Does Tennessee Have Inheritance Tax

Tennessee does not have a homestead exemption. Tennessee does not have an inheritance tax either.

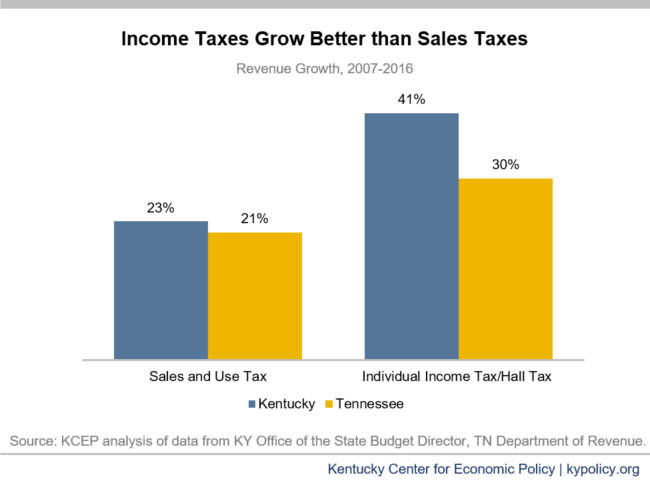

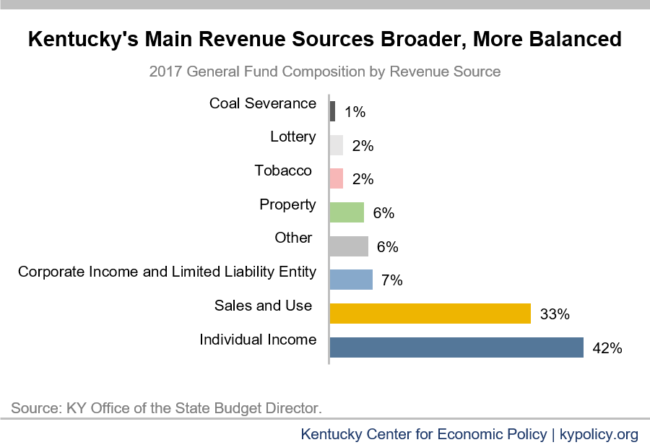

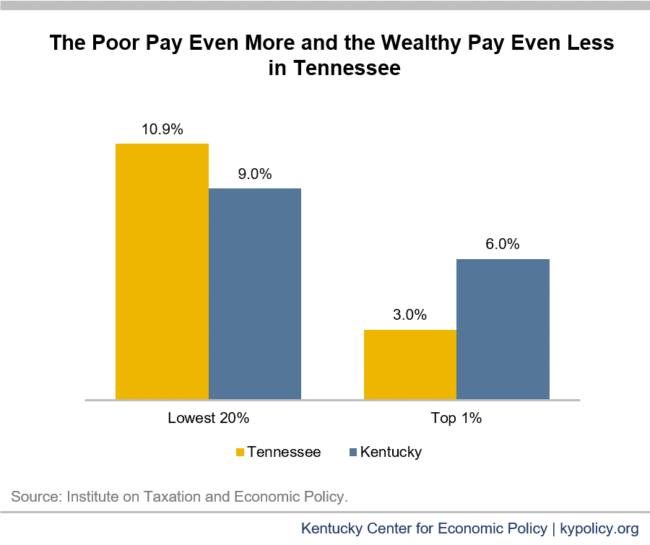

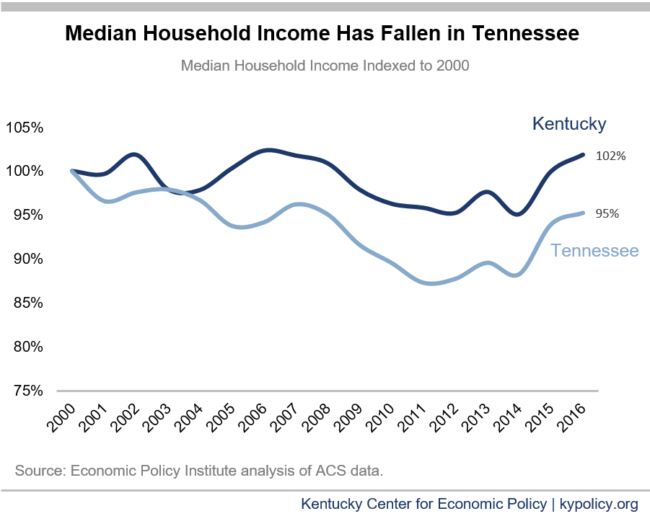

Shifting To A Tennessee-like Tax System Would Harm Kentucky - Kentucky Center For Economic Policy

The assessed valuation of a property is based on 25% of its fair market value.

Does tennessee have inheritance tax. It has no inheritance tax nor does it have a gift tax. Information about inheritance tax can be found here. So there are no separate considerations needed to handle any tennessee inheritance tax.

Transfer of property to a spouse is exempt from inheritance tax. Most state residents do not need to worry about a state estate or inheritance tax. As of 2019, iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania have their own inheritance tax.

However, if the estate is undergoing probate, a short form inheritance tax return (inh 302) is required. However, there is a property tax relief program for the elderly, disabled and veterans. Inheritances are treated specially under tax law, and not all aspects of an inheritance will be subject to income taxes.

No estate tax or inheritance tax. Inheritance income is taxable income received from an inheritance. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island:

Even though this is good news, it’s not really that surprising. Inheritance tax is a state tax on assets inherited from someone who died. Under tennessee law, the tax kicked in if your estate (all the property you own at your death) had a total value of more than $5 million.

For federal tax purposes, inheritance generally isn’t considered income. Uncle sam doesn’t have an inheritance tax and inheritances are not considered taxable income in most cases—so you won't have to report your inheritance on your state or federal income tax return. Tennessee does not have an inheritance tax either.

Tennessee gift tax and inheritance tax. It is possible though for tennessee residence to be subject to an inheritance. There is a chance, though, that another state’s inheritance tax will apply if you inherit something from someone who lives in that state.

Inheritance tax is imposed on the value of the decedent’s estate that exceeds the exemption amount applicable to the decedent’s year of death. Tennessee inheritance and gift tax. Exceptions include inheritances over a certain amount, as well as inheriting specific types of.

Those who handle your estate following your death, though, do have some other tax returns to take care of, such as: If the value of the gross estate is below the exemption allowed for the year of death, an inheritance tax return is not required. An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs.

The inheritance tax charged will be 40% of £175,000 (£500,000 minus £325,000). Does tennessee have an inheritance tax or estate tax? No estate tax or inheritance tax.

Until this estate tax is phased out, the minimum tax rate for estates larger than the exemption amount is 5.5% and the maximum remains 9.5%. An inheritance tax applies to assets after they have been inherited and are paid by the inheritor. Eleven states still impose an inheritance tax.

There is a $11.18 million exemption for the federal estate tax in 2018. Though tennessee has no estate tax, there is a federal estate tax that may apply to you if your estate is of sufficient value. There is a chance, though, that another state’s inheritance tax will apply if you inherit something from someone who lives in that state.

No estate tax or inheritance tax. What tennessee called an inheritance tax was really a state estate tax—that is, a tax imposed only when the total value of an estate exceeds a certain value. It simply does not exist any longer.

Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. The estate can pay inheritance tax at a reduced rate of 36% on some assets if you leave 10% or more of the ‘net. No estate tax or inheritance tax

The top estate tax rate is 16 percent (exemption threshold: Kentucky, for instance, has an inheritance tax that applies to all property in the state, even if the person inheriting it lives elsewhere. Only seven states impose and inheritance tax.

Connecticut, indiana, iowa, kansas, kentucky, maryland, nebraska, new jersey, oregon, pennsylvania and tennessee. Additionally, the tennessee inheritance tax is now abolished in tennessee for any person who dies in 2016 or later. There is no federal inheritance tax.

But some states do have these kinds of taxes, which are levied on people who either owned property in the state where they lived (estate tax) or who inherit property from someone who lived there (inheritance tax). Inheritance tax is a state tax. The tennessee inheritance tax exemption is steadily increasing to $2 million in 2014 to $5 million in 2015, and in 2016 there’ll be no inheritance tax.

Inheritance tax in tennessee in 2012, the tennessee general assembly chose to phase out the state’s inheritance tax over a period of several years. The inheritance tax is paid out of the. Also, estates of nonresidents holding property in tennessee must file an inheritance tax return (inh 301).

The net estate is the fair market value of all assets, less any allowable deductions such as property passing to a surviving spouse, debts, and administrative expenses. Did i mention that tennessee is a rather tax friendly state? Does tn have an estate or inheritance tax?

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Shifting To A Tennessee-like Tax System Would Harm Kentucky - Kentucky Center For Economic Policy

State-by-state Guide To Taxes On Retirees - Tennessee Gas Tax Inheritance Tax Income Tax

Economy Of Tennessee - Wikipedia

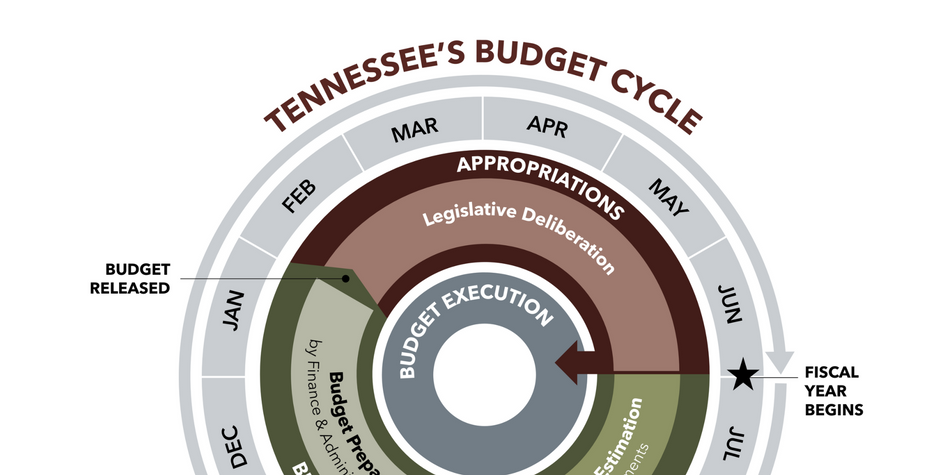

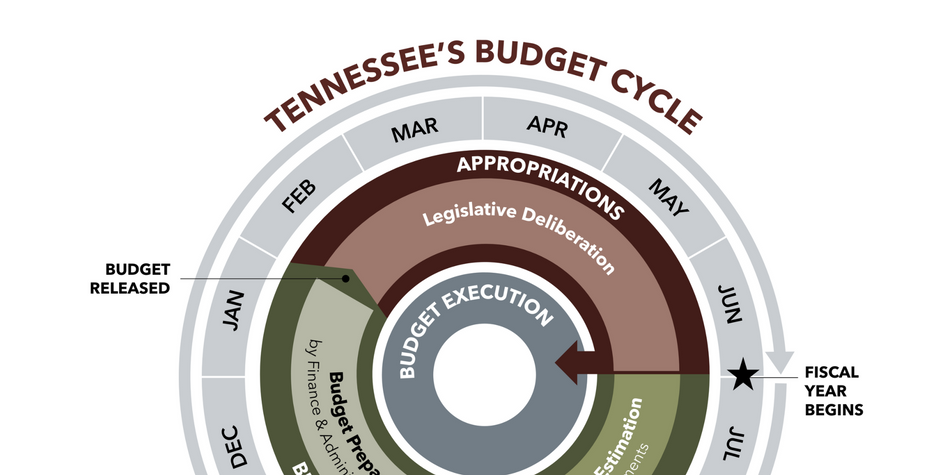

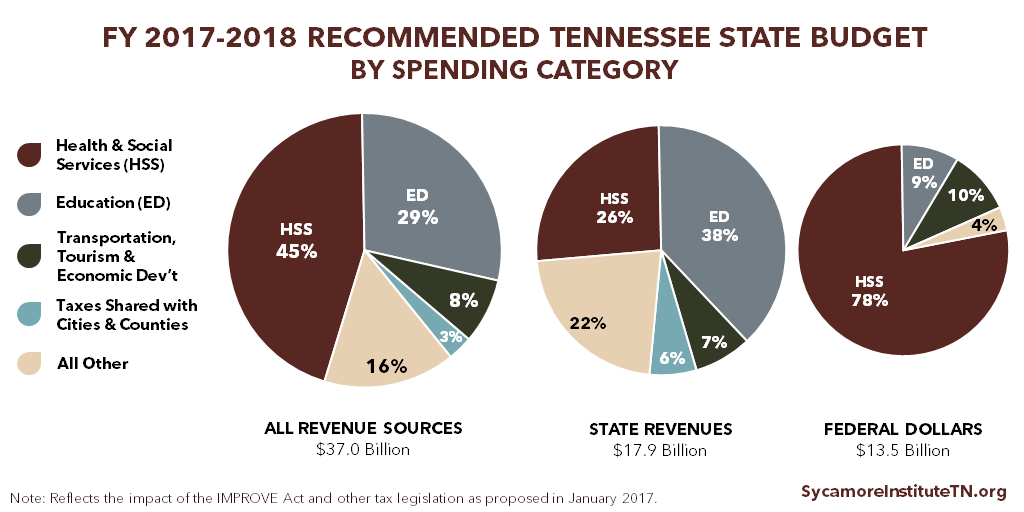

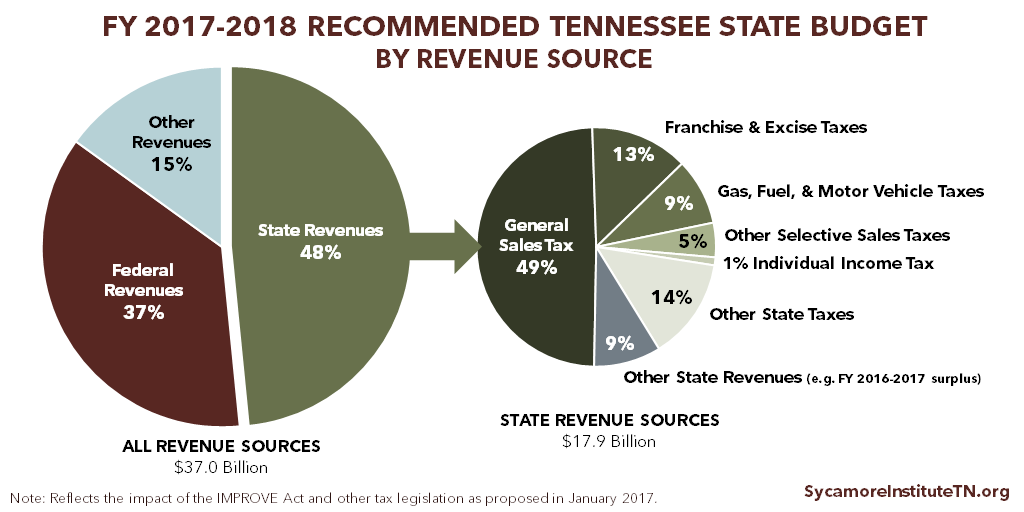

Healthy Debate 2018 Understanding Tennessees Budget

Here Are The 10 Best Cities In Wyoming To Retire In Wyoming Cities Best Places To Live Wyoming Travel

Shifting To A Tennessee-like Tax System Would Harm Kentucky - Kentucky Center For Economic Policy

What You Need To Know About Tennessee Will Laws

Shifting To A Tennessee-like Tax System Would Harm Kentucky - Kentucky Center For Economic Policy

Wheres My Tennessee Tn State Tax Refund Taxact Blog

Download Pdf The Everything Wills And Estate Planning Book Professional Advice To Safeguard Your Assets And Provid Estate Planning Professional Advice Advice

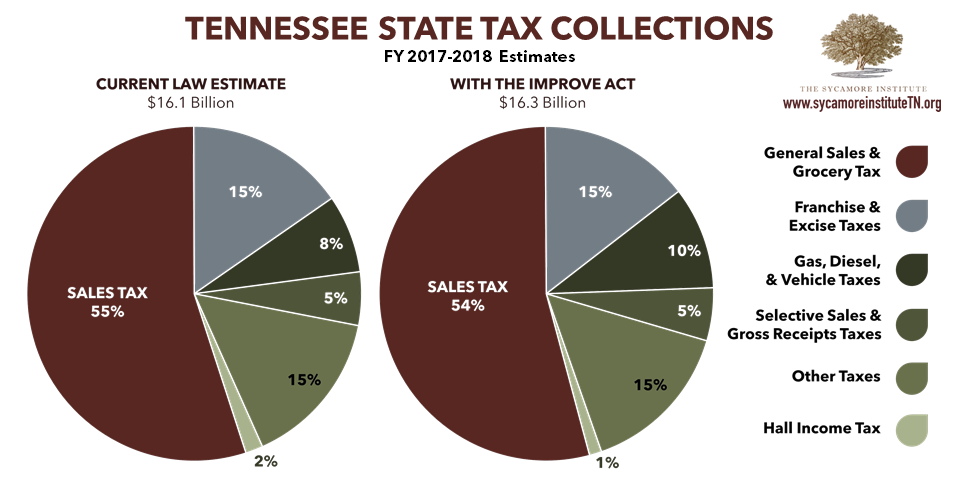

Summary Of Governor Haslams 2017 Tennessee Budget Proposal

Tennessee Inheritance Laws Nashville Bankruptcy Attorney Nashville Tn Probate Lawyer

Tennessee Retirement Tax Friendliness - Smartasset

Healthy Debate 2018 Understanding Tennessees Budget

Tennessee Taxes - Do Residents Pay Income Tax Hr Block

Healthy Debate 2018 Understanding Tennessees Budget

Historical Tennessee Tax Policy Information - Ballotpedia

United States Map Of States With No Income Tax Alaska Washington Nevade Wyoming Texas South Dakota And Florida As Well As S Income Tax Income Retirement Budget