Dekalb County Tax Assessor Il

Wedge property tax inquiry the information regarding assessments, sketches, and square footage is for general information purposes only and is submitted to our office by the specific township assessors. View property map, street map, land use, sales, tax, assessment, zoning, voting information.

Arguing With People About Where Upstate New York Starts Map Of New York New York County York Map

If your parcel is not listed, please go to our new property tax inquiry dashboard to find your parcel either by name, address, or pin.questions about these valuation should be directed to your township tax assessor.

Dekalb county tax assessor il. I would like to let you know a few things about myself and how i contribute to our township government. I hope you find this website informative and helpful. A message from your assessor.

The data contained here is a public record, is made available under the freedom of information act, and is maintained by the dekalb township assessor as a public service. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to. The median property tax in dekalb county, illinois is $4,267 per year for a home worth the median value of $192,300.

Below is a breakdown of the 8.00% sales tax rate: Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. The information is updated as soon as possible after changes are made to county data, and is available 24 hours a day, 7 days a week.

The installment due dates for dekalb county taxes are september 30th and november 15th. The property appraisal department is responsible for the appraisal and assessment of property. Search for the property record and click the link underneath the “pay now” button.

110 east sycamore st., sycamore, il. Johnson has held several positions within the tax office including supervisor and manager level positions over the past 21 years. Dekalb county collects, on average, 2.22% of a property's assessed fair market value as property tax.

Remember to have your property's tax id number or parcel number available when you call! Welcome to the dekalb township website! Dekalb county assessor's office services.

Property tax assessments in dekalb county are the responsibility of the dekalb county tax assessor, whose office is located in sycamore, illinois. Dekalb county property records are real estate documents that contain information related to real property in dekalb county, illinois. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property.

The median property tax on a $192,300.00 house is $2,019.15 in the united states. The dekalb county office of assessments assumes no responsibility for errors or omissions. The city receives 2.75% of the 8.00%.

The cortland township assessor, located in cortland, illinois, determines the value of all taxable property in dekalb county, il. The information regarding assessments, sketches, and square footage is for general information purposes only and is submitted to our office by the specific township assessors. The dekalb county assessor's office, located in sycamore, illinois, determines the value of all taxable property in dekalb county, il.

Dekalb county, illinois official site. You can visit their website for more information regarding property appraisal in dekalb county. 1.00% city share municipal tax.

For more information about property tax bills, select tax bill information under property tax from the services menu. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. 1.75% city share home rule tax.

Can i make a payment over the phone? The following listing include parcels that had changes and were published. The median property tax on a $192,300.00 house is $3,326.79 in illinois.

Johnson joined the dekalb county tax commissioner’s office in july 2000 as a network coordinator. Dekalb county chief assessment officer. Official publication of real estate assessments for 2021.

Dekalb county residents can sign up to receive property tax statements by email. This calculator can only provide you with a rough estimate of your tax liabilities based on the. The directory portal provides updated information of the local tax assessor and tax office for the reference of sycamore taxpayers:

The dekalb county office of assessments assumes no responsibility for errors or omissions. If you need to pay your property tax bill, ask about a property tax assessment, look up the dekalb county property tax due date, or find property tax records, visit the dekalb county tax assessor's page. If this page is not populated, contact your township assessor for the information.

If you choose to pay the full amount in one payment, it must be paid by september 30th. The sales tax rate for the city of dekalb is 8.00%. The information contained on this site was compiled from data available at the dekalb township assessor's office solely for the governmental purpose of property assessment.

Under the leadership of tom scott (deceased) and his successor, claudia lawson, mr. The dekalb county tax assessor is the local official who is responsible for assessing the taxable value of all properties within dekalb county, and may establish the amount of tax due on that property based on the fair market value appraisal. The median property tax on a $192,300.00 house is $4,269.06 in dekalb county.

Dekalb county government 200 north main street sycamore, illinois 60178. Dekalb county has one of the highest median property taxes in the united states, and is ranked 55th of the 3143 counties in order of median property taxes.

6897ac - 65 - 2 Leaf River In Jones County Mississippi Leaf River Jones County Mississippi

Georgia County Map Georgia Map Map Of Georgia Usa County Map

2

2

Morgan County Illinois Public Records Directory

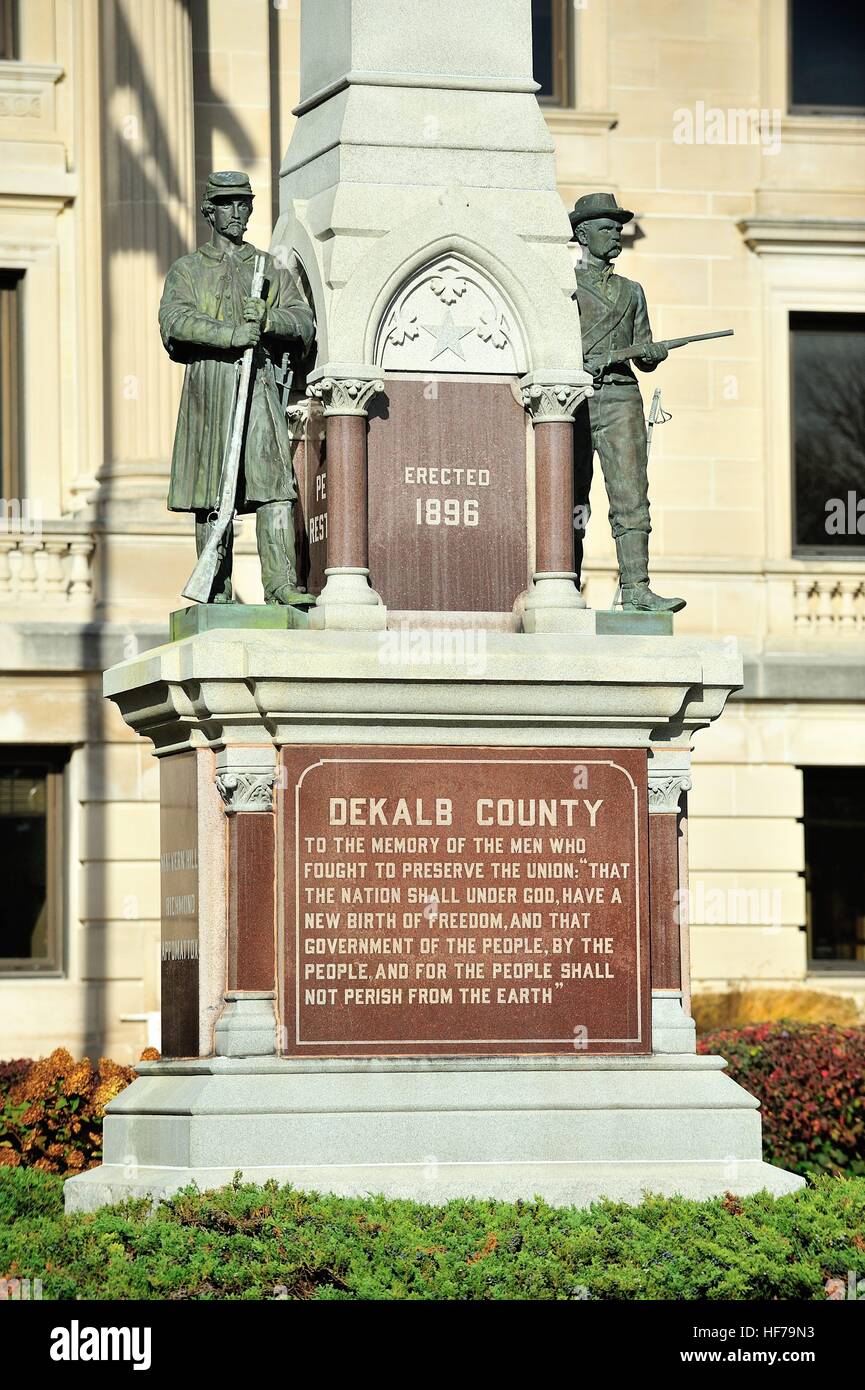

A Civil War Monument In Front Of The Dekalb County Courthouse In Sycamore Illinois Stock Photo - Alamy

Illinois Floodplain Maps - Firms

Pin On Us - Indiana Genealogy

2004jan Newsarticles - Kane County Il

Land Sales Bulletin - Accurate And Timely Land Sales Data

1180 Justine Drive Kankakee Il 60901 For Sale Homescom Renting A House Kankakee Home

Illinois Floodplain Maps - Firms

Dekalb County Illinois 1870 Map Dekalb County Dekalb Genealogy Map

Located In Mt Carmel Cemetery In Hillside Illinois Is The Grave Of The Man Who Once Ruled The City Of Chicago It Is Not T Al Capone Scary Places Cemetery

Illinois Floodplain Maps - Firms

Cook County Viewer

Home Value Report For 2442 N Surrey Ct Chicago Il 60614 View On Homescom As Well As Property Record Details Price History In 2021 Nokomis Home Values Belle Isle

Illinois Floodplain Maps - Firms

Duplin County North Carolina Ancestral Trackers Duplin County North Carolina Ancestral