Santa Ana Tax Rate 2021

In the city limits of las cruces at 2021 residential tax rate of 0.031258. How to calculate property taxes for your property.

![]()

Santa Ana California Measure X General Sales Tax November 2018 - Ballotpedia

See below for tax rates elsewhere.

Santa ana tax rate 2021. Orange county sales tax by city For tax rates in other cities, see california sales taxes by city and county. Then there’s regular state sales tax, which typically runs between 8.

The santa ana sales tax rate is %. 0.5% for countywide measure m transportation tax. Santa ana, ca sales tax rate the current total local sales tax rate in santa ana, ca is 9.250%.

Santa barbara campus rate is 7.75%)* 8.750%: , nm sales tax rate. The county sales tax rate is %.

You can also pay your unsecured property taxes on this website. The orange county sales tax is 0.25%. La habra and la palma also have higher tax rates at 8.25%.

City of los gatos 9.25%. Net taxable value * mil rate. You can print a 9.25% sales tax table here.

In the city limits of las cruces at 2021 residential tax rate of 0.031258. City of santa cruz 9.25% City of santa barbara 8.75%.

City of san jose 9.375%. Santa ana has the highest tax rate in orange county at 9.25% with fountain valley, garden grove, placentia, seal beach, stanton and westminster.5% behind at 8.75%. County 7.75% city of carpinteria 9.00%.

How 2021 sales taxes are calculated in santa ana. Santa ana pueblo, nm sales tax rate. The orange county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% orange county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 1.50% special district sales tax (used to fund transportation districts, local attractions, etc).

7.25% for state sales and use tax. County 9.125% city of campbell 9.375%. The current total local sales tax rate in santa ana pueblo, nm is 6.3750%.

The santa ana, california, general sales tax rate is 6%. 101 rows how 2021 sales taxes are calculated for zip code 92703. 1.5% for santa ana tax.

Cultivators also pay a tax based on the weight of what they sell, which in turn bumps up the retail price. See below for tax rates elsewhere. The orange county sales tax is collected by the merchant on all qualifying sales made.

You can also pay your unsecured property taxes on this website. The current total local sales tax rate in santa ana pueblo, nm is 6.3750%. City of santa maria 8.75%.

This is the total of state, county and city sales tax rates. The city of santa ana. The december 2020 total local sales tax rate was also 9.250%.

The minimum combined 2021 sales tax rate for santa ana, california is. Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate (1.5%), and in. The california sales tax rate is currently %.

The average sales tax rate in california is 8.551%. The december 2020 total local sales tax rate was also 6.3750%. Orange county, california sales tax rate 2021 up to 9.25%.

Property in orange county, ca, is taxed at a rate of 0.72 percent. The 9.25% sales tax rate in santa ana consists of 6% california state sales tax, 0.25% orange county sales tax, 1.5% santa ana tax and 1.5% special tax. Depending on the zipcode, the sales tax rate of santa ana may vary from 6.5% to 9.25%.

That applies not on the entire amount, but instead only on the gain on shares since he acquired them.

2

Bisnis Indonesia 17 Feb 2021 Pdf

2

California Stimulus Checks Santa Ana To Begin Handing Out 20000 Prepaid Visa Cards To Qualifying Residents - Abc7 Los Angeles

Information About Coronavirus The City Of Santa Ana

1422 S Rosewood Ave Santa Ana Ca 92707 Mls 21-737400 Redfin

California Sales Tax Rate Changes April 2019

Information About Coronavirus The City Of Santa Ana

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

Pdf The Influence Of Tax Understanding Tax Awareness And Tax Amnesty Toward Taxpayer Compliance

2425 Valencia St Santa Ana Ca 92706 Mls Oc21227125 Redfin

1501 E Avalon Ave Santa Ana Ca 92705 Mls Np21189966 Redfin

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

Reasons For Not Performing Mechanical Thrombectomy A Population-based Study Of Stroke Codes Stroke

Next Wave Of Orange County Covid-19 Deaths Looming

Tough Decisions Ahead For Amarillo City Council On Parks Assets After Prop A Fails Kamr - Myhighplainscom

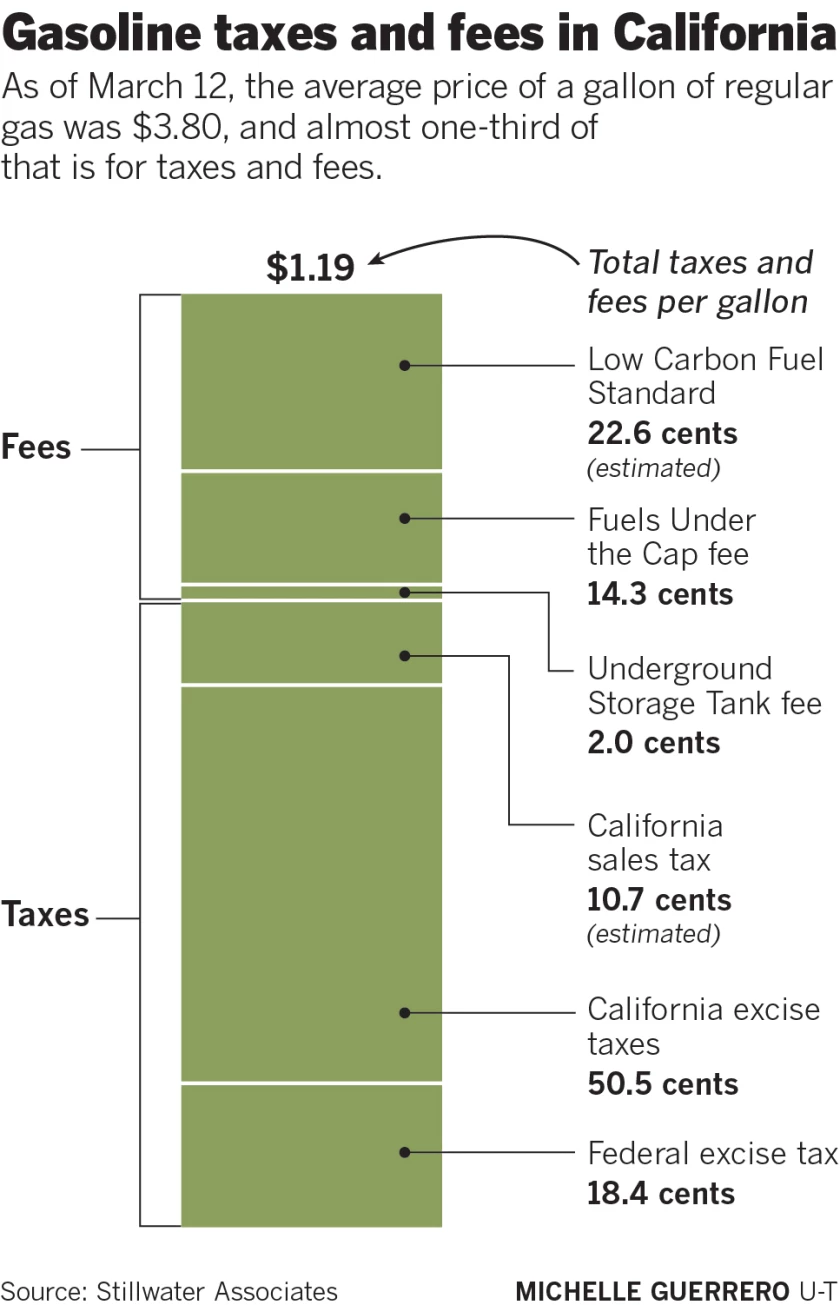

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

2

701 W 1st St Unit D102 Santa Ana Ca 92701 Mls Pw21098674 Redfin