Who Pays Sales Tax When Selling A Car Privately In Illinois

6.35% or 7% if the car ' s value is more than $50,000. The tax rate is based on the purchase price or fair market value of the car.

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer

Saying a “sale” is a “gift” is fraud.

Who pays sales tax when selling a car privately in illinois. You typically have to pay taxes on a car received as a gift in illinois. Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. The taxes can be different in the case of a vehicle being purchased by a private party.

When you sell a personal vehicle for less than you paid for it, there’s no need to pay tax. Sellers name, buyers name, date of sale, make/model/year of vehicle, and conditions of sale. However, the scenario is different when you profit from the sale.

However, if you bought it for $14,000 and sold it for $15,000, earning a $1,000 capital gain, you would report this on your tax return, using schedule d on form 1040 that's appropriately titled capital gains and losses. the form will instruct on you needed. Tax obligation when you buy a car through a private sale. It also depends upon the state that the car is going to, as there may be a buy car out of state tax for the vehicle's new owner to deal with.

In addition to state and county tax, the city of chicago has a 1.25% sales tax. Supply the buyer with a valid, signed, and dated title certificate at the time of sale. Exchange contact information with the buyer.

When i told them that i would rather sell it privately, they said “well, if you do that you will have to pay. In most states, you’ll need to bring your bill of sale and signed title to the department of motor vehicles (dmv) or motor vehicle registry agency to pay your taxes and obtain your registration, new title, and plates. Here’s a vehicle use tax chart.

But when it comes to selling a car, it depends on whether you make a profit or not. The car was an estate. Car sales tax is only imposed on the motor vehicles at the time of purchase and this varies by state and location.

However, you do not pay that tax to the car dealer or individual selling the car. According to the internal revenue service, the tax rate, which is based on the net capital gain, is usually no higher. If you gift a $20,000 worth of the car, you can save $1,250 on sales tax.

At the time of sale, you must provide the buyer with signed and dated certificate of title of the car. He must produce a sales receipt from you. It ends with $25 for vehicles at least 11 years old.

The tax due in is called use tax rather than sales tax, but the tax rate is the same: Car used for personal purpose will be personal effect and not treated as capital asset as per definition in section 2 (14). The receipt can be hand written and must contain:

When you purchase a vehicle through a private sale, you must pay the associated local and state taxes. You have to pay a use tax when you purchase a car in a private sale in illinois. The government views a vehicle as property, and as such, it is subject to personal property tax.

The title must be signed in the assignment of title area. For example, the illinois sales tax rate is currently at 6.25%. If you sell a vehicle to a customer who will title it in one of those states, then you must charge the customer illinois sales tax at the foreign state`s tax rate or at 6.25%, whichever is less.

However, no depreciation is admissible on personal effects. This won’t matter to the vast majority of car sales, though. Yes, you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

There is also between a 0.25% and 0.75% when it comes to county tax. When you sell your car, you must declare the actual selling/ purchase price. Because vehicles received as gifts are not subject to sales tax.

You will pay it to your state's dmv when you register the vehicle. Therefore, the profit on its sale or transfer will not be subjected to income tax. Both you and the buyer will need to complete the title assignment section.

Do you have to pay taxes on a car that's a gift in illinois? You may qualify for a tax exemption if: Assuming the private party transaction the tax amount depends on the year of the vehicle.

If you are selling a car in illinois you must follow the following steps: In such a sale, the buyer must pay the required state tax on the transaction when he or she registers the car with the department of motor vehicles. Who pays sales tax when selling a car privately in illinois?

The title must also have signed and printed names of all the buyers and sellers, certifying the odometer. So if you bought the car for $14,000 and sold it for $8,000, you would have a capitol loss of $6,000. • however, there will be an audit by the illinois department

Prepare a bill of sale for the buyer and keep a copy for yourself. Complete the notice of sale form attached to the bottom of the title and mail that in to the il secretary of state (sos). Taxes when selling a car.

The process to sell a used car out of state, like the process of buying a car in the same manner, depends somewhat upon the state in which you live. For vehicles worth less than $15,000, the tax is based on the age of the vehicle. However, you, the lessee, may be required to assume this responsibility.

A list of all the states for which you must collect sales tax and the rate you must charge can be found on the illinois department of revenue`s website. You would not have to report this to the irs. The buyer must pay $95 to the secretary of state, and a tax to the department of revenue.

In that case, you’ll owe capital gains tax on the profit you make when the vehicle is sold. There also may be a documentary fee of 166 dollars at some dealerships. The sales tax rate in illinois depends on whether the car is purchased from a private party or a dealer.

But then again, if you already own the vehicle, then gifting a car means no sales tax. Buyers must pay a transfer tax when they buy a car from a private seller in illinois although this tax is lower when you buy from a private party than when you buy from a dealer.

Should You Trade In Your Car Or Sell It Privately Autotraderca

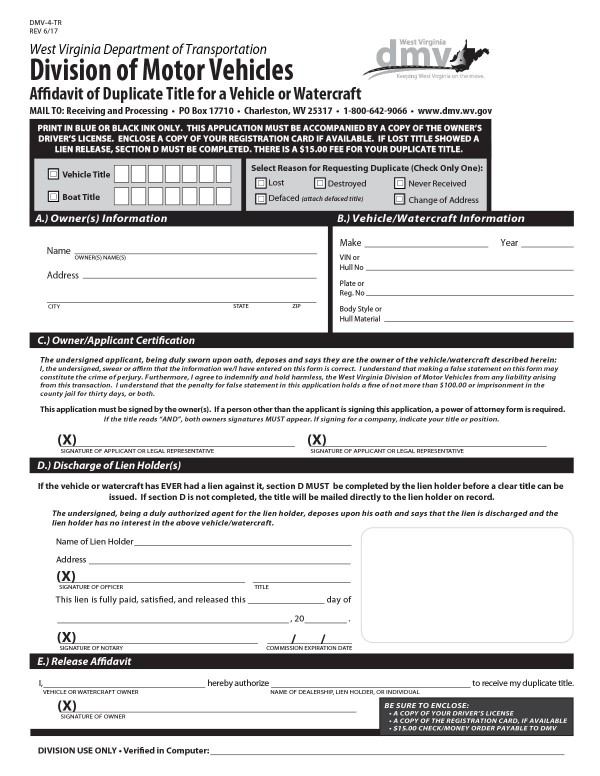

Bills Of Sale In West Virginia The Ownership Facts You Need To Know

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer

550m Santander Car Loan Class Action Website Is Active - Top Class Actions

Illinois Car Registration A Helpful Illustrative Guide

Free Vehicle Private Sale Receipt Template - Pdf Word Eforms

Free Vehicle Private Sale Receipt Template - Pdf Word Eforms

How To Register A Car In Illinois With Pictures - Wikihow

Can I Sell A Car For 0 If So On The Reassignment Of Title On The Back May I Write 000 For The Sale Price - Quora

How To Register A Car In Illinois With Pictures - Wikihow

How To Transfer A Car Title In South Carolina Yourmechanic Advice

Free Vehicle Private Sale Receipt Template - Pdf Word Eforms

Some States Allow Sales Tax Payments Via Credit Card Cpa Practice Advisor

Free Vehicle Private Sale Receipt Template - Pdf Word Eforms

Should You Trade In Your Car Or Sell It Privately Autotraderca

How To Sell Your Car - Carfax

How To Register A Car In Illinois With Pictures - Wikihow

How To Register A Car In Illinois With Pictures - Wikihow

Free Vehicle Private Sale Receipt Template - Pdf Word Eforms