Will Capital Gains Tax Rate Increase In 2021

There are exceptions to this, such as when it was 15% from 2004 to 2012. Joe biden says this tax increase funds a 1.8 trillion dollar plan to fund education and childcare.

Can Capital Gains Push Me Into A Higher Tax Bracket

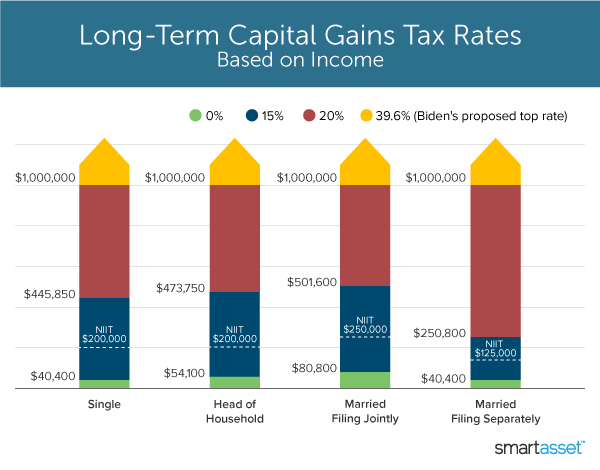

The niit can boost the effective federal tax rate on some capital gains above 40% in 2021 even if no tax legislation is enacted.

Will capital gains tax rate increase in 2021. Gains realized after that date would be taxed at a top rate of 25% for folks earning more than. The proposal is bumping this up to 39.6%. In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year.

A summary can be found here and the full text here. This has canada speculating, again, if a hike to the capital gains inclusion rate. Concerns that the tax law could change—and specifically that capital gains taxes will increase—is pushing investors to sell properties before the clock strikes 2022.

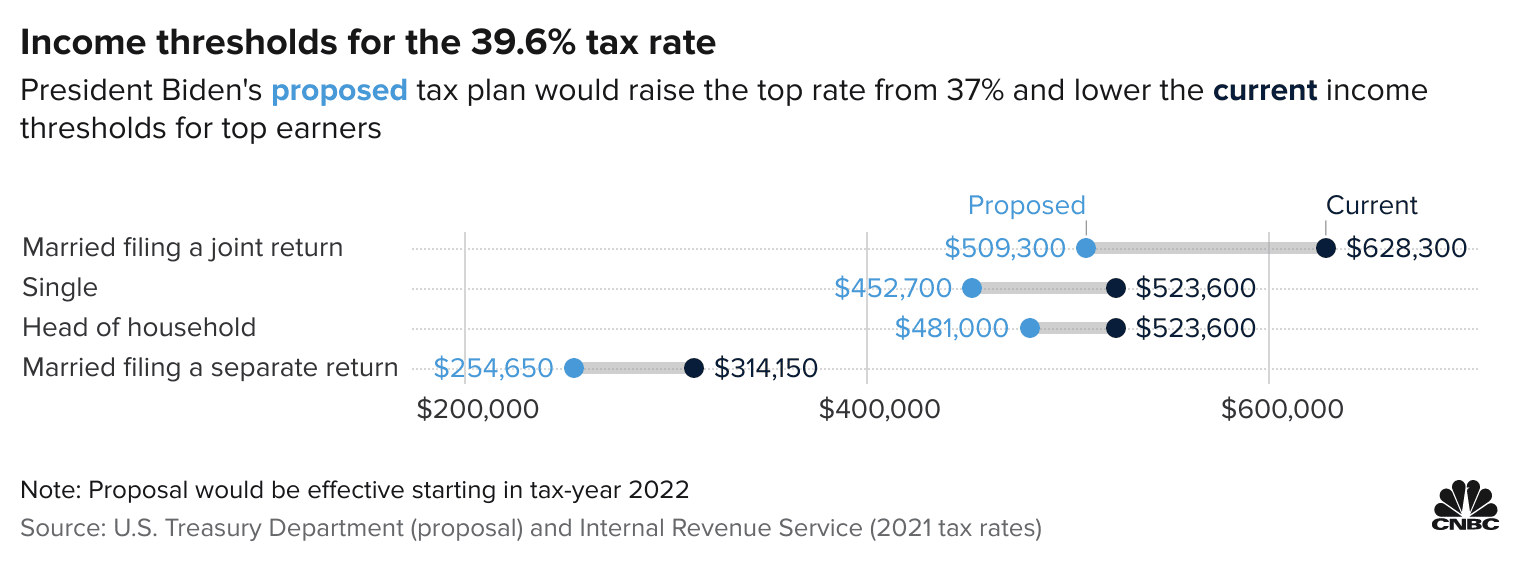

The proposal is bumping this up to 39.6%. Increasing the capital gain inclusion rate may be one tax change the canadian government could consider in order to boost tax revenues. Additionally, a section 1250 gain, the portion of a gain on a sale that.

Historically, capital gains tax has sat around 20%. The effective date for this increase would be september 13, 2021. And, when you add in.

The chancellor will announce the next budget on 3 march 2021. Currently, the capital gains tax rate for wealthy investors sits at 20%. There is a change on the horizon, which can take place as soon as 2022.

See more tax changes and key amounts for the 2021 tax year; This means that some investors face a tax responsibility as high as 43.4%, reversing a historic provision of the tax code that taxed investment income less than the income. November 18, 2021 by brian a.

The proposal would increase the maximum stated capital gain rate from 20% to 25%. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. Currently, the capital gains tax rate for wealthy investors sits at 20%.

“a lot of sellers aren. Tax base, improving tax enforcement and levying new taxes. Under the current proposal, “gains realized prior to sept.

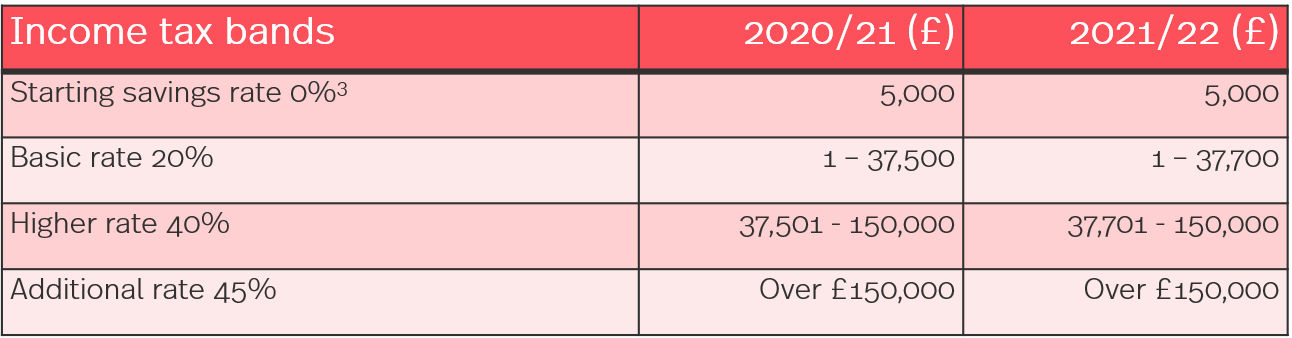

The rates do not stop there. For reference, the table below breaks down the tax rates and income brackets for tax year 2021. The house ways and means committee released their tax proposal on september 13, 2021.

Assuming you own $75,500 worth of bmo shares in your tfsa, your quarterly. We've got all the 2021 and 2022 capital gains tax rates in. Bmo also outperforms the tsx, thus far, 2021 (+36.6% versus +19.35).

To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate. 13 will be taxed at top rate of 20%; One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.[9] president biden’s budget proposal suggested raising the rate on such capital gains to 43.4 percent for households with income over $1 million, effective for all sales on or after april 2021.

Still another would make the change to capital gains tax retroactive, with a start date of april.

What You Need To Know About Capital Gains Tax

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

Biden Budget Reiterates 434 Top Capital Gains Tax Rate For Millionaires

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Whats In Bidens Capital Gains Tax Plan - Smartasset

House Democrats Tax On Corporate Income Third-highest In Oecd

Capital Gains Tax 101

Rethinking How We Score Capital Gains Tax Reform Bfi

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

What You Need To Know About Capital Gains Tax

25 Percent Corporate Income Tax Rate Details Analysis

How To Pay 0 Capital Gains Taxes With A Six-figure Income

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Bidens Proposed 396 Top Tax Rate Would Apply At These Income Levels

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe