Riverside County Tax Collector California

The following types of payments will be accepted at this office: If you entered a supplemental number and it is not listed below, it may be included in the secured prior year assessment or already paid.

Home

Registration requirements vary from sale to sale and are announced approximately six to eight weeks prior to a scheduled sale.

Riverside county tax collector california. It is our hope that this directory will assist in locating the site. Tax sale time and location. The combined office is led by jon christensen, a countywide, publicly elected official serving the fourth largest county in california.

The treasurer tax collector is committed to offering payment options to the public in the safest way possible. Furthermore, the riverside county tax collector's office will not be registering bidders nor accepting bids and all questions will be directed to the county tax sale auction website. Welcome to the riverside county property tax portal.

All tax bills paid online or by the automated phone system are due by midnight on the delinquent date. All tax bills paid online or by the automated phone system are due by midnight on the delinquent date. Credit card 2.28% convenience fee debit card $3.95 flat fee

We accept the following forms of payment: The combined office is led by jon christensen, a countywide, publicly elected official serving the fourth largest county in california. The tax collector is responsible for the billing and collection of secured, unsecured, supplemental, transient occupancy tax as well as various other special assessments.

The riverside county tax collector is a state mandated function that is governed by the california revenue & taxation code, government code, and, the code of civil procedures. We accept the following forms of payment: The county, most of the county's incorporated cities, school districts and all other taxing agencies located in the county, including special districts (e.g., flood control districts, sanitation districts).

Riverside county has one of the highest median property taxes in the united states, and is ranked 248th of the 3143 counties in order of median property taxes. Property taxes are collected by the county, although they are governed by california state law.the tax collector of riverside county collects taxes on behalf of the following entities: Debit card, credit card, personal checks, money orders.

The median property tax in riverside county, california is $2,618 per year for a home worth the median value of $325,300. The riverside county california tax sale in an online tax sale auction and. To add more items to your payment list, click last search results for the last assessment or new search for a new assessment.

Riverside county collects, on average, 0.8% of a property's assessed fair market value as property tax.

Riverside County Ca Property Tax Calculator - Smartasset

Riverside Countys Covid-19 Rental Assistance Program A Success And Model

Bid4assets To Hold Tax-defaulted Property Online Auction On Behalf Of Riverside County Treasurer-tax Collectors Office Newswire

Riverside-county Property Tax Records - Riverside-county Property Taxes Ca

Meet Your Treasurer-tax Collector

Understanding Californias Property Taxes

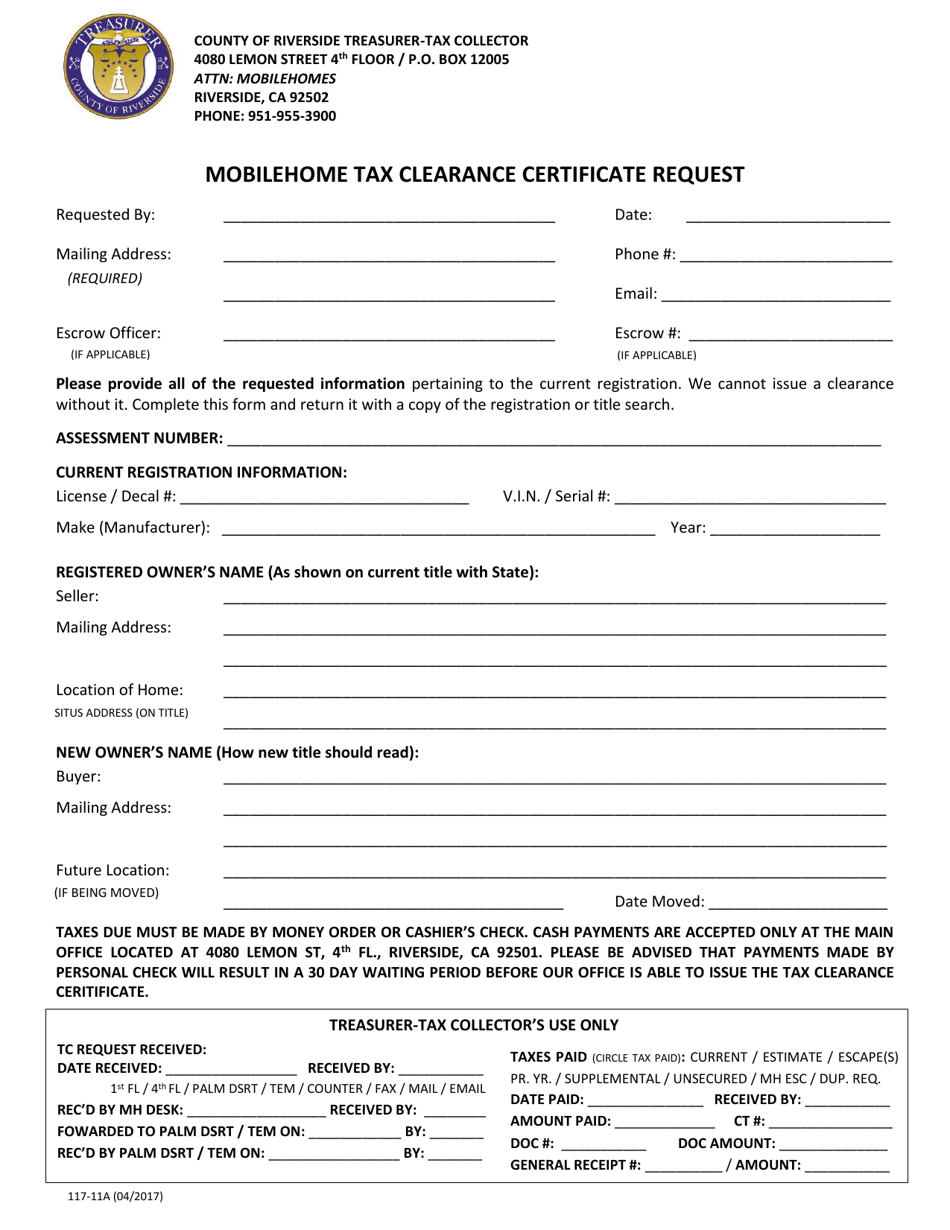

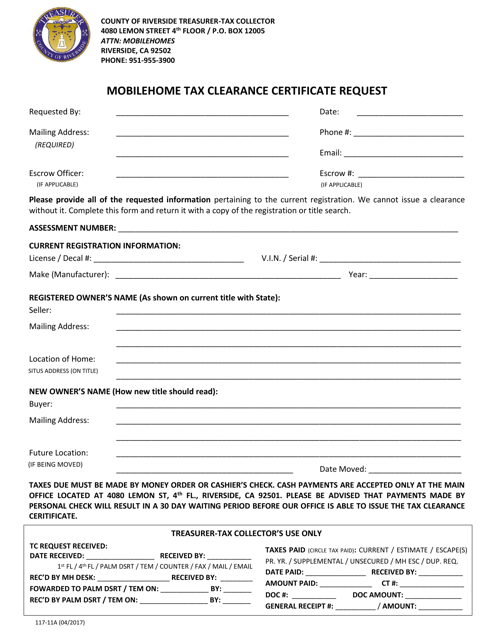

Form 117-11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

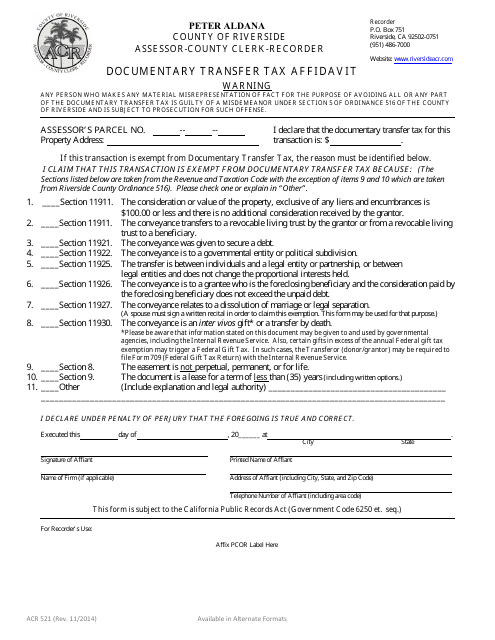

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Riverside County Ca Property Tax Calculator - Smartasset

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments - County Of San Luis Obispo

Property Tax Division

Riverside County Tax Collector And Assessor Riverside Property Tax

Senior Management

2

2

Jon Christensen California - Ballotpedia

Form 117-11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Riverside-county Property Tax Records - Riverside-county Property Taxes Ca

Riverside-county Property Tax Records - Riverside-county Property Taxes Ca