Nanny Tax Calculator Gtm

Use gross/net to estimate your federal and state tax obligations for a household employee. East wind nannies has over ten years experience helping families find professional care.

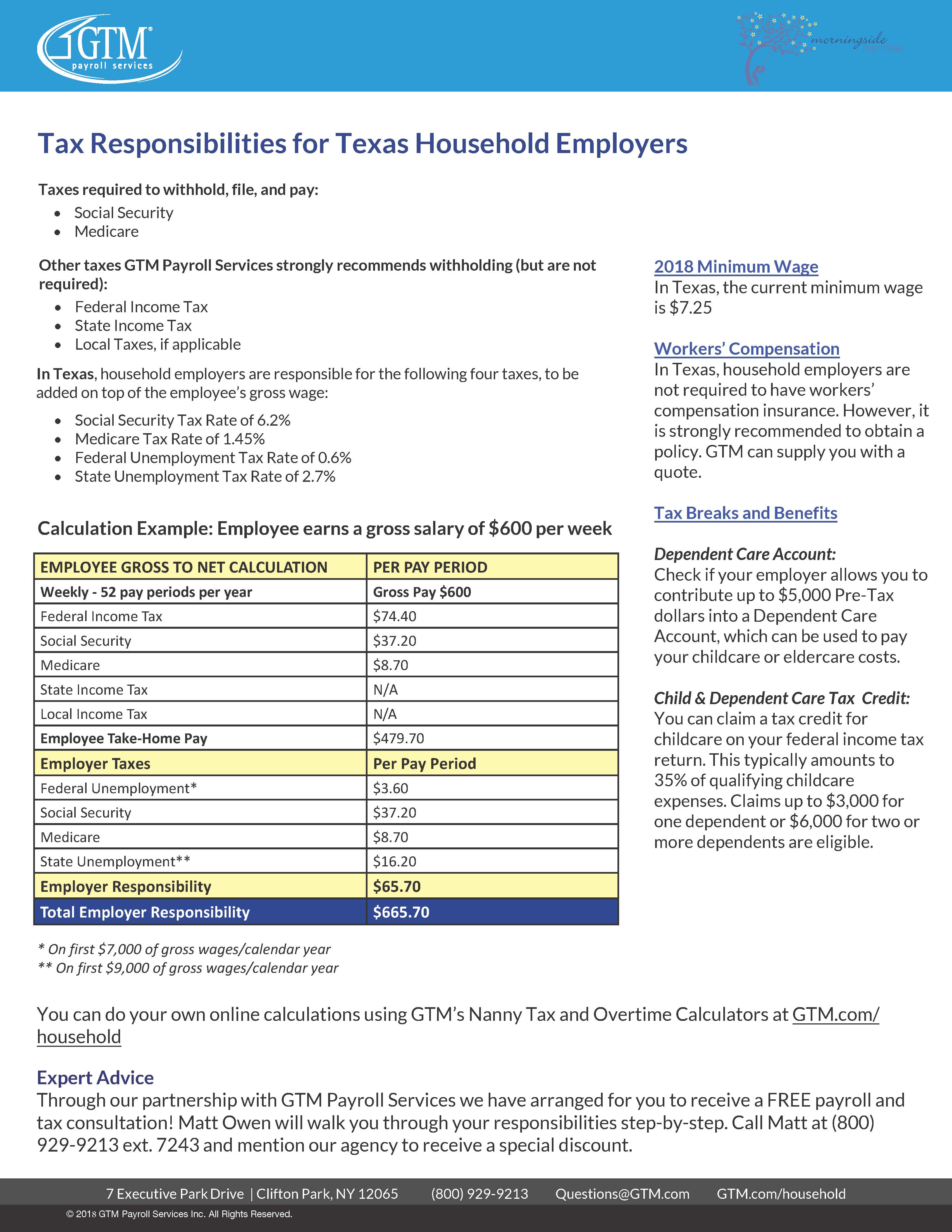

2018 Nanny Tax Responsibilities

However, benefits such as room and board can account for a portion of that wage.

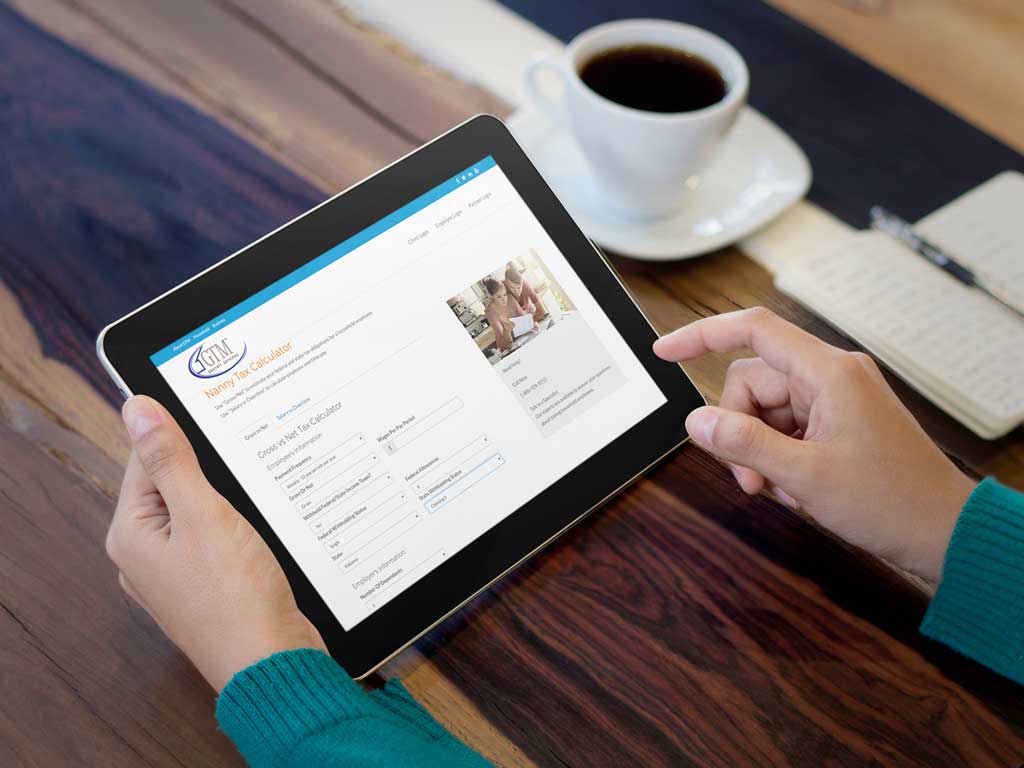

Nanny tax calculator gtm. Use a nanny tax calculator when budgeting for a nanny to figure out your total employer responsibility (wages and employer taxes) and how much you can save through an fsa and the child and dependent care tax credit. This calculator is intended to provide general payroll estimates only. Understanding nanny taxes you will likely need to pay nanny taxes if you employ someone to work in your home and they make $2,300 or more in gross wages in 2021.

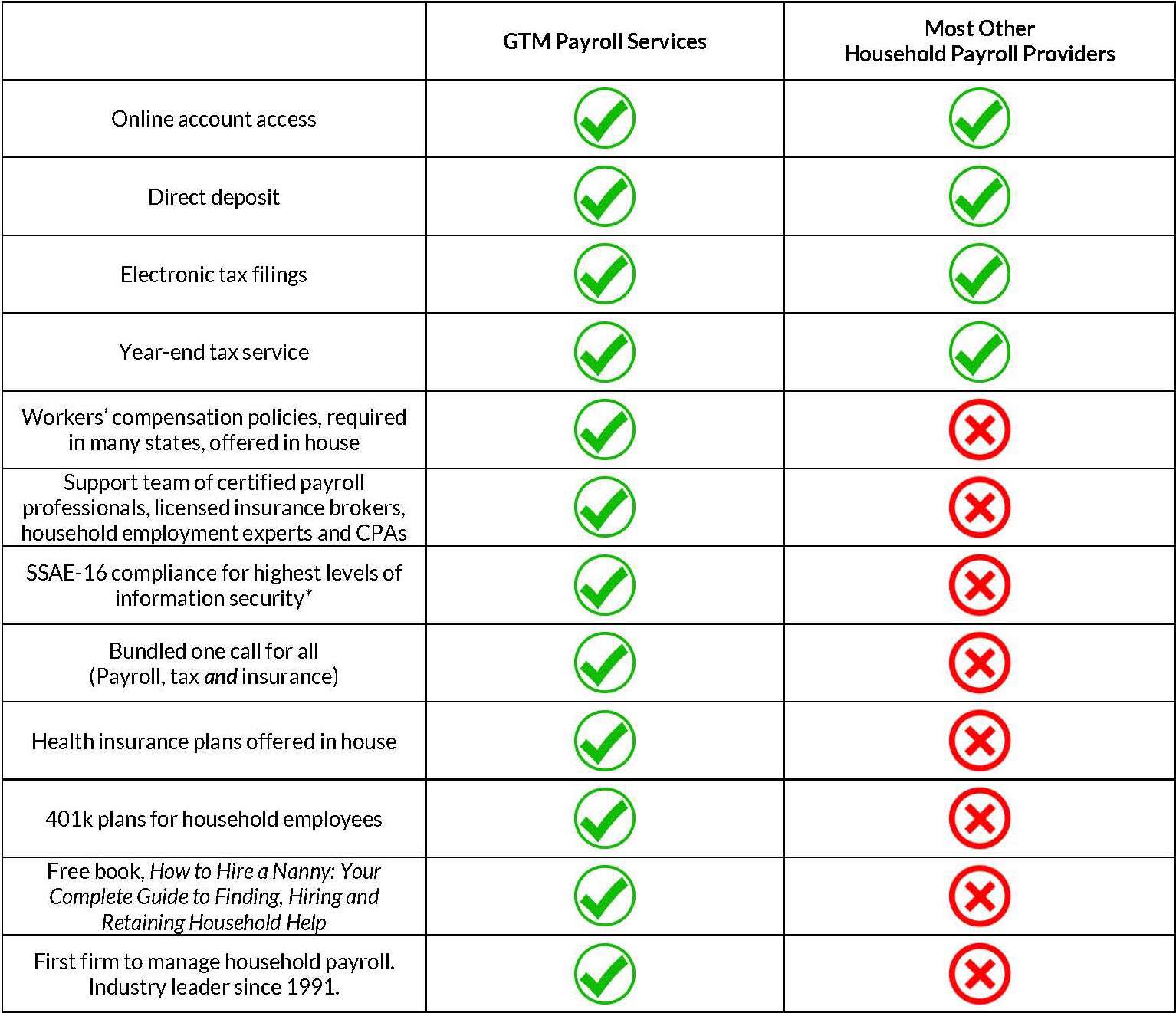

Household payroll & nanny tax compliance services. Our certified, licensed experts provide the trusted advice you need to make the best decisions for your household and your home. We provide our families with information about the nanny tax requirements and offer free setup to all our clients who choose to utilize our partner gtm payroll services.

Nanny/household employee payroll & tax services. The maximum total amount of the credit is $4,000 (50 percent of $8,000) if you have one qualifying person and $8,000 (50 percent of $16,000) if. We specialize in the pittsburgh and columbus markets as well as the surrounding areas.

Therefore, the family is responsible for paying the nanny’s wages and any applicable taxes. Use our nanny tax calculator to help your nanny determine what his/her nanny taxes will be. Using the hmrc calculator to calculate your grant entitlement.

Gtm provides all of the services you need, from a variety of health, dental, and vision insurance packages to workers’ compensation insurance to retirement plans. Gtm is a premier payroll agency and knows all the ins and outs of paying household employees properly. Child and dependent care tax credit.

In 2021, the maximum amount of childcare expenses (like wages paid to a nanny) you can put toward the child and dependent care tax credit is $8,000 for one child and $16,000 for two or more children. Calculate your nanny’s tax withholdings. The government have created a simple easy to use calculator which will give you and instant grant entitlement calculation so that you can get paid your grant entitlement quicker.

Gtm has a singular focus: Hsw will handle the entire setup and ongoing management of your tax accounts for you. The maximum percentage of your expenses allowed as a credit for 2021 is 50% (so $4,000 for one child and $8,000 for two or more children).

For more information on how gtm’s domestic payroll service please visit the link below. Please feel free to use this tool as a guide to estimate what your nanny will bring home after taxes and what your tax liability may be each payroll period. Whether you employ a nanny, babysitter, caregiver, housekeeper or personal assistant, our service helps you save time and comply with the law.

Backed by an exceptional team of women. Free tools to calculate withholding payroll taxes, minimum w. Get an estimate of your employee’s taxes, the taxes that you owe as the employer, and your tax breaks household employers tax guide & information.

They will show how doing payroll the right way benefits you and your caregiver, and will answer your questions. Step 4 using the hmrc calculator to calculate your grant entitlement. Enter your caregiver's payment info.

Plus, you can convert gross and net pay as well as salary to. Homework solutions nanny tax calculator. Link to payroll tax calculator below you will find a link to gtm’s handy payroll calculator.

Nanny taxes are all we do. When filing your 2021 taxes, you can claim up to $8,000 of qualifying child care expenses (such as your nanny’s pay) for one child or $16,000 for two or more children. Unlimited email, phone, and web chat support.

My household managed proudly partners with gtm payroll services. Payroll & tax resources gtm payroll services. Gtm’s nanny payroll service features our professional expertise in tax compliance, household payroll processing, insurance, and an unparalleled level of customer support.

Gtm has been an industry leader in domestic payroll for the last 30 years, helping. Let us simplify your life with a complete solution for all your nanny payroll needs. You must withhold 7.65 percent of their wages for social security and medicare (fica) taxes.

Gtm makes nanny tax and payroll easier. Secure online access to manage your payroll and tax accounts as a partner, client or employee of a gtm client. Gtm's household tax and payroll experts are available to answer your questions about paying nanny taxes, managing payroll, workers' compensation and other requirements.

Nanny Payroll Service Comparison - Gtm Payroll Services

Breaking The Barriers To Legal Pay Nanny Magazine

Gtm Payroll Services Inc - How To Compensate Your Nanny Facebook

Tax Calculator For Families Of Find The Right Nanny Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

/Priamry_Image-ab6539b746054bc2899c98b91ed227ae.jpg)

The Best Nanny Payroll Services For 2021

Nanny Payroll Service Comparison Gtm Payroll Services And Homepay

Nanny Tax Calculator Gtm Payroll Services Inc

What Everyone Must Know About A Nanny Tax Calculator -

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Gtmcom At Wi Gtm Payroll Services - Tax Payroll Insurance And Hr

Paying Your Employee - Charlottes Best Nanny Agency

The No Stress Way To Stay Compliant

Tax Calculator For Families Of Boston Nanny Centre Gtm Payroll Services Inc

Tax Calculator For Families Of Nannies On The Go Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculator Gtm Payroll Services Inc

Free Household Employment Resources Gtm Payroll Services

5 Answers You Need When Using A Nanny Tax Calculator