San Francisco Payroll Tax And Gross Receipts

Proposition f fully repeals the payroll expense tax and increases the gross receipts tax rates across most industries while providing relief to. Over the next few years, the city will phase in the gross receipts tax and reduce the payroll expense tax.

San Franciscos New Local Tax Effective In 2022

Proposition f fully repeals the payroll expense tax and increases the gross receipts tax rates across most industries while providing relief to.

San francisco payroll tax and gross receipts. The rules surrounding the san francisco payroll expense and gross receipts taxes, as well as the city’s new economic nexus standard, are unique and complex. 6 the passage of proposition f fully repeals the city’s payroll expense tax, which has existed in. The additional tax would either increase the gross receipts tax or the administrative office tax, whichever applies to that business and is effective january 2022.

Some of the same companies sued san. Consideration should be given as to whether a filing obligation exists and how payroll expenses and gross receipts should be. That’s because san francisco asks businesses to calculate their gross receipts tax burden in part on the portion of their overall payroll that’s earned in the city.

The ordinance replaces the existing payroll expense tax on the privilege of doing business in san francisco with a tax To avoid late penalties/fees, the returns. Gross receipts and payroll taxes.

And • 1% tax on gross receipts from the lease of warehouse space. Businesses with more than $260,000 in san francisco payroll need to pay taxes to san francisco. The 2018 payroll expense tax rate is 0.380 percent.

The city began making the transition to a gross receipts tax from a payroll tax (based on wages paid to employees) in 2014. San francisco businesses are also subject to annual registration fees based on san francisco gross receipts for the immediately preceding tax year. The current due date for the city of san francisco payroll expense tax and gross receipts tax statement is february 28.

Rents tax.6 unlike manhattan, san francisco’s commercial rents tax will be imposed on the landlord, not the tenant.7 gross receipts from a lease (or sublease) will be taxable at the following rates:8 • 3.5% tax on gross receipts from the lease of commercial space; Annual business tax returns (2020) the san francisco annual business tax returns include the gross receipts tax, payroll expense tax, administrative office tax , commercial rents tax and homelessness gross receipts tax. First enacted in 2014, the gross receipts tax (grt) is imposed on the amount of a taxpayer’s gross receipts that are sourced to san francisco.

For the gross receipts tax (gr), we calculate 25% of your projected tax liability for 2021 by applying the the gross receipts tax rates and small business exemption for 2021 to the san francisco gross receipts you entered in the annual business tax returns for 2020. Under the general rule, the registration fee is $90 for businesses with less than $100,000 in receipts, which increases to $35,000 for businesses with more than $200 million in gross receipts. In essence, it was decided that levying the gross receipts and payroll taxes against different firms simultaneously was unconstitutional.

However, because the last day of february falls on a weekend this year, the deadline has been extended to monday, march 2. San francisco’s gross receipts tax (grt) is calculated based on individual employees’ time spent in sf. Businesses operating in san francisco pay business taxes primarily based on gross receipts.

Gross receipts tax and payroll expense tax. For context, in 2012, san. If your 2020 gross receipts were less than $2,000,000, you do not have to pay any estimated payments for 2021.

San francisco voters passed proposition f, a business tax overhaul package that phases out the city’s payroll tax and increases the city’s gross receipts tax. Businesses with more then $1 million in gross receipts need to pay taxes to san francisco. Gross receipts tax (gr) proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021.

One or the other would be allowed, but it is illegal to do both. 50% less time in the city may mean a 50% reduction in tax owed. Lean more on how to submit these installments online to comply with the city's business and tax regulation.

The grt is based on a taxpayer’s city receipts for each calendar year, regardless of the taxpayer’s fiscal year end. San francisco imposes a payroll expense tax on the compensation earned for work and services performed within the city. Payroll expense tax (py) proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021.

Changes in san francisco gross receipts tax what to expect for tax season the gross receipts tax and business registration fees ordinance, or simply “ordinance,” was approved by san francisco voters on november 6, 2012. The progressive tax rate ranges between 0.1% to 0.6% and is assessed on gross receipts sourced to san francisco as determined for gross receipts tax purposes. 5 the current payroll expense tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the city in 2018.

What is the san francisco gross receipts tax? San francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons “engaging in business” within the city. Pay online the payroll expense tax and gross receipts tax quarterly installments.

W10 Form J10 Visa Five Reasons Why W100 Form J10 Visa Is Common In Usa In 2021 W2 Forms Tax Forms Filing Taxes

Will Your Stimulus Check Come Out Of Your 2020 Tax Return Report Answers The Question - Pennlivecom Checks Social Security How To Plan

2 Trillion Stimulus Deal Reached - 19 Things You Need To Know About Your Check Money Template Ways To Get Money Payroll Template

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

10 Simple Invoice Templates Every Freelancer Should Use Freelance Invoice Template Invoice Template Invoice Format In Excel

Overpaid Executive Gross Receipts Tax Approved Jones Day

Annual Business Tax Return Treasurer Tax Collector

San Francisco Gross Receipts Tax Clarification

Annual Business Tax Return Treasurer Tax Collector

Loaner Car Agreement Template Free Printable Templates Printable Free Payroll Template Agreement

Due Dates For San Francisco Gross Receipts Tax

Pin By Ava Cat On Urban Planning Data Viz Budgeting City Urban Planning

Supes Move Closer To Agreement With Breed Over Gross Receipts Tax Measure - The San Francisco Examiner

Gross Receipts Tax And Payroll Expense Tax Sfgov

Working From Home Can Save On Gross Receipts Taxes Grt - Topia

Instructor Invoice Word Format Free Templates Templates For Invoices How To Make The Simple Templates Fo Invoice Template Templates Templates Free Download

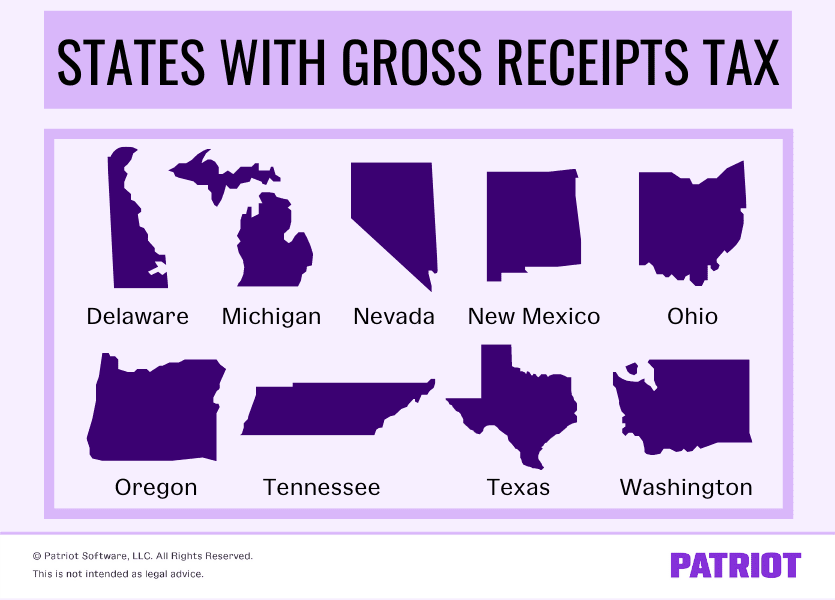

What Is Gross Receipts Tax Overview States With Grt More

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco Gross Receipts Tax