Tax Forfeited Land Mn Hunting

8 requires 3% of the purchase price be collected for the tax forfeited land assurance fund. Total state payments have increased substantially since the.

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise

How do you tax forfeited land?

Tax forfeited land mn hunting. But finding a great place to hunt is often as challenging as the actual hunting itself. That the sale will be. In those instances, the dnr may provide advice or recommendations to the counties.

I've tried to buy tax forfeited land with no luck from the county, from time to time the do sell some parcels but usually in town so someone will build a house and raise the tax base. What is happening is private land ownership is decreasing and state/fed land ownership is increasing. Twenty five dollars ($25) will be collected for a state deed and 0.33% of the purchase price (minimum $1.65) will cover the state deed tax.

3% assurance fee, $25 state deed fee, $46 recorder fee, 0.33% deed tax if over $500 or $1.65 if $500 and under. Payment rates and allocations vary by land class. If you would like to participate, please send you contact information to forestry@co.lake.mn.us to receive future notifications regarding land sales.

Tax forfeited land sale list current as of: What fees are involved with purchasing forfeited land? Tax forfeited lands are lands whose title has been acquired by the state of minnesota due to non payment of property taxes.

Parcels of land forfeited to the state of minnesota for nonpayment of taxes, which have been classified and appraised as provided by law, shall be sold to the highest bidder. For over a century, the citizens of minnesota have authorized the government and the courts to confiscate a taxpayer's real property, as a last resort, in order to compensate the taxing districts for lost revenue due to delinquent real property taxes. November 29, 2021 deeds for the following platted parcel(s) will not contain a restrictive covenant which will prohibit enrollment of the land in a state funded program providing compensation for conservation of marginal land or wetlands.

There are no current land auctions at this time. These auctions are usually held in late summer/early fall. Unsold parcels are available over the counter following the same terms of sale (pdf) approved by the becker county board of commissioners.

Minnesota hunters are fortunate that the search is not nearly as difficult as it is in many states, where public land is rare. You can hunt tax forfeited land, i do too. For over a century, the citizens of minnesota have authorized the government and the courts to confiscate the taxpayer's real property, as a last resort, in order to compensate the taxing districts for lost revenue due to delinquent real property taxes.

Please be aware that other members of the public. Minnesota is a hunting paradise thanks to millions of acres of public hunting land. Most tax forfeited land is open to the public for hunting, fishing, hiking, camping and other forms of dispersed recreation.

Any lands not sold, at any time following the closing of the sale, may be sold by the county auditor. All information regarding public land sales will be posted to this. Yes, hunting is permitted in accordance with all state dnr rules and regulations.

We have tax forfeit land surronding our 80 acres up in superior national forest near orr and offered to buy a couple 40's from the state. The most commonly hunted public lands in minnesota are state wildlife management areas (wmas), state forests, national. I believe it's owned by the county which is actually the people of the county.

Those changes have been incorporated into the This classification assists in establishing primary management directions for the land. That the basic sale price of each parcel included on the attached list be approved and authorization for a public and /or private sale of this land be granted, pursuant to the minnesota statute 282;

Our goal is to return these lands to productive use on the local tax rolls. Lake county regularly sells some tax forfeit/county fee lands by auction. Can i hunt on tax forfeit lands?

Becker County Selling Tax-forfeited Land Detroit Lakes Tribune

County Board Questions Fairness Of Hunting Cabin Leases Park Rapids Enterprise

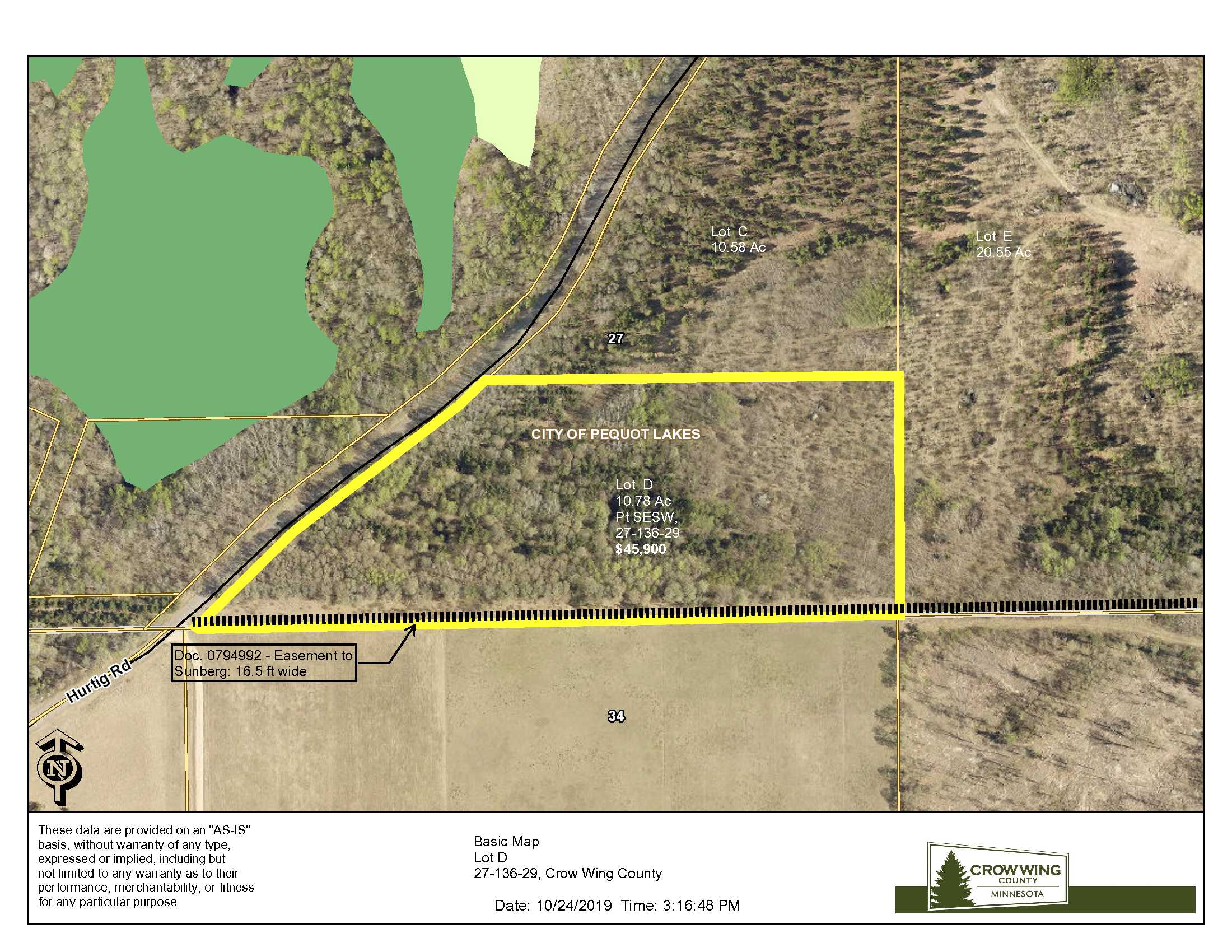

Crow Wing County Tax Forfeited Land Map - Tax Walls

Crow Wing County Tax Forfeited Land Map - Tax Walls

Cocarltonmnus

Report Finds Thousands Of Minnesota Public Acres Off Limits To The Public Echo Press

Tax Forfeited Land Lyon County Mn

County-owned Tax-forfeited Lands Can Be Impossible To Access Brainerd Dispatch

Welcome To Pine County Mn

Report Finds Thousands Of Minnesota Public Acres Off Limits To The Public Echo Press

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise

Hunting In Aitkin County

Crow Wing County Tax Forfeited Land Map - Tax Walls

Deer Hunting In Minnesota

Tax Forfeited Land Sales

Minnesota Counties Receive 363 Million In Payment In Lieu Of Taxes In 2021 Grand Forks Herald

Ideal Township Tax-forfeit Property Pulled From Land Sale Could Become A Park Brainerd Dispatch

Tax Forfeited Land Sales

20 Acres Garrison Mn Property Id 9126805 Land And Farm