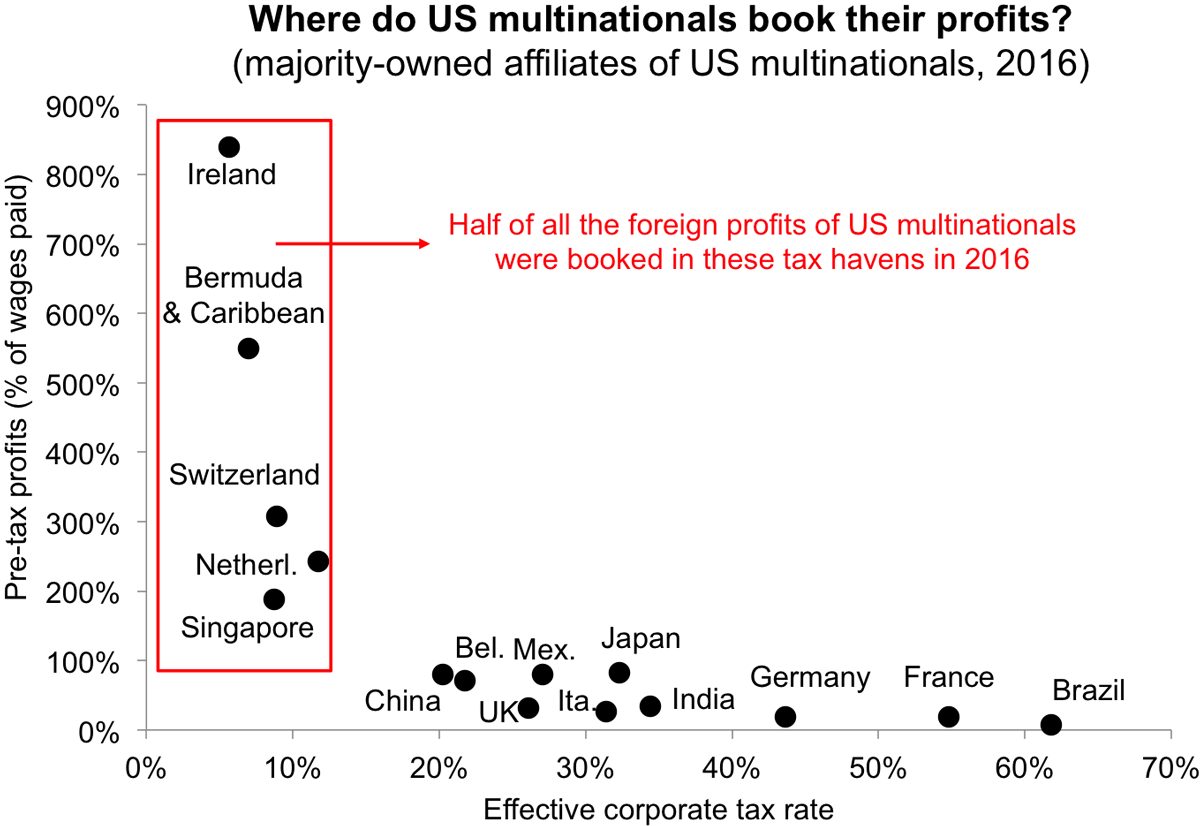

Taxing Multinational Corporations In The 21st Century - Economics For Inclusive Prosperity

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000-2020 Historical Chart

Corporate Tax Reform In The Wake Of The Pandemic Itep

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021- 2022 Shimada Associates