Vehicle Personal Property Tax Richmond Va

The county receives 1.0% of the 6.0% collected on each purchase.the state of virginia disburses these receipts. The next business day after the charge is made.

101 N 29th St Richmond Va 23223 Realtorcom

$25.00 for a vehicle over 4,000 pounds and over;

Vehicle personal property tax richmond va. If such percentage or percentages of original cost do not accurately reflect fair market. • mailing a copy to philip j. Reduce the tax by the relief amount:

How to qualify for personal property tax relief. Personal property tax relief, (pptr) gives tax relief on the taxes due for the first $20,000 in assessed value on qualified personal vehicles. Proration of personal property tax.

Kellam, commissioner of the revenue, attn: A vehicle is temporarily absent if it does not acquire a taxable status in another jurisdiction. The rate is $1 per $100 of the assessed value for qualifying vehicles used by volunteer firefighters and volunteer members of rescue squads, and $0.01 per $100 of the assessed value for disabled veterans’ vehicles and motor vehicles specially modified to provide.

Please include a daytime phone number and the driver's license number of the registered owner(s) with the attestation and/or les. Boats, trailers and airplanes are not prorated. $20.00 for a vehicle under 4,000 pounds;

Vehicles belonging to volunteer fire and rescue squad members And city officials say corrected bills. $0.001 per $100.00 of assessed value;

The city’s average effective property tax rate is 0.88%. Personal property taxes on automobiles, trucks, motorcycles, low speed vehicles and motor homes are prorated monthly. Contact the chesterfield county commissioner of the revenue to register your vehicle for personal property tax purposes.

Dmv stop fees and all required personal property tax bills must be paid in full before the hold on your dmv vehicle registration will be released, which will be by 5 p.m. No relief is given on any assessment amounts over $20,000. The governing body of any county, city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles, trailers, semitrailers, and boats which have acquired a situs within such locality after the tax day for the balance of the tax year.

Personal property taxpayers, 2401 courthouse drive., virginia beach, virginia, 23456. The personal property rates are: Where can i obtain a personal property tax return for my vehicle?

If you purchased a vehicle (car, truck, motorcycle, motor home, or low speed vehicle) anytime during the tax year you will receive a prorated bill within 60 days, from the purchase date to the end of the tax year. If the qualified vehicle is assessed at more than $1,000, tax relief will be given at a rate of 50% (up to a maximum of $20,000 in assessed value) for 2020. This special subclass includes the following:

Annual tax amount = $354.35; It is an ad valorem tax, meaning the tax amount is set according to the value of the property. Vehicles subject to tax nearly all vehicles located in the city of colonial heights are subject to personal property tax, including vehicles that do not run, and vehicles that are temporarily absent from colonial heights.

49% (for 2020) x $694.80 = $340.45. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. Situated along the atlantic ocean in the southeast corner of the state, virginia beach has property tax rates slightly higher than the state average.

Is more than 50% of the vehicle's annual mileage used as a business. The tax rate for most vehicles is $4.57 per $100 of assessed value. If you buy a home there, you can expect to pay a property tax bill of around $2,418 a year.

This does not include the registration fee currently set at $40.00 per vehicle. As expected, the richmond city council on tuesday passed an extension that will give taxpayers until june 1 to pay their personal property tax bills in full. Owners of qualified vehicles assessed at $1,000 or less will receive 100% tax relief on that vehicle.

If you can answer yes to any of the following questions, your vehicle is considered by state law to have a business use and does not qualify for personal property tax relief. Please retain the confirmation number provided for your records. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Personal property taxes are billed once a year with a december 5 th due date. For properties included in a special subclass, the tax rate is $0.01 per $100 of assessed value.

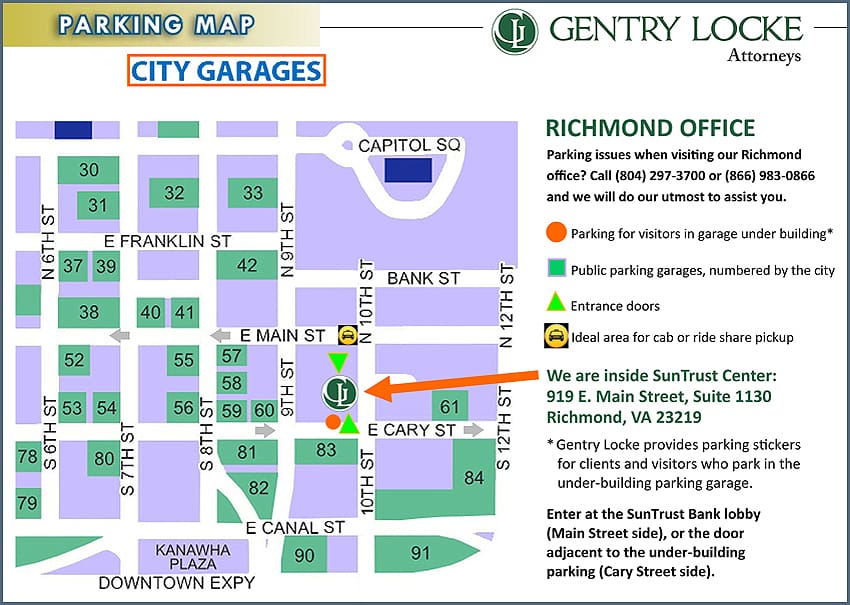

Visiting Our Richmond Office - Gentry Locke Attorneys

List Of Auto Insurance Companies General Auto Insurance

Try The 4-both Method To De-clutter Your Living Room Place 4 Boxes On The Ground Let One Box Be Your Trash Investment Firms Investing Real Estate Investing

Sppup1jikcqccm

Bankruptcy Lawyer Richmond Va Tax Attorney Attorneys Intellectual Property Law

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

Southside Richmond Virginia - Wikiwand

Queen Bee Co - Home Facebook

Formerly Redlined Areas Of Richmond Are Going Green - Chesapeake Bay Foundation

Southside Richmond Virginia - Wikiwand

3224 Patterson Ave Richmond Va 23221 - Realtorcom

Pin On Vintage Tobacco Tins

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

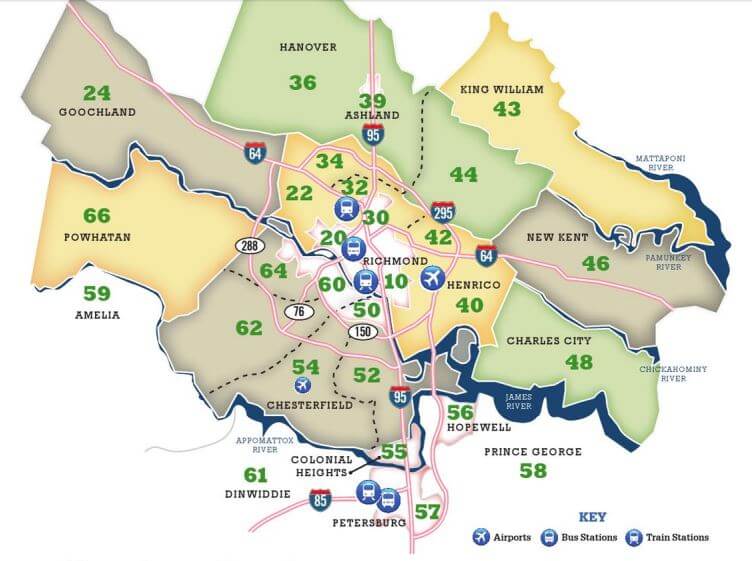

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

148 Honey Locust Richmond Va 23238 - Realtorcom

19 Best Richmond Accountants Expertisecom

Towncity Boundaries And Annexation

Public Housing In Richmond Virginia Richmond Cycling Corps