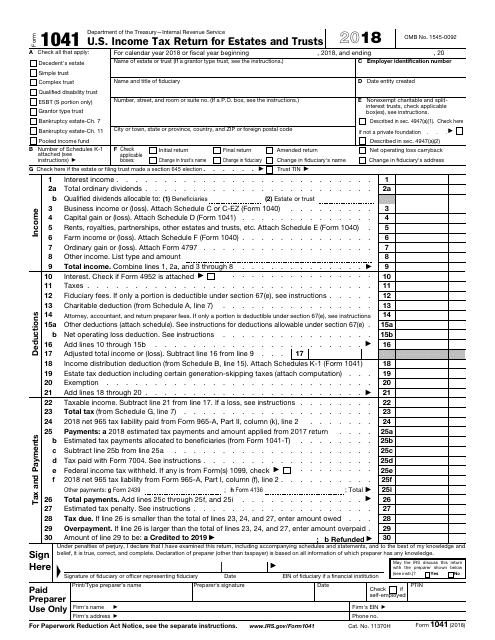

Estate Tax Return Due Date 1041

15th day of the 4th month after the close of the trust’s or estate’s tax year: (this is correct, but we did not need to file an estate tax return in 2020.) i propose to input all info as 2021 data & manually change these two dates on the form 1041 after printing it out.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation-skipping Transfer Tax Return Definition

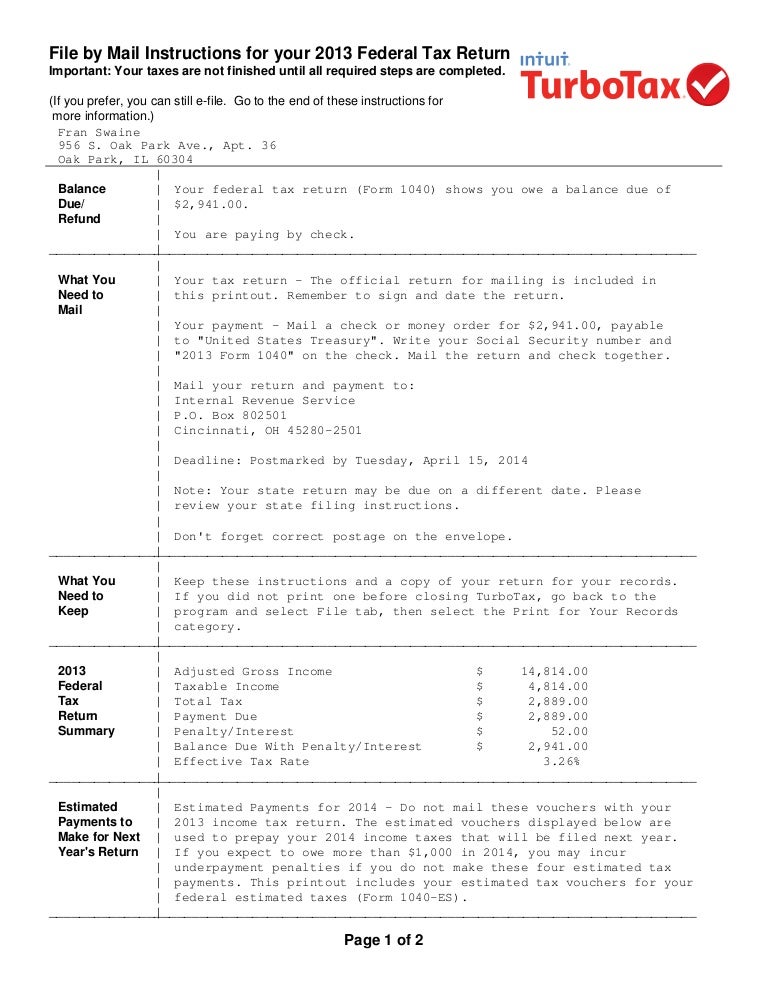

Apr 21 2020 the due date for filing many tax forms has been postponed to july 15 2020.

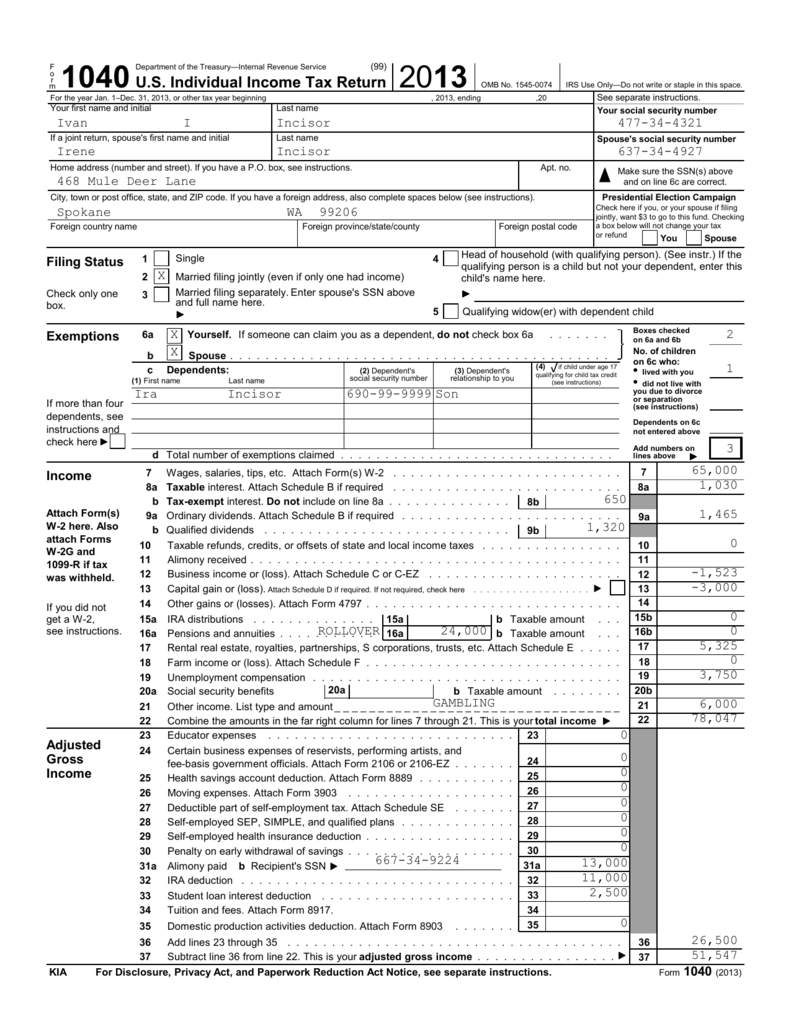

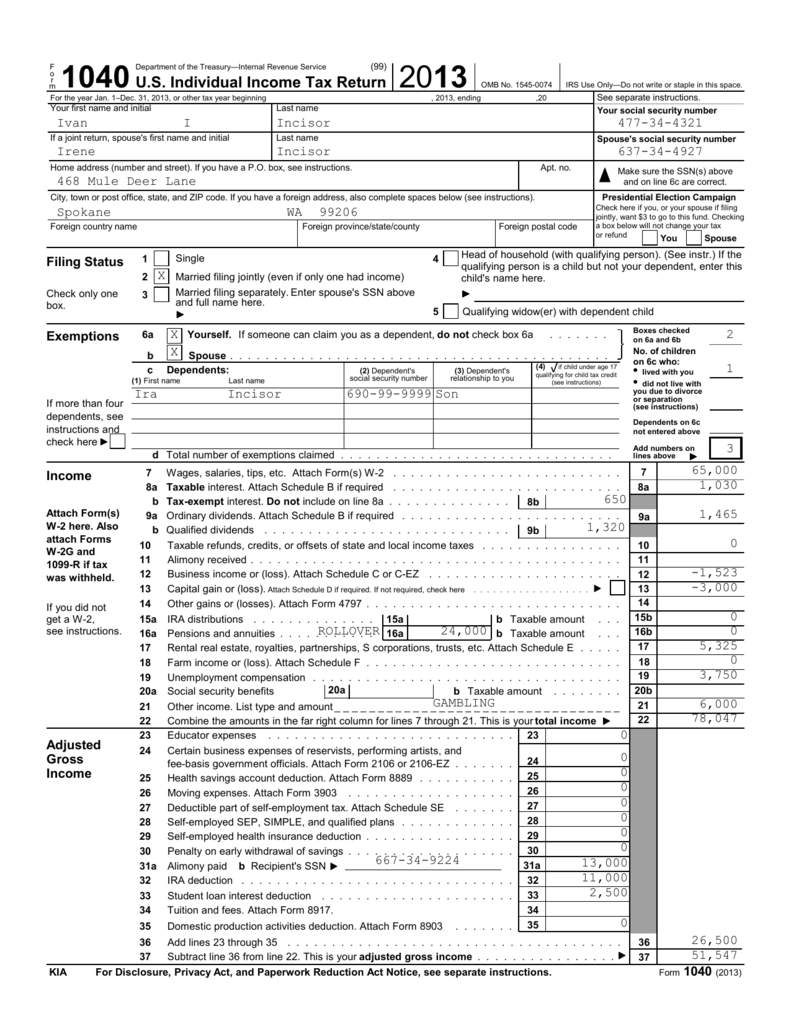

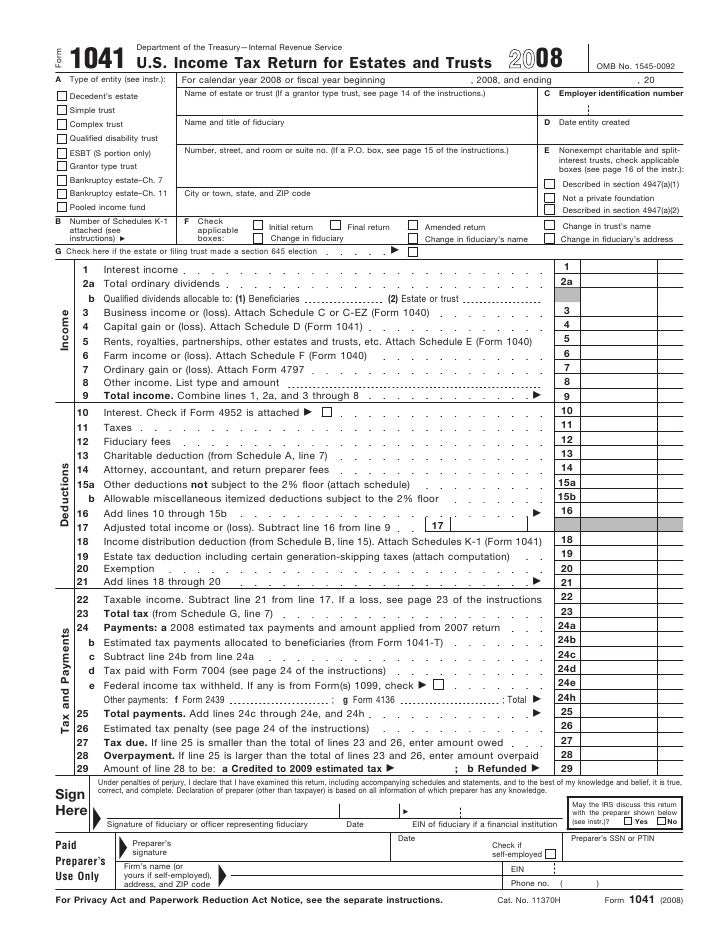

Estate tax return due date 1041. More assistance with filling out a form 1041 for an estate That is different than the estate tax return which is form 706. Normally you are supposed to file your u.s.

Form 7004 is an irs extension form that gives businesses, trusts, and estates more time on a variety of different income tax returns. For other forms in the form 706 series, and for forms 8892 and 8855, see the related instructions for due date information. For estate purposes, irs form 1041 is used to track the income an estate earns after the estate owner passes away and before any of the beneficiaries receive their designated assets.

For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Trusts and estates operating on a calendar year are required to file form 1041 by april 15, 2021. When to file the gift tax return is due on april 15th following the year in which the gift is made.

It’s due on april 15 of the following year, or on the fifteen day of the. Federal estate tax returns are due no later than 9 months after the deceased person’s date of death. 15th day of the 4th month after the close of the trust’s or estate’s tax year:

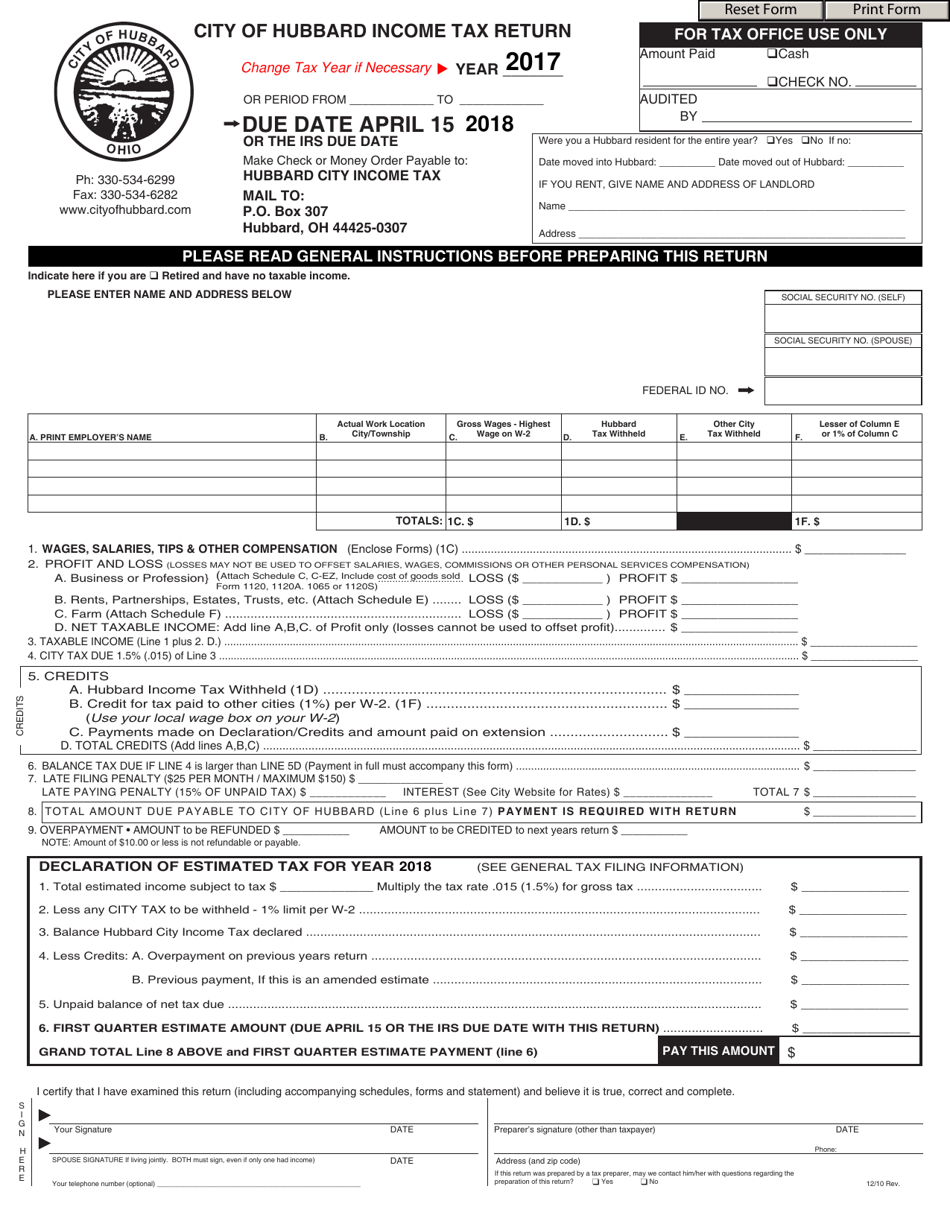

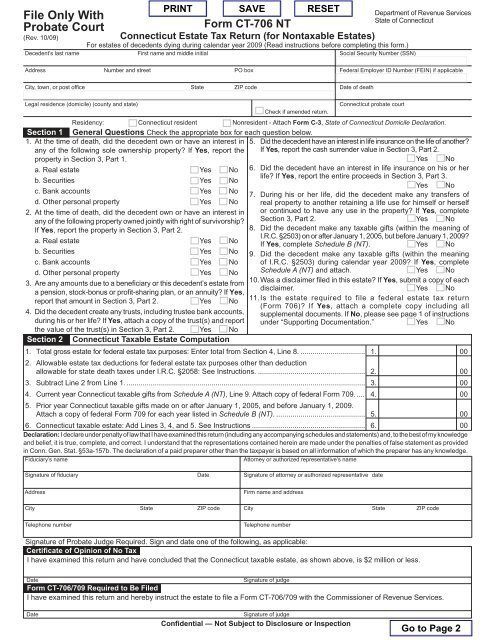

Estate and trust income tax payments and return filings on: Form 4768 must be filed on or before the due date for form 706, or for the equivalent form for a given estate. California income tax return for the estate.

The due date will vary for organizations operating in the fiscal tax year. Just need to explain for calendar year estates and trusts file form 1041 and schedule s k 1 on or before april 17 2018 for fiscal year estates file form 1041 by the 15th day of the 4th month following the close of the tax year for example an estate that has a tax year that ends on june 30 2018 must file form estate or trust 1041 return due date taxact. For businesses operating on the calendar tax year, the due date is april 15, 2021.

Also 26 usc §441(e) also answers this same. In general form 8855 election to treat a qualified revocable trust as part of an estate must be filed by the due date for form 1041 for the first tax year of the related estate. Typically, the estate calendar year starts on the day of the estate owner’s death and ends on dec.

The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. 31 of the same year. Refer to irs form 706.

Please note that the irs notice cp 575 bthat assigns an employer id number (tax id number) to the estate will probably say that the form 1041 is due on april 15. Filing form 4768 automatically gives the executor of an estate or the trustee of a living trust an additional six months to file a tax return. Updated for tax year 2018.

Form 1041 is used to report income taxes for both trusts and estates. Form 1041 is due by the 15th day of the fourth month following the end of the tax period. There is an important distinction regarding the timeline of filing form 1041.

Find your due date here. What is the due date for filing form 706 for an estate? However, the new extension deadline is 5½ months from that date, or sept.

Income tax return for estates and trusts by the 15th of april. For fiscal year estates, file form 1041 by the 15th day of the 4th month following the close of the tax year. A franchise tax board form 541 california fiduciary income tax return must be filed by the estate or trust having net income of $100 or more, or gross income of $10,000, regardless of net income, or that has an alternative minimum tax liability.

Tt business filled in the 1041 estate beginning date to be the death date in april 2020, and the end date to be dec 31, 2020. 18 the estimated tax should be paid by that date as well. That being said, if you aren’t ready to meet the form 1041 deadline, you can request an extension with form 7004.

Of particular significance in the trusts and estates area is the new extension deadline date for filing trust and estate form 1041. More help with filing a form 1041 for an estate When is form 1041 due?

13 rows only about one in twelve estate income tax returns are due on april 15! The standard filing deadline remains april 15 (april 18 for 2017 due to a weekend and holiday). When is form 1041 due?

Irs publication 559 states, “the estate’s first tax year can be any period that ends on the last day of a month and does not exceed 12 months.” so unfortunately, the estate will have to have a january 31st year end, and a second 1041 tax return will have to be filed for the activity in february. The information stating the length of the extension is outlined in the form 7004 instructions. The extension request will allow a 5 1/2 month extension for form 1041 which will make the due date september 30, 2021.

Do i file a 706 or 1041? For help in determining when tax returns are due for a deceased individual in a particular year, read the irs instructions. The estate tax year is not always the same as the traditional calendar tax year.

Irs Form 1041 Download Fillable Pdf Or Fill Online Us Income Tax Return For Estates And Trusts - 2018 Templateroller

Using Form 1041 For Filing Taxes For The Deceased Hr Block

Turbo Taxreturn

Prepare Federal And State Usa Income Tax Return By Naatservices Fiverr

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

City Of Hubbard Ohio Income Tax Return Download Fillable Pdf Templateroller

Estate Income Tax Return - When Is It Due

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Form 1040 Individual Income Tax Return Form Form 1041 Us Income Tax Return For Estates And Trusts United States Tax Forms 20162017 Form 1040ez Income Tax Return Stock Photo - Download Image Now - Istock

Form 1040 Individual Income Tax Return Form Form 1041 Us Income Tax Return For Estates And Trusts United States Tax Forms 20162017 Form 1040ez Income Tax Return Stock Photo - Download Image Now - Istock

Understanding The 1065 Form Scalefactor

Us Individual Income Tax Return

31114 Income Tax Returns For Estates And Trusts Forms 1041 1041-qft And 1041-n Internal Revenue Service

Ct-706709 Nt Connecticut Estate Tax Return For - Ctgov

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

Us Tax Return Filing For Us Citizen Or Non-resident Usa Expat Taxes

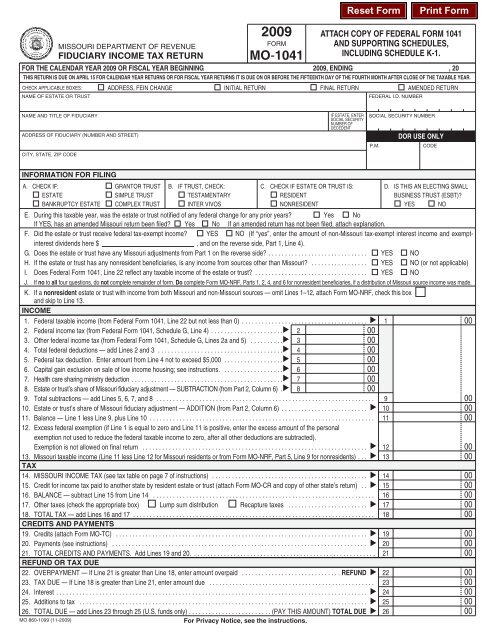

Mo-1041 Fiduciary Income Tax Return - Missouri Department Of

Form 1041 Us Income Tax Return For Estates And Trusts Form 1041